Best Strategies to Choose a Financial Advisor that You Can Trust

Choosing a financial advisor is very important because it can significantly affect how much money you have in the future.

Choosing a financial advisor is very important because it can significantly affect how much money you have in the future. A good advisor can help you save money, plan for retirement, invest wisely, and achieve your financial goals. However, a lousy good advisor can make good decisions that will save you money. Therefore, carefully considering who you choose as your financial advisor is crucial.

1. Understand Your Needs

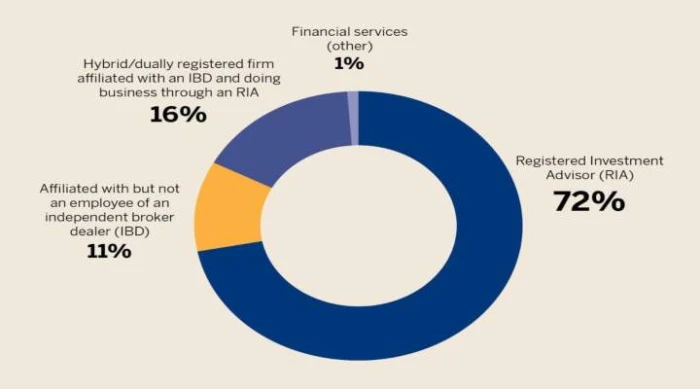

Before asking for help with your money, you should know what you want to do with it. Are you saving for when you're old, growing your money, saving on taxes, or planning what happens to your money when you die? Knowing your goals will help you find the right kind of money expert. For example, a Registered Investment Advisor (RIA) may be suitable if you're primarily looking for investment management. A Certified Financial Planner (CFP) might be better if you need comprehensive financial planning.

2. Check Credentials and Experience

Credentials are a crucial indicator of an advisor's qualifications and expertise. Look for advisors who have recognized certifications, such as CFP, Chartered Financial Analyst (CFA), or Personal Financial Specialist (PFS). These designations require rigorous exams and adherence to ethical standards. Additionally, consider the advisor's experience. An advisor with several years of experience will better understand market cycles and client needs.

3. Research their Background

It's essential to check out an advisor's past before you hire them. Look into their work history to see if they've been in trouble and if people have complained about them. You can find this information on websites like FINRA Broker Check and the SEC's Investment Advisor Public Disclosure. These websites will tell you about the advisor's work history and any problems they've had.

4. Understand their Fee Structure

Financial advisors can get paid in different ways. Some charge a flat fee or a percentage of your money but don't earn extra from selling your products. This means they're looking out for your best interests, not just trying to make more money for themselves. Fee-based advisors might charge fees but also earn commissions, while commission-based advisors earn their income through their products, which can lead to biased advice. Knowing how an advisor gets paid will help you find someone who wants what you want.

5. Seek Fiduciary Responsibility

A fiduciary is legally required to act in your best interest, putting your needs above their own. Not all financial advisors are fiduciaries, so confirming this status is essential before hiring an advisor. Fiduciaries provide more transparency and are less likely to push products that benefit them at your expense.

6. Conduct Interviews

Meeting with potential advisors allows you to gauge their communication style, personality, and approach to financial planning. During these interviews, ask about their experience, services, investment philosophy, and how they would address your financial goals. This interaction will give you a sense of whether you can build a trusting relationship with the advisor.

7. Ask for References and Reviews

Ask the advisor for names of people they've helped in the past. This will show you how good they are at their job. You can also read what other people think of them online. But be careful because sometimes these reviews must be more accurate or fair. Check many different places to make sure what you read is true.

Overview of the Best Strategies for Choosing a Trusted Financial Advisor

Here's an overview of the best strategies for choosing a trusted financial advisor, focusing on key aspects such as choosing the best financial advisor, finding a fiduciary financial advisor, finding a financial planner, selecting the right investment advisor, and picking a financial planner.

-

Choosing the Best Financial Advisor

For choosing the right financial advisor for your finances, you should first decide from whom you should get help, this strategy will save you a lot of time. Some people help with saving for retirement, others help with taxes, while some help with planning what happens to your money when you die or invest your money. Knowing what you want to do with your money will help you find someone who can do it.

Additionally, searching for potential advisor's background, credentials, and experience is vital. Look for certifications like Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Personal Financial Specialist (PFS), which indicate a high level of competency and commitment to ethical standards.

-

Finding a Fiduciary Financial Advisor

It's essential to ensure your financial advisor is a "fiduciary". This means they have to do what's best for them rather than for themselves. Some advisors might get paid to sell you certain things so that they might care about you less. To find a good advisor, ask them if they're a fiduciary. You can also check with government groups like the SEC or FINRA.

-

Finding a Financial Planner

If your financial needs are broader and include budgeting, saving, and planning for significant life events, you may want to find a financial planner. Financial planners offer comprehensive services that cover various aspects of personal finance. To choose the right financial planner, consider their approach to financial planning, their fees, and how they work with clients. Look for a planner who listens to your needs, provides customized advice, and communicates clearly.

-

Choosing an Investment Advisor

Finding the right investment advisor is significant if you want to grow your money. Investment advisors help people manage and choose investments. When picking one, check how they invest money, their past results, and how much they charge. They should also be honest about their fees and how well your money is doing. This helps you trust them.

-

Finally Picking a Financial Planner

Finally, when picking a financial planner, consider your connection with the advisor. Financial planning is a long-term relationship, and trust is built over time. It is essential to meet with potential planners to discuss your financial situation and gauge their understanding and approach. A good financial planner will have the technical skills and demonstrate empathy and a commitment to helping you achieve your financial goals.

Financial a financial advisor you can trust takes time and effort. It would help if you do a lot of research and carefully consider who you choose. The best strategies involve the following.

- Understanding your financial needs.

- Verifying the advisor's credentials and experience.

- Understanding their fee structure.

- Ensuring they have a fiduciary duty.

- Conducting interviews.

- Seeking references.

By following these steps, you can find a good advisor who knows much about money and wants to help you. This strategy can help you build a solid and safe financial future.

Also, read the following related posts.

- Top Passive Income Ideas

- Types of GDP and Methods of Calculating GDP

Choosing a financial advisor is very important because it can significantly affect how much money you have in the future. A good advisor can help you save money, plan for retirement, invest wisely, and achieve your financial goals. However, a lousy good advisor can make good decisions that will save you money. Therefore, carefully considering who you choose as your financial advisor is crucial.

1. Understand Your Needs

Before asking for help with your money, you should know what you want to do with it. Are you saving for when you're old, growing your money, saving on taxes, or planning what happens to your money when you die? Knowing your goals will help you find the right kind of money expert. For example, a Registered Investment Advisor (RIA) may be suitable if you're primarily looking for investment management. A Certified Financial Planner (CFP) might be better if you need comprehensive financial planning.

2. Check Credentials and Experience

Credentials are a crucial indicator of an advisor's qualifications and expertise. Look for advisors who have recognized certifications, such as CFP, Chartered Financial Analyst (CFA), or Personal Financial Specialist (PFS). These designations require rigorous exams and adherence to ethical standards. Additionally, consider the advisor's experience. An advisor with several years of experience will better understand market cycles and client needs.

3. Research their Background

It's essential to check out an advisor's past before you hire them. Look into their work history to see if they've been in trouble and if people have complained about them. You can find this information on websites like FINRA Broker Check and the SEC's Investment Advisor Public Disclosure. These websites will tell you about the advisor's work history and any problems they've had.

4. Understand their Fee Structure

Financial advisors can get paid in different ways. Some charge a flat fee or a percentage of your money but don't earn extra from selling your products. This means they're looking out for your best interests, not just trying to make more money for themselves. Fee-based advisors might charge fees but also earn commissions, while commission-based advisors earn their income through their products, which can lead to biased advice. Knowing how an advisor gets paid will help you find someone who wants what you want.

5. Seek Fiduciary Responsibility

A fiduciary is legally required to act in your best interest, putting your needs above their own. Not all financial advisors are fiduciaries, so confirming this status is essential before hiring an advisor. Fiduciaries provide more transparency and are less likely to push products that benefit them at your expense.

6. Conduct Interviews

Meeting with potential advisors allows you to gauge their communication style, personality, and approach to financial planning. During these interviews, ask about their experience, services, investment philosophy, and how they would address your financial goals. This interaction will give you a sense of whether you can build a trusting relationship with the advisor.

7. Ask for References and Reviews

Ask the advisor for names of people they've helped in the past. This will show you how good they are at their job. You can also read what other people think of them online. But be careful because sometimes these reviews must be more accurate or fair. Check many different places to make sure what you read is true.

Overview of the Best Strategies for Choosing a Trusted Financial Advisor

Here's an overview of the best strategies for choosing a trusted financial advisor, focusing on key aspects such as choosing the best financial advisor, finding a fiduciary financial advisor, finding a financial planner, selecting the right investment advisor, and picking a financial planner.

-

Choosing the Best Financial Advisor

For choosing the right financial advisor for your finances, you should first decide from whom you should get help, this strategy will save you a lot of time. Some people help with saving for retirement, others help with taxes, while some help with planning what happens to your money when you die or invest your money. Knowing what you want to do with your money will help you find someone who can do it.

Additionally, searching for potential advisor's background, credentials, and experience is vital. Look for certifications like Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Personal Financial Specialist (PFS), which indicate a high level of competency and commitment to ethical standards.

-

Finding a Fiduciary Financial Advisor

It's essential to ensure your financial advisor is a "fiduciary". This means they have to do what's best for them rather than for themselves. Some advisors might get paid to sell you certain things so that they might care about you less. To find a good advisor, ask them if they're a fiduciary. You can also check with government groups like the SEC or FINRA.

-

Finding a Financial Planner

If your financial needs are broader and include budgeting, saving, and planning for significant life events, you may want to find a financial planner. Financial planners offer comprehensive services that cover various aspects of personal finance. To choose the right financial planner, consider their approach to financial planning, their fees, and how they work with clients. Look for a planner who listens to your needs, provides customized advice, and communicates clearly.

-

Choosing an Investment Advisor

Finding the right investment advisor is significant if you want to grow your money. Investment advisors help people manage and choose investments. When picking one, check how they invest money, their past results, and how much they charge. They should also be honest about their fees and how well your money is doing. This helps you trust them.

-

Finally Picking a Financial Planner

Finally, when picking a financial planner, consider your connection with the advisor. Financial planning is a long-term relationship, and trust is built over time. It is essential to meet with potential planners to discuss your financial situation and gauge their understanding and approach. A good financial planner will have the technical skills and demonstrate empathy and a commitment to helping you achieve your financial goals.

Financial a financial advisor you can trust takes time and effort. It would help if you do a lot of research and carefully consider who you choose. The best strategies involve the following.

- Understanding your financial needs.

- Verifying the advisor's credentials and experience.

- Understanding their fee structure.

- Ensuring they have a fiduciary duty.

- Conducting interviews.

- Seeking references.

By following these steps, you can find a good advisor who knows much about money and wants to help you. This strategy can help you build a solid and safe financial future.

Also, read the following related posts.

- Top Passive Income Ideas

- Types of GDP and Methods of Calculating GDP

Conversation

Latest Blogs

© Blog CoolCalculator, Explore CoolCalculator, your destination for the latest insights, tips, and updates on the world of online calculators. Stay informed and make your calculations smarter with our blog. ,

Designed

by Saad Media Team , Team Lead M.Rizwan Akhtar