Best Methods to Calculate Net Worth

Net worth shows how much money a person or company has left after paying off all their debts. It reflects the value of assets owned minus liabilities owed.

Net Worth shows how much money a person or company has left after paying off all their debts. It reflects the value of assets owned minus liabilities owed. Calculating net worth regularly provides insight into overall economic stability and can guide essential budgeting, investments, and retirement planning decisions.

Here, we’ll explore the best methods for calculating net worth and provide an overall understanding of its significance.

What is Net Worth?

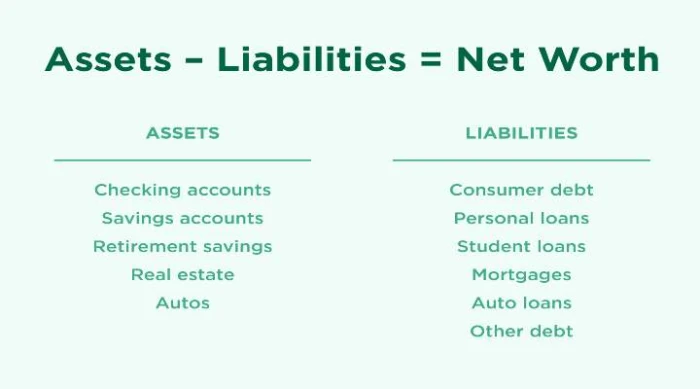

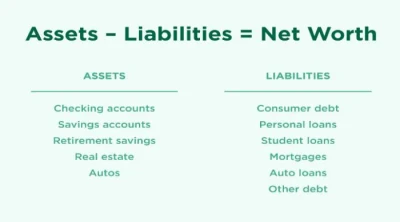

Net worth is equal to the total value of assets minus total value of liabilities. It is calculated using the below-given formula.

Net Worth = Total Value of Assets – Total Value of Liabilities

Assets include everything you own with financial value, such as real estate, vehicles, investments, cash, and valuable possessions like jewelry. Conversely, liabilities refer to everything you owe, including mortgages, credit card balances, loans, and other debts. The difference between these two aspects, i.e., assets and liabilities, gives a clear picture of your financial standing.

Methods to Calculate Net Worth

Manual Net Worth Calculation Using a Spreadsheet

The most straightforward method of calculating net worth is manually calculating the net worth using a spreadsheet. This method lets individuals personalize their net worth calculations, including every detail from significant assets like homes and cars to smaller items such as household goods.

- Step 1

In one column, list all assets, including their estimated current values. This can include cash, retirement accounts, real estate, cars, and other valuables.

- Step 2

In another column, list all your debts, like money you owe on a credit card, a house, a car, or school charges.

- Step 3

Subtract the total liabilities from total assets to find net worth.

Spreadsheets like Excel or Google Sheets provide valuable templates to help automate calculations, like adding totals for each category.

Using Financial Software or Apps

Various financial software programs and mobile apps automate the net worth calculation process, providing a faster and more accurate method. Applications such as Personal Capital, Mint, and Quicken connect directly to bank accounts, investments, credit cards, and loans, automatically updating values.

- Benefits of Using Software/Apps

These platforms reduce manual input, track changes over time, and help visualize trends. Many offer additional features, like budget tracking and investment advice, providing a holistic view of your finances.

- Challenges of Using Software/Apps

Some services charge fees, and data security can be a concern, especially if users input sensitive financial information.

Net Worth Calculators

For individuals seeking a quick solution, various online net worth calculators allow users to instantly input asset and liability details and generate a net worth figure. These calculators are widely available on personal finance websites and often include pre-set categories for assets and liabilities, making the process simple and fast.

- Advantages of Using Net Worth Calculators

Calculators are easy to use, often free, and can provide an immediate snapshot of financial health.

- Limitations of Using Net Worth Calculators

While quick, they may need more detail and personalization available with manual or software-based tools. They don’t track your net worth over time.

Assessing Net Worth through Financial Advisors

Some people prefer to work with a professional financial advisor to calculate their net worth. Advisors can provide expertise, especially when dealing with complex financial situations like managing a business, multiple properties, or investments.

- Benefits of Knowing Net Worth through Financial Advisor

Advisors offer personalized insights, help optimize financial decisions, and can assist in tax strategies, estate planning, and investments.

- Drawbacks of Knowing Net Worth through Financial Advisor

Hiring an advisor comes with fees, which may not be necessary for people with more straightforward financial situations.

Key Considerations When Calculating Net Worth

- Asset Valuation

When listing assets, it is essential to use current market values. The market can fluctuate for real estate, vehicles, and investments. Regular updates are necessary to ensure an accurate net worth calculation.

- Depreciating Assets

Some assets, like cars and electronics, depreciate over time. Depreciating assets at their original value can inflate net worth, so adjusting their value over time is essential.

- Liabilities

Be thorough in accounting for all liabilities. More than smaller debts or installment payments are needed to maintain the accuracy of net worth.

Importance of Tracking Net Worth

Regularly tracking net worth allows individuals to attain certain benefits, while some of them are given below.

- Assess Financial Progress

By calculating net worth periodically (quarterly or annually), people can assess their financial progress and adjust their goals accordingly.

- Identify Financial Strengths and Weaknesses

A positive or growing net worth shows financial health, while a negative or shrinking net worth might highlight issues such as overspending or excessive debt.

- Plan for Future Goals

Knowing how much money you have is essential for big things like buying a home, saving for when you stop working or paying for the school.

Elaborating further, here are some of the best methods to calculate net worth, along with essential concepts like net worth formulas, tangible net worth, net worth ration, and real-life examples for individuals and businesses.

Methods to Calculate Net Worth

Net worth is like the money left after you pay off your bills or debts. It’s what you own (like houses, stocks, and cash) minus what you owe (like loans and mortgages).

Both individuals and businesses benefit from calculating their net worth regularly. There are two primary ways to calculate net worth.

-

For Individuals

Net worth is a benchmark for financial health, helping them plan for future goals, such as retirement or purchasing a home. A positive and growing net worth indicates financial stability, while a negative net worth suggests potential challenges.

Net worth is calculated by listing all assets and liabilities, including bank accounts, real estate, investments, credit card debt, and loans.

-

For Businesses

Net worth is vital for assessing the company’s financial performance and attracting investors. Companies with a solid net worth are more likely to secure loans and investments, while a low net worth might signal financial instability.

Companies calculate their net worth, also called shareholder’s equity, by considering both tangible and intangible assets, along with liabilities like loans and payables.

Net Worth Formula

The basic formula for calculating net worth is as given below.

Net Worth = Total Assets – Total Liabilities

For individuals, assets include savings, property, and investments, while liabilities include mortgages, student loans, or credit card debt. For businesses, assets could consist of machinery, equipment, property, and accounts receivable, while liabilities include debts, accounts payable, and outstanding obligations.

Tangible Net Worth

Tangible net worth refers to physical assets that can be measured and valued, excluding intangible assets like patents, goodwill, or intellectual property.

Tangible Net Worth = Total Assets – Intangible Assets – Total Liabilities

This metric is essential for both businesses and individuals. It shows the core value of physical assets. It benefits creditors and investors who need to assess a company’s or individuals’ financial health without considering assets that might be harder to liquidate.

Examples of Net Worth

- Individual Net Worth Example

Consider an individual with $500,000 in total assets (including home equity, savings, and retirement accounts) and $200,000 in liabilities (including a mortgage and student loan debt). The net worth would be calculated as below.

Net Worth = 500,000 – 200,000 = 300,000

This means the individual has a net worth of $300,000 representing their financial standing after accounting for debts.

- Business Net Worth Example

A small business has $10,00,000 in total assets (including equipment, inventory, and cash) and $600,000 in liabilities (including loans and accounts payable).

The company’s net worth would be as given below.

Net Worth = 10,00,000 – 600,000 = 400,000

This means the business has shareholder equity of $400,000, reflecting the owners’ stake in the company after all liabilities have been paid.

Net Worth Formula on a Balance Sheet

The balance sheet of a company or individual provides a clear breakdown of assets and liabilities, making it a valuable tool for calculating net worth. The formula used on a balance sheet is same as subtracting total liabilities from total assets to know the net worth figure. For businesses, the equity section of the balance sheet reflects net worth or shareholder’s equity.

Calculating net worth is an essential practice for understanding and managing personal finances. Whether done manually, through financial software, online calculators, or with the help of a financial advisor, knowing one’s net worth offers valuable insights into financial health. Regular net worth assessments provide clarity and confidence, helping individuals achieve long-term economic success.

Net Worth shows how much money a person or company has left after paying off all their debts. It reflects the value of assets owned minus liabilities owed. Calculating net worth regularly provides insight into overall economic stability and can guide essential budgeting, investments, and retirement planning decisions.

Here, we’ll explore the best methods for calculating net worth and provide an overall understanding of its significance.

What is Net Worth?

Net worth is equal to the total value of assets minus total value of liabilities. It is calculated using the below-given formula.

Net Worth = Total Value of Assets – Total Value of Liabilities

Assets include everything you own with financial value, such as real estate, vehicles, investments, cash, and valuable possessions like jewelry. Conversely, liabilities refer to everything you owe, including mortgages, credit card balances, loans, and other debts. The difference between these two aspects, i.e., assets and liabilities, gives a clear picture of your financial standing.

Methods to Calculate Net Worth

Manual Net Worth Calculation Using a Spreadsheet

The most straightforward method of calculating net worth is manually calculating the net worth using a spreadsheet. This method lets individuals personalize their net worth calculations, including every detail from significant assets like homes and cars to smaller items such as household goods.

- Step 1

In one column, list all assets, including their estimated current values. This can include cash, retirement accounts, real estate, cars, and other valuables.

- Step 2

In another column, list all your debts, like money you owe on a credit card, a house, a car, or school charges.

- Step 3

Subtract the total liabilities from total assets to find net worth.

Spreadsheets like Excel or Google Sheets provide valuable templates to help automate calculations, like adding totals for each category.

Using Financial Software or Apps

Various financial software programs and mobile apps automate the net worth calculation process, providing a faster and more accurate method. Applications such as Personal Capital, Mint, and Quicken connect directly to bank accounts, investments, credit cards, and loans, automatically updating values.

- Benefits of Using Software/Apps

These platforms reduce manual input, track changes over time, and help visualize trends. Many offer additional features, like budget tracking and investment advice, providing a holistic view of your finances.

- Challenges of Using Software/Apps

Some services charge fees, and data security can be a concern, especially if users input sensitive financial information.

Net Worth Calculators

For individuals seeking a quick solution, various online net worth calculators allow users to instantly input asset and liability details and generate a net worth figure. These calculators are widely available on personal finance websites and often include pre-set categories for assets and liabilities, making the process simple and fast.

- Advantages of Using Net Worth Calculators

Calculators are easy to use, often free, and can provide an immediate snapshot of financial health.

- Limitations of Using Net Worth Calculators

While quick, they may need more detail and personalization available with manual or software-based tools. They don’t track your net worth over time.

Assessing Net Worth through Financial Advisors

Some people prefer to work with a professional financial advisor to calculate their net worth. Advisors can provide expertise, especially when dealing with complex financial situations like managing a business, multiple properties, or investments.

- Benefits of Knowing Net Worth through Financial Advisor

Advisors offer personalized insights, help optimize financial decisions, and can assist in tax strategies, estate planning, and investments.

- Drawbacks of Knowing Net Worth through Financial Advisor

Hiring an advisor comes with fees, which may not be necessary for people with more straightforward financial situations.

Key Considerations When Calculating Net Worth

- Asset Valuation

When listing assets, it is essential to use current market values. The market can fluctuate for real estate, vehicles, and investments. Regular updates are necessary to ensure an accurate net worth calculation.

- Depreciating Assets

Some assets, like cars and electronics, depreciate over time. Depreciating assets at their original value can inflate net worth, so adjusting their value over time is essential.

- Liabilities

Be thorough in accounting for all liabilities. More than smaller debts or installment payments are needed to maintain the accuracy of net worth.

Importance of Tracking Net Worth

Regularly tracking net worth allows individuals to attain certain benefits, while some of them are given below.

- Assess Financial Progress

By calculating net worth periodically (quarterly or annually), people can assess their financial progress and adjust their goals accordingly.

- Identify Financial Strengths and Weaknesses

A positive or growing net worth shows financial health, while a negative or shrinking net worth might highlight issues such as overspending or excessive debt.

- Plan for Future Goals

Knowing how much money you have is essential for big things like buying a home, saving for when you stop working or paying for the school.

Elaborating further, here are some of the best methods to calculate net worth, along with essential concepts like net worth formulas, tangible net worth, net worth ration, and real-life examples for individuals and businesses.

Methods to Calculate Net Worth

Net worth is like the money left after you pay off your bills or debts. It’s what you own (like houses, stocks, and cash) minus what you owe (like loans and mortgages).

Both individuals and businesses benefit from calculating their net worth regularly. There are two primary ways to calculate net worth.

-

For Individuals

Net worth is a benchmark for financial health, helping them plan for future goals, such as retirement or purchasing a home. A positive and growing net worth indicates financial stability, while a negative net worth suggests potential challenges.

Net worth is calculated by listing all assets and liabilities, including bank accounts, real estate, investments, credit card debt, and loans.

-

For Businesses

Net worth is vital for assessing the company’s financial performance and attracting investors. Companies with a solid net worth are more likely to secure loans and investments, while a low net worth might signal financial instability.

Companies calculate their net worth, also called shareholder’s equity, by considering both tangible and intangible assets, along with liabilities like loans and payables.

Net Worth Formula

The basic formula for calculating net worth is as given below.

Net Worth = Total Assets – Total Liabilities

For individuals, assets include savings, property, and investments, while liabilities include mortgages, student loans, or credit card debt. For businesses, assets could consist of machinery, equipment, property, and accounts receivable, while liabilities include debts, accounts payable, and outstanding obligations.

Tangible Net Worth

Tangible net worth refers to physical assets that can be measured and valued, excluding intangible assets like patents, goodwill, or intellectual property.

Tangible Net Worth = Total Assets – Intangible Assets – Total Liabilities

This metric is essential for both businesses and individuals. It shows the core value of physical assets. It benefits creditors and investors who need to assess a company’s or individuals’ financial health without considering assets that might be harder to liquidate.

Examples of Net Worth

- Individual Net Worth Example

Consider an individual with $500,000 in total assets (including home equity, savings, and retirement accounts) and $200,000 in liabilities (including a mortgage and student loan debt). The net worth would be calculated as below.

Net Worth = 500,000 – 200,000 = 300,000

This means the individual has a net worth of $300,000 representing their financial standing after accounting for debts.

- Business Net Worth Example

A small business has $10,00,000 in total assets (including equipment, inventory, and cash) and $600,000 in liabilities (including loans and accounts payable).

The company’s net worth would be as given below.

Net Worth = 10,00,000 – 600,000 = 400,000

This means the business has shareholder equity of $400,000, reflecting the owners’ stake in the company after all liabilities have been paid.

Net Worth Formula on a Balance Sheet

The balance sheet of a company or individual provides a clear breakdown of assets and liabilities, making it a valuable tool for calculating net worth. The formula used on a balance sheet is same as subtracting total liabilities from total assets to know the net worth figure. For businesses, the equity section of the balance sheet reflects net worth or shareholder’s equity.

Calculating net worth is an essential practice for understanding and managing personal finances. Whether done manually, through financial software, online calculators, or with the help of a financial advisor, knowing one’s net worth offers valuable insights into financial health. Regular net worth assessments provide clarity and confidence, helping individuals achieve long-term economic success.

Conversation

Latest Blogs

© Blog CoolCalculator, Explore CoolCalculator, your destination for the latest insights, tips, and updates on the world of online calculators. Stay informed and make your calculations smarter with our blog. ,

Designed

by Saad Media Team , Team Lead M.Rizwan Akhtar