Best Investing Books You Must Read

Reading the best investing books can offer profound knowledge and actionable strategies, helping individuals improve their financial decision-making.

Investing is a complex and rewarding journey, and many successful investors attribute their knowledge to a blend of experience and learning. A fundamental way to accelerate your understanding is by reading some of the best investing books by renowned experts. These books offer timeless wisdom, strategies, and psychological insights into how markets function and how investors can maximize their potential returns.

In this guide, we elaborated the detail of some must-read investing books and why they remain indispensable for novice and seasoned investors.

1. The Intelligent Investor by Benjamin Graham

One of the best books about investing is The Intelligent Investor written by Benjamin Graham, who is often called the “Father of Value Investing”.

He says investing in things worth more than they cost and focusing on making money over a long time instead of trying to make a quick profit is essential. The book encourages investors to look at stocks as ownership in businesses rather than pieces of paper to trade. Graham differentiates between the intelligent investor, who makes calculated, disciplined decisions, and the speculator who chases trends and market movements.

The book advocates for a conservative, value-based approach to investing, where patience and rationality trump emotional responses to market fluctuations. The Intelligent Investor remains an essential reading for those looking to build a strong foundation in value investing.

2. A Random Walk Down Wall Street by Burton Malkiel

Burton Malkiel’s book A Random Walk Down Wall Street discusses the efficient market hypothesis (EMH) theory. This theory says that the price of a stock shows all the information we know about it. So, it’s tough to make more money from stocks than everyone else without taking significant risks. Malkiel says that different ways of investing like looking at the past prices of a stock or studying the company itself, won’t do better than just buying a bunch of different stocks.

Malkiel advocates for a more passive investing strategy through low-cost index funds. This book offers readers a comprehensive view of the stock market, exploring historical trends and the pitfalls of speculative bubbles. His recommendations favor long-term investment strategies that focus on diversification and minimizing fees.

Malkiel’s work is highly regarded for simplifying the complexities of investing and helping investors focus on long-term, low-cost strategies that align with the principles of diversification.

3. The Little Book of Common Sense Investing by John C. Bogle

John Bogle, the founder of Vanguard Group and creator of the first index mutual fund, emphasizes simplicity and long-term investing in his influential book “The Little Book of Common Sense Investing”. Bogle had expertise in index investing. This means buying a bunch of different stocks that follow a big market like the S&P 500. This way, you get a mix of stocks and don’t have to pick just a few. His main idea is that most fund managers who try to pick good stocks don’t do as well as the market over a long time. This is because they charge more money and buy and sell stocks more often, which costs them money.

Bogle advises individual investors to avoid the pitfalls of trying to time the market or select winning stocks. Instead, he emphasizes the value of low-cost index funds, which deliver broad market exposure and offer higher returns over time than actively managed funds. His way is perfect for people who want to build wealth quickly without worrying too much about choosing the right stocks. In essence, Bogle’s philosophy is grounded in the belief that common sense investing is sticking with low-cost and diversified index funds is the surest way to build wealth over the long term.

4. One Up On Wall Street by Peter Lynch

Peter Lynch, a famous manager of a big-money fund called Fidelity Magellan, offers great advice on choosing stocks in his book One Up On Wall Street.

Lynch’s main argument is that individual investors can often outperform professional fund managers because they have access to information about companies they interact with in their everyday lives. He encourages investors to invest in what they know, which gives them a unique advantage in identifying promising companies before they become popular on Wall Street.

Lynch outlines several categories of companies, such as stalwarts, fast growers, and turnarounds, and explains how to identify and evaluate them. His advice on thorough research and understanding of the businesses you invest in resonates with investors looking to build a focused, strategic portfolio. The book’s message encourages individual investors to leverage their knowledge and experience in the marketplace to make informed, profitable investment decisions.

5. Thinking, Fast and Slow by Daniel Kahneman

While not strictly an investing book, Thinking Fast and Slow by nobel laureate Daniel Kahneman’s offers profound insights into human behavior, decision making, and critical factors in investing. Kahneman distinguishes between two modes of thinking, fast (intuitive and emotional) and slow (deliberative and logical). Many investing mistakes stem from fast thinking, where emotional reactions lead to poor decisions, such as buying high during a market rally or selling low during a crash.

By understanding the cognitive biases influencing decision-making, investors can better control their impulses and make rational, informed decisions. Kahneman’s work complements other investment books by focusing on the psychological aspect of investing, which is often as important as financial knowledge.

Below, we’ll explore various categories of investing books, including those for beginners, stock market enthusiasts, property investors, and value investors, as well as audiobook options for those on the go.

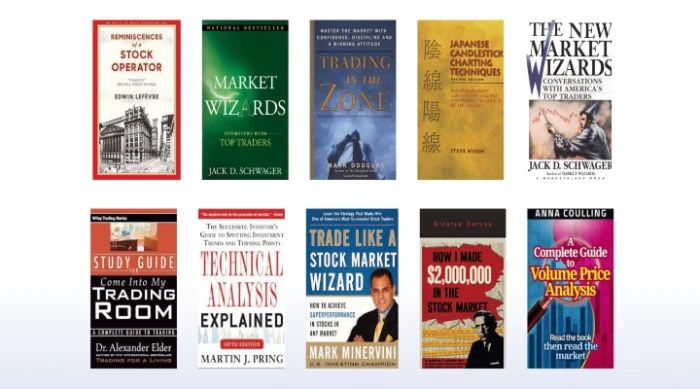

Best Investing Books on the Market

The Best Investing Books have endured and continue to offer timeless principles. These books are not just about technical trading or market analysis but also delve into the psychological and strategic elements of investing.

-

Benjamin Graham’s Book “The Intelligent Investor”

It is often cited as the most essential book on investing. Value investing involves buying stocks worth more than they cost. This strategy focuses on buying stocks of undervalued companies. Instead of trying to make quick profits, value investors focus on long-term growth. They also think carefully about risk and try to avoid putting money into too dangerous companies. To succeed at value investing, it’s essential to understand a company’s actual worth, which is called intrinsic value.

-

Common Stocks and Uncommon Profits by Philip Fisher

Philip Fisher’s approach focuses on quality stocks and emphasizes the importance of a company’s management.

-

Burton Malkiel’s Book “A Random Walk Down Wall Street”

It is perfect for those looking to understand the efficient market hypothesis, which asserts that asset prices reflect all available information.

These books teach people how to invest their money wisely. They explain that it’s essential to be patient and think about the long-term when trying to get rich.

Best Trading Books for Beginners

If you’re new to trading, it’s essential to start with books that break down complex concepts into easily understandable terms.

-

The Little Book of Common Sense Investing by John C. Bogle

This book provides a beginner friendly introduction to index fund investing. Bogle, the founder of Vanguard, advocates for low-cost passive investing through index funds, which he argues will outperform most actively managed portfolios.

-

Trading for a Living by Alexander Elder

He combines psychology, technical analysis, and money management. It’s a beginner’s guide to disciplined trading that emphasizes controlling emotions when making trading decisions.

-

How to Make Money in Stocks by William J. O’Neil

This book is an ideal starting point for those looking to learn the basics of stock picking and market timing. O’Neil outlines his CAN SLIM strategy, a data-driven approach to identifying winning stocks.

These books provide a strong foundation in trading principles for beginners, offering practical tips and step-by-step guidance.

Best Stock Market Books

Experienced traders and market analysts can provide knowledge for those specifically interested in the stock market.

-

Market Wizards by Jack D. Schwager

This book is a fascinating collection of interviews with some of the world’s top traders. Schwager distills their advice and strategies, revealing that there is no one-size-fits-all approach to success in the stock market.

-

Joel Greenblatt’s Book “The Little Book that Still Beats the Market”

It explains the concept of magic formula investing. Greenblatt simplifies the process of finding undervalued stocks with high returns on capital.

-

The Essays of Warren Buffett by Warren Buffett and Lawrence Cunningham

It is an insightful compilation of letters Buffett has written to shareholders over the years. It offers a deep dive into his investment philosophy, which is rooted in value investing.

These stock market books provide the technical knowledge and mindset needed to thrive in investing.

Best Rental Property Investing Books

Buying property can be a great way to get richer and make money without much work. Several books can guide aspiring real estate investors through purchasing and managing rental properties.

-

Brandon Turner’s Book “The Book on Rental Property Investing”

This book is a comprehensive beginner guide. It covers everything from finding properties, financing them, managing tenants, and scaling a rental business.

-

Investing in Rental Properties for Beginners by Lisa Phillips

This book is another excellent resource for novice investors looking to enter the rental property market.

-

Real Estate Investing for Dummies by Eric Tyson and Robert S. Griswold

It simplifies real estate investment, making it approachable even for those without experience. The authors cover everything from property selection to taxation.

These books offer solid advice for building wealth through rental properties, making them essential for aspiring real estate investors.

Best Value Investing Books

It’s like finding a diamond for the price of a rock. Benjamin Graham was one of the first people to talk about this idea. Many investors still use his ideas today.

-

The Intelligent Investor by Benjamin Graham

The Intelligent Investor book is widely regarded as the bible of value investing. It teaches investors to focus on long-term results, avoid speculative trends, and understand the intrinsic value of businesses.

-

Benjamin Graham and David Dodd’s Book “Security Analysis”

It is a more technical and detailed exploration of value investing, providing a rigorous approach to evaluating stocks.

-

You Can Be a Stock Market Genius by Joel Greenblatt

In this book, the writer reveals lesser-known strategies for value investors, including special situations like mergers and spinoffs that can lead to outsized returns.

These books are crucial for anyone looking to adopt a disciplined, value-driven approach to investing.

Best Audio Books about Investing

There are many high-quality audiobooks on investing for those who prefer to listen to books while commuting or exercising.

-

Principles: Life and Work by Ray Dalio

The audiobook contains details about Dalio’s investment philosophy and life principles. It is available as an audiobook and is narrated engagingly.

-

Rich Dad Poor Dad

A book by Robert Kiyosaki about money. It is a popular audiobook that teaches people how to make money without working.

-

The Simple Path to Wealth by JL Collins

It teaches you how to manage your money and invest for financial independence. The book is easy to understand and gives practical advice.

Audiobooks are a great way to absorb valuable information while on the go, making them an excellent choice for busy individuals.

Reading the best investing books can offer profound knowledge and actionable strategies, helping individuals improve their financial decision-making. These books teach us different ways to invest money. Graham talks about finding stocks that are worth more than they cost. Malkiel says buying many stocks is an excellent way to invest. Bogle believes keeping things simple is essential. Lynch gives tips on choosing good stocks.

Kahneman’s studies how people think and make decisions when investing. Each book provides timeless insights that can help investors navigate the complex and often emotional investing world with clarity and confidence. By reading these seminal works, novice and experienced investors can develop the tools necessary to approach the markets with a well-rounded, strategic mindset.

Investing is a complex and rewarding journey, and many successful investors attribute their knowledge to a blend of experience and learning. A fundamental way to accelerate your understanding is by reading some of the best investing books by renowned experts. These books offer timeless wisdom, strategies, and psychological insights into how markets function and how investors can maximize their potential returns.

In this guide, we elaborated the detail of some must-read investing books and why they remain indispensable for novice and seasoned investors.

1. The Intelligent Investor by Benjamin Graham

One of the best books about investing is The Intelligent Investor written by Benjamin Graham, who is often called the “Father of Value Investing”.

He says investing in things worth more than they cost and focusing on making money over a long time instead of trying to make a quick profit is essential. The book encourages investors to look at stocks as ownership in businesses rather than pieces of paper to trade. Graham differentiates between the intelligent investor, who makes calculated, disciplined decisions, and the speculator who chases trends and market movements.

The book advocates for a conservative, value-based approach to investing, where patience and rationality trump emotional responses to market fluctuations. The Intelligent Investor remains an essential reading for those looking to build a strong foundation in value investing.

2. A Random Walk Down Wall Street by Burton Malkiel

Burton Malkiel’s book A Random Walk Down Wall Street discusses the efficient market hypothesis (EMH) theory. This theory says that the price of a stock shows all the information we know about it. So, it’s tough to make more money from stocks than everyone else without taking significant risks. Malkiel says that different ways of investing like looking at the past prices of a stock or studying the company itself, won’t do better than just buying a bunch of different stocks.

Malkiel advocates for a more passive investing strategy through low-cost index funds. This book offers readers a comprehensive view of the stock market, exploring historical trends and the pitfalls of speculative bubbles. His recommendations favor long-term investment strategies that focus on diversification and minimizing fees.

Malkiel’s work is highly regarded for simplifying the complexities of investing and helping investors focus on long-term, low-cost strategies that align with the principles of diversification.

3. The Little Book of Common Sense Investing by John C. Bogle

John Bogle, the founder of Vanguard Group and creator of the first index mutual fund, emphasizes simplicity and long-term investing in his influential book “The Little Book of Common Sense Investing”. Bogle had expertise in index investing. This means buying a bunch of different stocks that follow a big market like the S&P 500. This way, you get a mix of stocks and don’t have to pick just a few. His main idea is that most fund managers who try to pick good stocks don’t do as well as the market over a long time. This is because they charge more money and buy and sell stocks more often, which costs them money.

Bogle advises individual investors to avoid the pitfalls of trying to time the market or select winning stocks. Instead, he emphasizes the value of low-cost index funds, which deliver broad market exposure and offer higher returns over time than actively managed funds. His way is perfect for people who want to build wealth quickly without worrying too much about choosing the right stocks. In essence, Bogle’s philosophy is grounded in the belief that common sense investing is sticking with low-cost and diversified index funds is the surest way to build wealth over the long term.

4. One Up On Wall Street by Peter Lynch

Peter Lynch, a famous manager of a big-money fund called Fidelity Magellan, offers great advice on choosing stocks in his book One Up On Wall Street.

Lynch’s main argument is that individual investors can often outperform professional fund managers because they have access to information about companies they interact with in their everyday lives. He encourages investors to invest in what they know, which gives them a unique advantage in identifying promising companies before they become popular on Wall Street.

Lynch outlines several categories of companies, such as stalwarts, fast growers, and turnarounds, and explains how to identify and evaluate them. His advice on thorough research and understanding of the businesses you invest in resonates with investors looking to build a focused, strategic portfolio. The book’s message encourages individual investors to leverage their knowledge and experience in the marketplace to make informed, profitable investment decisions.

5. Thinking, Fast and Slow by Daniel Kahneman

While not strictly an investing book, Thinking Fast and Slow by nobel laureate Daniel Kahneman’s offers profound insights into human behavior, decision making, and critical factors in investing. Kahneman distinguishes between two modes of thinking, fast (intuitive and emotional) and slow (deliberative and logical). Many investing mistakes stem from fast thinking, where emotional reactions lead to poor decisions, such as buying high during a market rally or selling low during a crash.

By understanding the cognitive biases influencing decision-making, investors can better control their impulses and make rational, informed decisions. Kahneman’s work complements other investment books by focusing on the psychological aspect of investing, which is often as important as financial knowledge.

Below, we’ll explore various categories of investing books, including those for beginners, stock market enthusiasts, property investors, and value investors, as well as audiobook options for those on the go.

Best Investing Books on the Market

The Best Investing Books have endured and continue to offer timeless principles. These books are not just about technical trading or market analysis but also delve into the psychological and strategic elements of investing.

-

Benjamin Graham’s Book “The Intelligent Investor”

It is often cited as the most essential book on investing. Value investing involves buying stocks worth more than they cost. This strategy focuses on buying stocks of undervalued companies. Instead of trying to make quick profits, value investors focus on long-term growth. They also think carefully about risk and try to avoid putting money into too dangerous companies. To succeed at value investing, it’s essential to understand a company’s actual worth, which is called intrinsic value.

-

Common Stocks and Uncommon Profits by Philip Fisher

Philip Fisher’s approach focuses on quality stocks and emphasizes the importance of a company’s management.

-

Burton Malkiel’s Book “A Random Walk Down Wall Street”

It is perfect for those looking to understand the efficient market hypothesis, which asserts that asset prices reflect all available information.

These books teach people how to invest their money wisely. They explain that it’s essential to be patient and think about the long-term when trying to get rich.

Best Trading Books for Beginners

If you’re new to trading, it’s essential to start with books that break down complex concepts into easily understandable terms.

-

The Little Book of Common Sense Investing by John C. Bogle

This book provides a beginner friendly introduction to index fund investing. Bogle, the founder of Vanguard, advocates for low-cost passive investing through index funds, which he argues will outperform most actively managed portfolios.

-

Trading for a Living by Alexander Elder

He combines psychology, technical analysis, and money management. It’s a beginner’s guide to disciplined trading that emphasizes controlling emotions when making trading decisions.

-

How to Make Money in Stocks by William J. O’Neil

This book is an ideal starting point for those looking to learn the basics of stock picking and market timing. O’Neil outlines his CAN SLIM strategy, a data-driven approach to identifying winning stocks.

These books provide a strong foundation in trading principles for beginners, offering practical tips and step-by-step guidance.

Best Stock Market Books

Experienced traders and market analysts can provide knowledge for those specifically interested in the stock market.

-

Market Wizards by Jack D. Schwager

This book is a fascinating collection of interviews with some of the world’s top traders. Schwager distills their advice and strategies, revealing that there is no one-size-fits-all approach to success in the stock market.

-

Joel Greenblatt’s Book “The Little Book that Still Beats the Market”

It explains the concept of magic formula investing. Greenblatt simplifies the process of finding undervalued stocks with high returns on capital.

-

The Essays of Warren Buffett by Warren Buffett and Lawrence Cunningham

It is an insightful compilation of letters Buffett has written to shareholders over the years. It offers a deep dive into his investment philosophy, which is rooted in value investing.

These stock market books provide the technical knowledge and mindset needed to thrive in investing.

Best Rental Property Investing Books

Buying property can be a great way to get richer and make money without much work. Several books can guide aspiring real estate investors through purchasing and managing rental properties.

-

Brandon Turner’s Book “The Book on Rental Property Investing”

This book is a comprehensive beginner guide. It covers everything from finding properties, financing them, managing tenants, and scaling a rental business.

-

Investing in Rental Properties for Beginners by Lisa Phillips

This book is another excellent resource for novice investors looking to enter the rental property market.

-

Real Estate Investing for Dummies by Eric Tyson and Robert S. Griswold

It simplifies real estate investment, making it approachable even for those without experience. The authors cover everything from property selection to taxation.

These books offer solid advice for building wealth through rental properties, making them essential for aspiring real estate investors.

Best Value Investing Books

It’s like finding a diamond for the price of a rock. Benjamin Graham was one of the first people to talk about this idea. Many investors still use his ideas today.

-

The Intelligent Investor by Benjamin Graham

The Intelligent Investor book is widely regarded as the bible of value investing. It teaches investors to focus on long-term results, avoid speculative trends, and understand the intrinsic value of businesses.

-

Benjamin Graham and David Dodd’s Book “Security Analysis”

It is a more technical and detailed exploration of value investing, providing a rigorous approach to evaluating stocks.

-

You Can Be a Stock Market Genius by Joel Greenblatt

In this book, the writer reveals lesser-known strategies for value investors, including special situations like mergers and spinoffs that can lead to outsized returns.

These books are crucial for anyone looking to adopt a disciplined, value-driven approach to investing.

Best Audio Books about Investing

There are many high-quality audiobooks on investing for those who prefer to listen to books while commuting or exercising.

-

Principles: Life and Work by Ray Dalio

The audiobook contains details about Dalio’s investment philosophy and life principles. It is available as an audiobook and is narrated engagingly.

-

Rich Dad Poor Dad

A book by Robert Kiyosaki about money. It is a popular audiobook that teaches people how to make money without working.

-

The Simple Path to Wealth by JL Collins

It teaches you how to manage your money and invest for financial independence. The book is easy to understand and gives practical advice.

Audiobooks are a great way to absorb valuable information while on the go, making them an excellent choice for busy individuals.

Reading the best investing books can offer profound knowledge and actionable strategies, helping individuals improve their financial decision-making. These books teach us different ways to invest money. Graham talks about finding stocks that are worth more than they cost. Malkiel says buying many stocks is an excellent way to invest. Bogle believes keeping things simple is essential. Lynch gives tips on choosing good stocks.

Kahneman’s studies how people think and make decisions when investing. Each book provides timeless insights that can help investors navigate the complex and often emotional investing world with clarity and confidence. By reading these seminal works, novice and experienced investors can develop the tools necessary to approach the markets with a well-rounded, strategic mindset.

Conversation

Latest Blogs

© Blog CoolCalculator, Explore CoolCalculator, your destination for the latest insights, tips, and updates on the world of online calculators. Stay informed and make your calculations smarter with our blog. ,

Designed

by Saad Media Team , Team Lead M.Rizwan Akhtar