Best Private Student Loans

When selecting a private student loan, choosing a lender that offers competitive rates and exceptional customer service is essential.

Financing higher education is a significant concern for students and families alike. While scholarships and grants can cover some costs, many students require additional financial assistance through student loans. Both federal and private lenders offer student loans, each catering to different needs, from undergraduate degrees to specialized graduate programs.

In this guide, we have discussed various student loans, including private student loans, international student loans, federal student loans, and bank student loans, while focusing on the best private student loan providers, interest rates, and how factors like having a cosigner can impact loan terms.

Understanding the Types of Student Loans for College Education

Students have various options when funding a college education, including federal and private student loans. These loans are designed to cover books, tuition, room and board, and other educational expenses. Depending on the student’s needs and circumstances, one may opt for federal student loans, which come with government-backed benefits, or private loans offered by banks, credit unions, and other financial institutions.

Federal Student Loans

The government provides these with standardized interest rates, loan forgiveness programs, and flexible repayment plans. They are typically easier to qualify for and have benefits such as deferment or forbearance in cases of financial hardship.

Private Student Loans

Private financial institutions often offer these loans with competitive interest rates, especially for students or cosigners with excellent credit. However, they don’t provide the same benefits as federal loans, such as forgiveness options or income-driven repayment plans.

Best Private Student Loan Companies

When selecting a private student loan, it is essential to choose a lender that offers competitive rates and exceptional customer service. Some of the best student loan companies are listed here, so let’s have a look.

Sallie Mae

One of the largest private lenders, Sallie Mae offers undergraduate and graduate student loans and career training programs. It provides flexible repayment options and allows cosigners to help students with limited credit histories secure better interest rates.

College Ave

Known for its simplicity and ease of use, it allows students to customize their loan terms and repayment options. Its loan come with competitive interest rates and offer repayment plans to meet students’ unique needs.

Earnest

Earnest is recognized for its customer-centric approach, offering flexible repayment terms, including the ability to skip one payment a year without penalty. They also offer low-interest loans for both undergraduate and graduate students.

Discover Student Loans

Known for their lack of fees (no application, origination, or late fees), Discover Student Loans offers competitive rates and a cash back reward for good academic performance.

Lend Key

This platform connects students with community banks and credit unions, offering lower interest rates and more personalized service. Lend Key is known for its transparent terms and the ease of managing loans through its online platform.

Things to Consider When Applying for Private Loan for College

Private student loans are ideal for students who need to borrow beyond the federal loan limits or want to secure lower interest rates. These loans can also help cover additional expenses such as housing, meal plans, and other non-tuition related costs.

- Eligibility Requirements

Unlike federal loans, private loans require credit checks and often a cosigner. Students with little to no credit history might struggle to qualify independently.

- Interest Rates

Private loans generally offer both fixed and variable interest rates. Fixed rates stay the same for the whole time you have the loan. However, variable rates can go up or down depending on what happens in the market.

- Repayment Terms

Private loans typically offer less flexibility than federal loans. However, some lenders, such as Sallie Mae and College Ave, provide various repayment plans to suit different financial situations.

Best Graduate Student Loan Providers

Graduate students often face higher tuition costs than undergraduates, and while federal loans such as Direct Unsubsidized Loans and Grad PLUS Loans are available, they come with borrowing limits. Private graduate student loans can bridge the financial gap for students pursuing medical, law, MBA, or other advanced degrees.

Common Bond

This lender is famous for its competitive rates and customer service. It offers both fixed-rate and variable-rate loans tailored specifically for graduate students.

SoFi

SoFi is known for providing loans with no fees and offering additional perks like career coaching and networking events. Their loans cater to students pursuing professional degrees, and they offer competitive rates for credit-worthy borrowers.

Citizens Bank

With multi-year approval options and loyalty discounts for existing customers, Citizens Bank is a strong choice for graduate students who need ongoing financial support throughout their studies.

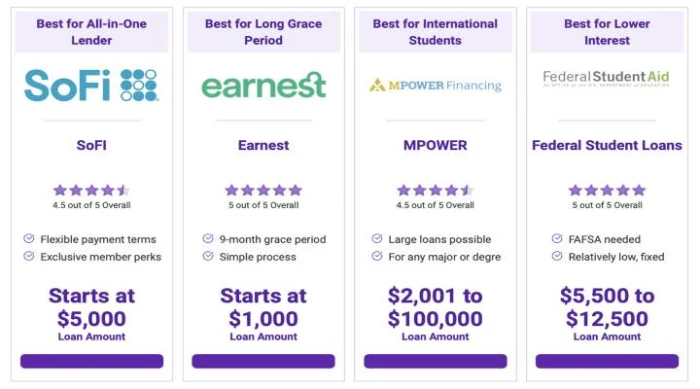

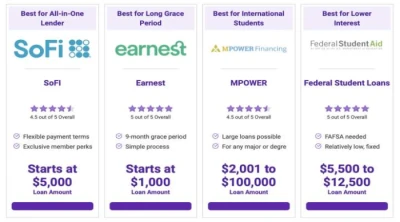

Top Student Loan Providers

Choosing the best student loan provider involves considering interest rates, customer service, repayment options, and borrower benefits. The following providers consistently rank among the best in terms of their specialties.

- Sallie Mae – Offers a wide range of loans for all educational levels.

- Earnest – Stands out for its borrower-friendly policies including customizable repayment options.

- Lend Key – Provides some of the lowest loan rates in the market.

- College Ave – With a straightforward approach, it offers transparent loan options with competitive rates.

- Ascent – Offers loans with and without cosigners for international students.

Impact of Cosigner on Student Loan Interest Rates

Interest rates are among the most important factors when choosing a private student loan. The interest rate on a loan depends on your credit history, how long you want to borrow the money, and whether you choose a fixed or changing interest rate.

- Lowest Interest Rates of Private Student Loans

Lenders like Earnest, SoFi, and College Ave currently offer some of the lowest interest rates for private student loans. These lenders provide loans with interest rates of about 3% to 5% for borrowers with good credit. These loans have a fixed interest rate, which means the rate will not change. Variable rate loans might have a lower starting interest rate, but the rate can increase over time.

- Cosigner Impact on Rates

Many students need a cosigner to secure a lower interest rate. Lenders like Sallie Mae, College Ave, and Lend Key allow cosigners, which can significantly reduce the interest rate if the cosigner has excellent credit. Some lenders also offer cosigner release programs, allowing cosigners to be removed from the loan after a set number of on-time payments.

If you are finding it hard to do calculations while giving attention to multiple aspects of student loan offers, then, you should use the student loan calculator to know the actual amounts even before applying for the loan term.

Benefits of Cosigner

For students with limited or no credit history, having a cosigner can dramatically improve their chances of securing a private student loan with favorable terms. A cosigner is like a helper for all the process. Simply, a cosigner promises to pay back the loan if the student can’t.

- Improved Approval Odds

A cosigner with a strong credit history can help students who would otherwise be denied a loan plan.

- Lowest Interest Rates

If someone with a good credit score agrees to sign the loan, it can help you get a lower interest rate. This means you’ll pay less money overall when you repay the loan.

- Cosigner Release

Some lenders like College Ave and Sallie Mae offer cosigner release options. These allow the cosigner to be removed from the loan after the borrower makes a series of on-time payments.

Things that Influence Student Loan Interest Rates

Obtaining the lowest private student loan rates is crucial for minimizing the cost of borrowing. Lenders like SoFi, Earnest, and College Ave are known for offering highly competitive rates to qualified borrowers.

- Credit Score

Borrowers with excellent credit are likelier to receive lower interest rates.

- Loan Type

Fixed-rate loans tend to have slightly higher starting rates than variable-rate loans, which may start lower but fluctuate over time.

- Repayment Term

Loans with shorter repayment terms usually have lower interest rates. However, this can increase monthly payments, so borrowers must carefully assess their financial situation.

Federal VS Private Student Loans

Federal and private student loans serve different purposes, and choosing one over the other, or a combination of both, depends on individual circumstances.

Federal Student Loans

Pros

Standardized interest rates, income-driven repayment plans, and the potential for loan forgiveness. Many loans don’t require good credit, which means more students can get them.

Cons

Loan limits may not cover the total cost of education, and interest rates can be higher than private loans for well-qualified borrowers.

Private Student Loans

Pros

Lower interest rates are available for creditworthy borrowers, and there are no borrowing limits. There are also more options for tailoring repayment terms, and some lenders offer perks like career coaching or cash back rewards.

Cons

Requires a credit check and often a cosigner. Lacks the borrower protections and repayment flexibility of federal loans, such as forbearance, deferment, or forgiveness programs.

When you’re going to college, nitpicking the right loan is essential to help pay for it. Government loans are good because they have flexible payment plans and can sometimes be forgiven. Sometimes, private loans are good, especially if you need to borrow more money than the government lets you or if you can get a better interest rate with someone else signing the loan with you.

Whether you’re in college or getting a degree after college, it’s essential to compare different loans, consider interest rates and how long you have to pay them back, and choose a lender that fits your financial goals and what you need.

Financing higher education is a significant concern for students and families alike. While scholarships and grants can cover some costs, many students require additional financial assistance through student loans. Both federal and private lenders offer student loans, each catering to different needs, from undergraduate degrees to specialized graduate programs.

In this guide, we have discussed various student loans, including private student loans, international student loans, federal student loans, and bank student loans, while focusing on the best private student loan providers, interest rates, and how factors like having a cosigner can impact loan terms.

Understanding the Types of Student Loans for College Education

Students have various options when funding a college education, including federal and private student loans. These loans are designed to cover books, tuition, room and board, and other educational expenses. Depending on the student’s needs and circumstances, one may opt for federal student loans, which come with government-backed benefits, or private loans offered by banks, credit unions, and other financial institutions.

Federal Student Loans

The government provides these with standardized interest rates, loan forgiveness programs, and flexible repayment plans. They are typically easier to qualify for and have benefits such as deferment or forbearance in cases of financial hardship.

Private Student Loans

Private financial institutions often offer these loans with competitive interest rates, especially for students or cosigners with excellent credit. However, they don’t provide the same benefits as federal loans, such as forgiveness options or income-driven repayment plans.

Best Private Student Loan Companies

When selecting a private student loan, it is essential to choose a lender that offers competitive rates and exceptional customer service. Some of the best student loan companies are listed here, so let’s have a look.

Sallie Mae

One of the largest private lenders, Sallie Mae offers undergraduate and graduate student loans and career training programs. It provides flexible repayment options and allows cosigners to help students with limited credit histories secure better interest rates.

College Ave

Known for its simplicity and ease of use, it allows students to customize their loan terms and repayment options. Its loan come with competitive interest rates and offer repayment plans to meet students’ unique needs.

Earnest

Earnest is recognized for its customer-centric approach, offering flexible repayment terms, including the ability to skip one payment a year without penalty. They also offer low-interest loans for both undergraduate and graduate students.

Discover Student Loans

Known for their lack of fees (no application, origination, or late fees), Discover Student Loans offers competitive rates and a cash back reward for good academic performance.

Lend Key

This platform connects students with community banks and credit unions, offering lower interest rates and more personalized service. Lend Key is known for its transparent terms and the ease of managing loans through its online platform.

Things to Consider When Applying for Private Loan for College

Private student loans are ideal for students who need to borrow beyond the federal loan limits or want to secure lower interest rates. These loans can also help cover additional expenses such as housing, meal plans, and other non-tuition related costs.

- Eligibility Requirements

Unlike federal loans, private loans require credit checks and often a cosigner. Students with little to no credit history might struggle to qualify independently.

- Interest Rates

Private loans generally offer both fixed and variable interest rates. Fixed rates stay the same for the whole time you have the loan. However, variable rates can go up or down depending on what happens in the market.

- Repayment Terms

Private loans typically offer less flexibility than federal loans. However, some lenders, such as Sallie Mae and College Ave, provide various repayment plans to suit different financial situations.

Best Graduate Student Loan Providers

Graduate students often face higher tuition costs than undergraduates, and while federal loans such as Direct Unsubsidized Loans and Grad PLUS Loans are available, they come with borrowing limits. Private graduate student loans can bridge the financial gap for students pursuing medical, law, MBA, or other advanced degrees.

Common Bond

This lender is famous for its competitive rates and customer service. It offers both fixed-rate and variable-rate loans tailored specifically for graduate students.

SoFi

SoFi is known for providing loans with no fees and offering additional perks like career coaching and networking events. Their loans cater to students pursuing professional degrees, and they offer competitive rates for credit-worthy borrowers.

Citizens Bank

With multi-year approval options and loyalty discounts for existing customers, Citizens Bank is a strong choice for graduate students who need ongoing financial support throughout their studies.

Top Student Loan Providers

Choosing the best student loan provider involves considering interest rates, customer service, repayment options, and borrower benefits. The following providers consistently rank among the best in terms of their specialties.

- Sallie Mae – Offers a wide range of loans for all educational levels.

- Earnest – Stands out for its borrower-friendly policies including customizable repayment options.

- Lend Key – Provides some of the lowest loan rates in the market.

- College Ave – With a straightforward approach, it offers transparent loan options with competitive rates.

- Ascent – Offers loans with and without cosigners for international students.

Impact of Cosigner on Student Loan Interest Rates

Interest rates are among the most important factors when choosing a private student loan. The interest rate on a loan depends on your credit history, how long you want to borrow the money, and whether you choose a fixed or changing interest rate.

- Lowest Interest Rates of Private Student Loans

Lenders like Earnest, SoFi, and College Ave currently offer some of the lowest interest rates for private student loans. These lenders provide loans with interest rates of about 3% to 5% for borrowers with good credit. These loans have a fixed interest rate, which means the rate will not change. Variable rate loans might have a lower starting interest rate, but the rate can increase over time.

- Cosigner Impact on Rates

Many students need a cosigner to secure a lower interest rate. Lenders like Sallie Mae, College Ave, and Lend Key allow cosigners, which can significantly reduce the interest rate if the cosigner has excellent credit. Some lenders also offer cosigner release programs, allowing cosigners to be removed from the loan after a set number of on-time payments.

If you are finding it hard to do calculations while giving attention to multiple aspects of student loan offers, then, you should use the student loan calculator to know the actual amounts even before applying for the loan term.

Benefits of Cosigner

For students with limited or no credit history, having a cosigner can dramatically improve their chances of securing a private student loan with favorable terms. A cosigner is like a helper for all the process. Simply, a cosigner promises to pay back the loan if the student can’t.

- Improved Approval Odds

A cosigner with a strong credit history can help students who would otherwise be denied a loan plan.

- Lowest Interest Rates

If someone with a good credit score agrees to sign the loan, it can help you get a lower interest rate. This means you’ll pay less money overall when you repay the loan.

- Cosigner Release

Some lenders like College Ave and Sallie Mae offer cosigner release options. These allow the cosigner to be removed from the loan after the borrower makes a series of on-time payments.

Things that Influence Student Loan Interest Rates

Obtaining the lowest private student loan rates is crucial for minimizing the cost of borrowing. Lenders like SoFi, Earnest, and College Ave are known for offering highly competitive rates to qualified borrowers.

- Credit Score

Borrowers with excellent credit are likelier to receive lower interest rates.

- Loan Type

Fixed-rate loans tend to have slightly higher starting rates than variable-rate loans, which may start lower but fluctuate over time.

- Repayment Term

Loans with shorter repayment terms usually have lower interest rates. However, this can increase monthly payments, so borrowers must carefully assess their financial situation.

Federal VS Private Student Loans

Federal and private student loans serve different purposes, and choosing one over the other, or a combination of both, depends on individual circumstances.

Federal Student Loans

Pros

Standardized interest rates, income-driven repayment plans, and the potential for loan forgiveness. Many loans don’t require good credit, which means more students can get them.

Cons

Loan limits may not cover the total cost of education, and interest rates can be higher than private loans for well-qualified borrowers.

Private Student Loans

Pros

Lower interest rates are available for creditworthy borrowers, and there are no borrowing limits. There are also more options for tailoring repayment terms, and some lenders offer perks like career coaching or cash back rewards.

Cons

Requires a credit check and often a cosigner. Lacks the borrower protections and repayment flexibility of federal loans, such as forbearance, deferment, or forgiveness programs.

When you’re going to college, nitpicking the right loan is essential to help pay for it. Government loans are good because they have flexible payment plans and can sometimes be forgiven. Sometimes, private loans are good, especially if you need to borrow more money than the government lets you or if you can get a better interest rate with someone else signing the loan with you.

Whether you’re in college or getting a degree after college, it’s essential to compare different loans, consider interest rates and how long you have to pay them back, and choose a lender that fits your financial goals and what you need.

Conversation

Latest Blogs

© Blog CoolCalculator, Explore CoolCalculator, your destination for the latest insights, tips, and updates on the world of online calculators. Stay informed and make your calculations smarter with our blog. ,

Designed

by Saad Media Team , Team Lead M.Rizwan Akhtar