10 Best Retirement Income Funds

When picking a retirement fund, you must consider what you need, how much risk you can handle, and how much money you want to make.

Retirement income funds are like savings accounts you use after you stop working. They invest your money in different things, like bonds, stocks, and sometimes other investments. This helps you get a steady income when you’re retired.

These funds aim to balance the need for income with the preservation of capital, making them popular among retirees who need a reliable income stream without taking on excessive risk.

Here are some of the best retirement income funds available right now.

Vanguard Wellesley Income Fund (VWINX)

The Vanguard Wellesley Income Fund is known for its conservative allocation, investing about 40% in stocks and 60% in bonds. It has a long history of stable returns and low volatility, making it ideal for risk-averse retirees. The fund focuses on high-quality bonds and dividend-paying stocks, ensuring a steady income stream.

Fidelity Strategic Dividend & Income Fund (FSDIX)

This fund invests in different kinds of stocks and bonds that pay money to investors. The text focuses on stocks that pay cash to investors, exceptional stocks called preferred stocks, and stocks that can be changed into other types of stocks. The strategy aims to provide high current income and potential for capital appreciation, making it a well-rounded option for retirees looking for revenue and growth.

T. Rowe Price Retirement Income 2020 Fund (TRRIX)

A target-date fund designed for those who retired around 2020, TRRIX gradually shifted its asset allocation to become more conservative over time. It balances growth potential with income generation, making it suitable for retirees looking for a hands-off investment approach.

Schwab Target Income Fund (SWLRX)

Schwab’s Target Income Fund is designed for retirees who prioritize income. The fund invests primarily in bonds with a small allocation to dividend-paying stocks. It’s a good choice for those who prefer a higher emphasis on stability and income than growth.

PIMCO Income Fund (PIMIX)

The PIMCO Income Fund is a highly regarded option among retirees seeking a higher yield. It invests in various fixed-income securities, including corporate bonds, mortgage-backed securities, and government debt. The fund is carefully managed, so it can change to fit the way the market is doing.

American Funds the Income Fund of America (AMECX)

This fund combines growth and income by investing in stocks and bonds. It has a strong track record of paying dividends while offering potential for capital appreciation, making it a versatile option for retirees.

Vanguard Target Retirement Income Fund (VTINX)

The VTINX fund is part of Vanguard’s target-date series, designed for those already in retirement. It has a conservative allocation, heavily emphasizing bonds and a smaller portion in stocks. The fund automatically rebalances, making it a simple choice for income-focused retirees.

Blackrock Multi-Asset Income Fund (BKMIX)

This fund aims to provide high current income through a diversified mix of assets, including global stocks, bonds, and alternative investments. It’s suitable for retirees looking for a higher yield, though it comes with more risk than conservative funds.

Dodge & Cox Income Fund (DODIX)

The Dodge & Cox Income Fund is a highly regarded bond fund focusing on high-quality fixed-income securities. It offers a conservative investment approach that emphasizes capital preservation and income generation.

JP Morgan Income Builder Fund (JNBAX)

This fund is designed to provide a balanced approach to income and growth by investing in a diversified portfolio of dividend-paying stocks, bonds, and other income-generating assets. It’s an attractive option for retirees looking for a blend of income and capital appreciation.

Various Aspects of Retirement Income Funds

Further, we will cover the key aspects of retirement income funds, including their benefits, the role of Roth IRA contributions, and some of the best income funds for retirees from leading financial institutions like Fidelity and Vanguard.

Retirement Income Funds

Retirement income funds are mutual or exchange-traded funds (ETFs) specifically designed to provide retirees with stable incomes. These funds often put money into various things, like bonds, stocks that give back money, and sometimes other investments. The main goal is to make regular income while keeping the money safe. This makes them a good choice for retired people who want to replace their salary with a steady income.

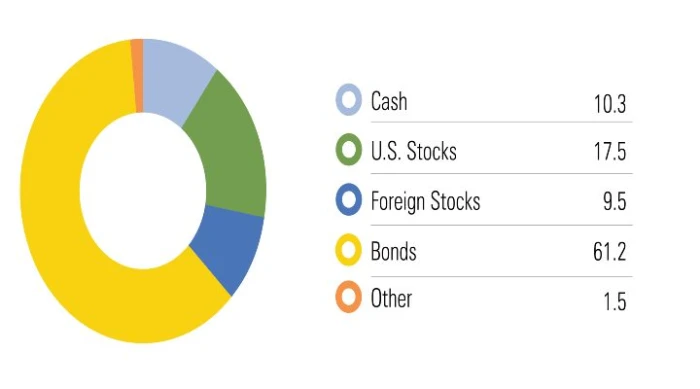

Asset allocation within retirement income funds is usually more conservative than growth-oriented funds. Bonds and other fixed-income securities often comprise a significant portion of the portfolio, providing the stability needed during retirement. However, these funds also include dividend-paying stocks to offer growth potential and protect against inflation.

Roth IRA Contributions

Roth IRAs are an excellent method for retirement savings, especially when considering retirement income funds. When you put money into a Roth IRA, you already paid the taxes. This means that you don’t have to pay taxes again when you take the money out later in life. This feature makes Roth IRAs particularly beneficial for retirees, allowing them to receive income without worrying about tax implications.

Investing in retirement income funds within a Roth IRA can be a smart strategy for those still contributing to their retirement accounts. It combines the tax-free growth and withdrawals of a Roth IRA with the steady income these funds provide, creating a powerful tool for retirement planning.

Best Income Funds for Retirees

Several options stand out when it comes to selecting the best income funds for retirees. Well-established financial institutions manage these funds and have a track record of providing consistent income while managing risk.

- Fidelity Income Funds

Fidelity offers a range of income-focused funds suitable for retirees. The Fidelity Strategic Income Fund (FSICX) is a popular choice for investing in a diversified portfolio of bonds and other fixed-income securities. Fidelity also offers the Fidelity Equity-Income Fund (FEQIX), which focuses on dividend-paying stocks, providing income and potential for capital appreciation.

- Vanguard Income Funds for Retirees

Vanguard is known for its low-cost, high-quality funds, and its retirement income options are no exception. The Vanguard Wellesley Income Fund (VWINX) is a balanced fund that combines bonds and dividend-paying stocks, offering a conservative approach to income generation. Another option is the Vanguard Target Retirement Income Fund (VTINX), which automatically adjusts its asset allocation over time to reduce risk as you age.

Dividend Income Funds for Retirees

Dividend income funds are desirable for retirees because they offer regular income through dividends. The Vanguard Dividend Growth Fund (VDIGX) invests in companies that have been paying dividends for a long time. This means you can get a regular income from the fund, which might also grow in value over time.

Building the Retirement Income Portfolio

Building a retirement income portfolio involves more than just selecting the suitable funds. It requires careful planning and diversification to meet income needs while minimizing risks. A well-constructed portfolio typically includes a mix of retirement income funds, dividend-paying stocks, and bonds. This combination helps to balance the need for income with the need for capital preservation and growth.

When picking a retirement fund, you must consider what you need, how much risk you can handle, and how much money you want to make. The funds mentioned above offer different ways to invest, from safe ones that mostly buy bonds to ones that mix stocks and bonds. Some funds, like Vanguard Wellesley Income and Fidelity Strategic Dividend & Income, are safe and focus on getting money from dividends and bonds. If you’re okay with taking a little more risk for a chance to make more money, look at funds like PIMCO Income Fund and Blackrock Multi-Asset Income Fund.

To find the best retirement money, look for funds that invest in many different things, have low costs, and have a good track record. Retirees should consider their money, how long they need it to last, and how much they need each year. A financial advisor can help them choose the right fund for their situation.

Also, read the following related posts.

Retirement income funds are like savings accounts you use after you stop working. They invest your money in different things, like bonds, stocks, and sometimes other investments. This helps you get a steady income when you’re retired.

These funds aim to balance the need for income with the preservation of capital, making them popular among retirees who need a reliable income stream without taking on excessive risk.

Here are some of the best retirement income funds available right now.

Vanguard Wellesley Income Fund (VWINX)

The Vanguard Wellesley Income Fund is known for its conservative allocation, investing about 40% in stocks and 60% in bonds. It has a long history of stable returns and low volatility, making it ideal for risk-averse retirees. The fund focuses on high-quality bonds and dividend-paying stocks, ensuring a steady income stream.

Fidelity Strategic Dividend & Income Fund (FSDIX)

This fund invests in different kinds of stocks and bonds that pay money to investors. The text focuses on stocks that pay cash to investors, exceptional stocks called preferred stocks, and stocks that can be changed into other types of stocks. The strategy aims to provide high current income and potential for capital appreciation, making it a well-rounded option for retirees looking for revenue and growth.

T. Rowe Price Retirement Income 2020 Fund (TRRIX)

A target-date fund designed for those who retired around 2020, TRRIX gradually shifted its asset allocation to become more conservative over time. It balances growth potential with income generation, making it suitable for retirees looking for a hands-off investment approach.

Schwab Target Income Fund (SWLRX)

Schwab’s Target Income Fund is designed for retirees who prioritize income. The fund invests primarily in bonds with a small allocation to dividend-paying stocks. It’s a good choice for those who prefer a higher emphasis on stability and income than growth.

PIMCO Income Fund (PIMIX)

The PIMCO Income Fund is a highly regarded option among retirees seeking a higher yield. It invests in various fixed-income securities, including corporate bonds, mortgage-backed securities, and government debt. The fund is carefully managed, so it can change to fit the way the market is doing.

American Funds the Income Fund of America (AMECX)

This fund combines growth and income by investing in stocks and bonds. It has a strong track record of paying dividends while offering potential for capital appreciation, making it a versatile option for retirees.

Vanguard Target Retirement Income Fund (VTINX)

The VTINX fund is part of Vanguard’s target-date series, designed for those already in retirement. It has a conservative allocation, heavily emphasizing bonds and a smaller portion in stocks. The fund automatically rebalances, making it a simple choice for income-focused retirees.

Blackrock Multi-Asset Income Fund (BKMIX)

This fund aims to provide high current income through a diversified mix of assets, including global stocks, bonds, and alternative investments. It’s suitable for retirees looking for a higher yield, though it comes with more risk than conservative funds.

Dodge & Cox Income Fund (DODIX)

The Dodge & Cox Income Fund is a highly regarded bond fund focusing on high-quality fixed-income securities. It offers a conservative investment approach that emphasizes capital preservation and income generation.

JP Morgan Income Builder Fund (JNBAX)

This fund is designed to provide a balanced approach to income and growth by investing in a diversified portfolio of dividend-paying stocks, bonds, and other income-generating assets. It’s an attractive option for retirees looking for a blend of income and capital appreciation.

Various Aspects of Retirement Income Funds

Further, we will cover the key aspects of retirement income funds, including their benefits, the role of Roth IRA contributions, and some of the best income funds for retirees from leading financial institutions like Fidelity and Vanguard.

Retirement Income Funds

Retirement income funds are mutual or exchange-traded funds (ETFs) specifically designed to provide retirees with stable incomes. These funds often put money into various things, like bonds, stocks that give back money, and sometimes other investments. The main goal is to make regular income while keeping the money safe. This makes them a good choice for retired people who want to replace their salary with a steady income.

Asset allocation within retirement income funds is usually more conservative than growth-oriented funds. Bonds and other fixed-income securities often comprise a significant portion of the portfolio, providing the stability needed during retirement. However, these funds also include dividend-paying stocks to offer growth potential and protect against inflation.

Roth IRA Contributions

Roth IRAs are an excellent method for retirement savings, especially when considering retirement income funds. When you put money into a Roth IRA, you already paid the taxes. This means that you don’t have to pay taxes again when you take the money out later in life. This feature makes Roth IRAs particularly beneficial for retirees, allowing them to receive income without worrying about tax implications.

Investing in retirement income funds within a Roth IRA can be a smart strategy for those still contributing to their retirement accounts. It combines the tax-free growth and withdrawals of a Roth IRA with the steady income these funds provide, creating a powerful tool for retirement planning.

Best Income Funds for Retirees

Several options stand out when it comes to selecting the best income funds for retirees. Well-established financial institutions manage these funds and have a track record of providing consistent income while managing risk.

- Fidelity Income Funds

Fidelity offers a range of income-focused funds suitable for retirees. The Fidelity Strategic Income Fund (FSICX) is a popular choice for investing in a diversified portfolio of bonds and other fixed-income securities. Fidelity also offers the Fidelity Equity-Income Fund (FEQIX), which focuses on dividend-paying stocks, providing income and potential for capital appreciation.

- Vanguard Income Funds for Retirees

Vanguard is known for its low-cost, high-quality funds, and its retirement income options are no exception. The Vanguard Wellesley Income Fund (VWINX) is a balanced fund that combines bonds and dividend-paying stocks, offering a conservative approach to income generation. Another option is the Vanguard Target Retirement Income Fund (VTINX), which automatically adjusts its asset allocation over time to reduce risk as you age.

Dividend Income Funds for Retirees

Dividend income funds are desirable for retirees because they offer regular income through dividends. The Vanguard Dividend Growth Fund (VDIGX) invests in companies that have been paying dividends for a long time. This means you can get a regular income from the fund, which might also grow in value over time.

Building the Retirement Income Portfolio

Building a retirement income portfolio involves more than just selecting the suitable funds. It requires careful planning and diversification to meet income needs while minimizing risks. A well-constructed portfolio typically includes a mix of retirement income funds, dividend-paying stocks, and bonds. This combination helps to balance the need for income with the need for capital preservation and growth.

When picking a retirement fund, you must consider what you need, how much risk you can handle, and how much money you want to make. The funds mentioned above offer different ways to invest, from safe ones that mostly buy bonds to ones that mix stocks and bonds. Some funds, like Vanguard Wellesley Income and Fidelity Strategic Dividend & Income, are safe and focus on getting money from dividends and bonds. If you’re okay with taking a little more risk for a chance to make more money, look at funds like PIMCO Income Fund and Blackrock Multi-Asset Income Fund.

To find the best retirement money, look for funds that invest in many different things, have low costs, and have a good track record. Retirees should consider their money, how long they need it to last, and how much they need each year. A financial advisor can help them choose the right fund for their situation.

Also, read the following related posts.

Conversation

Latest Blogs

© Blog CoolCalculator, Explore CoolCalculator, your destination for the latest insights, tips, and updates on the world of online calculators. Stay informed and make your calculations smarter with our blog. ,

Designed

by Saad Media Team , Team Lead M.Rizwan Akhtar