Best Strategies to Diversify an Investment Portfolio

Diversification means spreading your money across different kinds of investments. Putting money in various places like stocks, bonds, and different businesses can make your money grow steadier.

Diversification means spreading your money across different kinds of investments. This helps protect your money if one investment gives bad experience or say poor results. Putting money in various places like stocks, bonds, and different businesses can make your money grow steadier and smoother. We'll talk about some ways to diversify your investment.

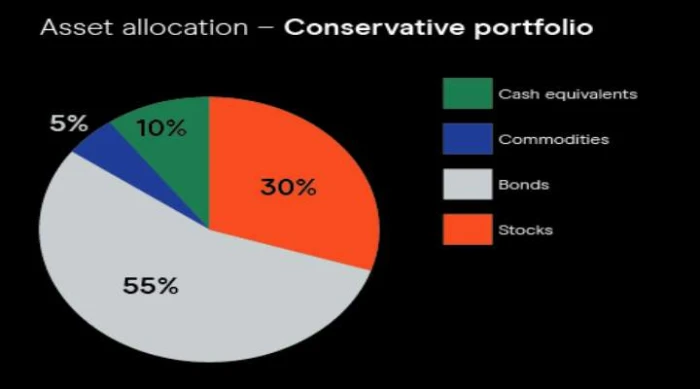

1. Asset Class Diversification

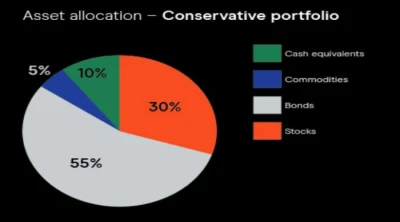

Putting your money in different kinds of investments is a smart way to protect your money. The primary asset classes include stocks, bonds, real estate, commodities, and cash or cash equivalents. Each asset class has risk and return characteristics, often performing differently under various market conditions. For example, stocks may offer high returns but also have higher volatility. Bonds, on the other hand, tend to be more stable but provide lower returns. By spreading your money across different investments, you can protect yourself from losing too much if one investment does poorly.

2. Geographic Diversification

Putting your money in different places worldwide is an excellent way to protect your investments. By spreading investments across multiple countries, investors can reduce their exposure to risks specific to a single country or region, such as political instability, economic downturns, or currency fluctuations. For instance, while the U.S. stock market might be struggling, Asian or European markets could be performing well, thus, balancing the portfolio's performance. Geographic diversification can be achieved through international stocks, exchange-traded funds (ETFs), or mutual funds focusing on global markets.

3. Industry and Sector Diversification

It's important to diversify across various industries and sectors within the equity portion of a portfolio. Different industries often perform differently based on economic cycles, technological advancements, and consumer preferences. For example, technology stocks may thrive during periods of innovation, while energy stocks perform better during economic expansions. Investing in a mix of different kinds of businesses, like tech companies, healthcare companies, banks, and stores that sell things people use every day, can help protect your money. If one business does poorly, the others might do well, so your overall investments won't be hurt as much.

4. Investment Style Diversification

Investors can also diversify by including different investment styles in their portfolios. This consists of a mix of growth and value stocks, large-cap and small-cap stocks, and other investment strategies such as active and passive management. Growth stocks offer higher potential returns but come with higher risk, while value stocks are usually more stable and may provide dividends. By combining these different styles, investors can achieve a balanced portfolio that performs well in varying market conditions.

5. Regular Portfolio Rebalancing

A well-diversified portfolio requires regular maintenance to align with an investor's risk tolerance and financial goals. Market conditions and individual asset performances can cause a portfolio to drift from its intended asset allocation. Regular rebalancing-adjusting the proportions of different assets to their target allocations helps maintain the portfolio's risk level and ensures that diversification benefits are preserved.

An Overview of Different Aspects about Diversifying an Investment Portfolio

A good investment plan means putting money in different kinds of things like stocks, bonds, and things from different countries. This helps protect your money if one thing doesn't do well. To make a really good plan, you need to think ahead, use technology to help you, and always be looking for new and better ways to invest.

- Different Kinds of Investment

Diversification means putting your money in different kinds of investments. You can invest in stocks, bonds, houses, things like gold, and even new kinds of money called crypto currencies. The key is to mix assets that are not closely correlated, meaning their prices do not move in the same direction simultaneously. For instance, while equities offer higher returns, bonds can provide stability, particularly during market downturns. Similarly, adding international assets can protect against domestic economic slowdowns.

- Strategic Planning

Making a good plan is the most important thing for a business to try new things and be successful. It involves setting clear investment goals, assessing risk tolerance, and determining the appropriate asset allocation. When planning their portfolios, investors must consider their time horizon, financial objectives, and market conditions. A well-thought-out strategic plan helps maintain discipline during volatile market conditions and ensures the portfolio remains aligned with the investor's long-term goals.

- Digital Investment Strategy

Incorporating a digital investment strategy is crucial for portfolio diversification in the digital age. The rise of fintech platforms and robo-advisors has democratized access to various investment options. These tools use algorithms to create and manage diversified portfolios tailored to individual risk profiles. Moreover, digital assets like crypto currencies and Blockchain based investments offer new avenues for diversification. While these assets are highly volatile, they can hedge against traditional market movements when used strategically.

- Growth Strategies

Investment growth strategies are essential for building wealth over time. These strategies include reinvesting dividends, capitalizing on compound interest, and using tax-efficient investment vehicles. Growth strategies often focus on high-potential sectors such as technology, healthcare, and renewable energy. Investors can achieve significant portfolio growth by identifying and investing in emerging trends and innovative companies. However, balancing growth investments with more stable, income-generating assets is essential to manage risk.

- Business Strategies with Innovation

Business strategies play a crucial role in portfolio diversification, especially for private equity or venture capital investors. Investing in innovative startups or companies with strong growth potential can yield high returns. But, this way of doing things needs a good understanding of what's happening in the market, which the competition is, and being able to find new and important technologies. Investors must stay abreast of business innovation strategies, which involve supporting companies driving change in their industries. This diversifies the portfolio and positions it to benefit from future growth opportunities.

- A Thorough Business Development Plan

A business development plan is essential for investors seeking to diversify their portfolios through direct involvement in businesses. This plan outlines identifying, evaluating, and investing in companies that complement the existing portfolio. It includes strategies for entering new markets, expanding product lines, and forming strategic partnerships. A robust business development plan can create a diversified portfolio that balances high-risk, high-reward investment with stable, income-generating assets.

Diversification means putting your money in different places to manage risk. It's not just about spreading your money around but choosing where to put it wisely to balance the chance of losing money investment and the chance of making money reward.

Diversified investments help protect your money when one investment doesn't do well, keeping your cash safer over time. But having different investments doesn't mean you'll always make money or won't lose any money, especially when the whole market is going down.

Diversification is essential, but it's just one part of a reasonable investment plan. You should consider how much risk you can handle, how long you plan to invest, and what you want to achieve with your money. You should also regularly check your investments and change them as needed to balance risk and reward.

Also, read the following related posts.

- Best Passive Income Ideas

- Ways to Save Money on Everyday Expenses

Diversification means spreading your money across different kinds of investments. This helps protect your money if one investment gives bad experience or say poor results. Putting money in various places like stocks, bonds, and different businesses can make your money grow steadier and smoother. We'll talk about some ways to diversify your investment.

1. Asset Class Diversification

Putting your money in different kinds of investments is a smart way to protect your money. The primary asset classes include stocks, bonds, real estate, commodities, and cash or cash equivalents. Each asset class has risk and return characteristics, often performing differently under various market conditions. For example, stocks may offer high returns but also have higher volatility. Bonds, on the other hand, tend to be more stable but provide lower returns. By spreading your money across different investments, you can protect yourself from losing too much if one investment does poorly.

2. Geographic Diversification

Putting your money in different places worldwide is an excellent way to protect your investments. By spreading investments across multiple countries, investors can reduce their exposure to risks specific to a single country or region, such as political instability, economic downturns, or currency fluctuations. For instance, while the U.S. stock market might be struggling, Asian or European markets could be performing well, thus, balancing the portfolio's performance. Geographic diversification can be achieved through international stocks, exchange-traded funds (ETFs), or mutual funds focusing on global markets.

3. Industry and Sector Diversification

It's important to diversify across various industries and sectors within the equity portion of a portfolio. Different industries often perform differently based on economic cycles, technological advancements, and consumer preferences. For example, technology stocks may thrive during periods of innovation, while energy stocks perform better during economic expansions. Investing in a mix of different kinds of businesses, like tech companies, healthcare companies, banks, and stores that sell things people use every day, can help protect your money. If one business does poorly, the others might do well, so your overall investments won't be hurt as much.

4. Investment Style Diversification

Investors can also diversify by including different investment styles in their portfolios. This consists of a mix of growth and value stocks, large-cap and small-cap stocks, and other investment strategies such as active and passive management. Growth stocks offer higher potential returns but come with higher risk, while value stocks are usually more stable and may provide dividends. By combining these different styles, investors can achieve a balanced portfolio that performs well in varying market conditions.

5. Regular Portfolio Rebalancing

A well-diversified portfolio requires regular maintenance to align with an investor's risk tolerance and financial goals. Market conditions and individual asset performances can cause a portfolio to drift from its intended asset allocation. Regular rebalancing-adjusting the proportions of different assets to their target allocations helps maintain the portfolio's risk level and ensures that diversification benefits are preserved.

An Overview of Different Aspects about Diversifying an Investment Portfolio

A good investment plan means putting money in different kinds of things like stocks, bonds, and things from different countries. This helps protect your money if one thing doesn't do well. To make a really good plan, you need to think ahead, use technology to help you, and always be looking for new and better ways to invest.

- Different Kinds of Investment

Diversification means putting your money in different kinds of investments. You can invest in stocks, bonds, houses, things like gold, and even new kinds of money called crypto currencies. The key is to mix assets that are not closely correlated, meaning their prices do not move in the same direction simultaneously. For instance, while equities offer higher returns, bonds can provide stability, particularly during market downturns. Similarly, adding international assets can protect against domestic economic slowdowns.

- Strategic Planning

Making a good plan is the most important thing for a business to try new things and be successful. It involves setting clear investment goals, assessing risk tolerance, and determining the appropriate asset allocation. When planning their portfolios, investors must consider their time horizon, financial objectives, and market conditions. A well-thought-out strategic plan helps maintain discipline during volatile market conditions and ensures the portfolio remains aligned with the investor's long-term goals.

- Digital Investment Strategy

Incorporating a digital investment strategy is crucial for portfolio diversification in the digital age. The rise of fintech platforms and robo-advisors has democratized access to various investment options. These tools use algorithms to create and manage diversified portfolios tailored to individual risk profiles. Moreover, digital assets like crypto currencies and Blockchain based investments offer new avenues for diversification. While these assets are highly volatile, they can hedge against traditional market movements when used strategically.

- Growth Strategies

Investment growth strategies are essential for building wealth over time. These strategies include reinvesting dividends, capitalizing on compound interest, and using tax-efficient investment vehicles. Growth strategies often focus on high-potential sectors such as technology, healthcare, and renewable energy. Investors can achieve significant portfolio growth by identifying and investing in emerging trends and innovative companies. However, balancing growth investments with more stable, income-generating assets is essential to manage risk.

- Business Strategies with Innovation

Business strategies play a crucial role in portfolio diversification, especially for private equity or venture capital investors. Investing in innovative startups or companies with strong growth potential can yield high returns. But, this way of doing things needs a good understanding of what's happening in the market, which the competition is, and being able to find new and important technologies. Investors must stay abreast of business innovation strategies, which involve supporting companies driving change in their industries. This diversifies the portfolio and positions it to benefit from future growth opportunities.

- A Thorough Business Development Plan

A business development plan is essential for investors seeking to diversify their portfolios through direct involvement in businesses. This plan outlines identifying, evaluating, and investing in companies that complement the existing portfolio. It includes strategies for entering new markets, expanding product lines, and forming strategic partnerships. A robust business development plan can create a diversified portfolio that balances high-risk, high-reward investment with stable, income-generating assets.

Diversification means putting your money in different places to manage risk. It's not just about spreading your money around but choosing where to put it wisely to balance the chance of losing money investment and the chance of making money reward.

Diversified investments help protect your money when one investment doesn't do well, keeping your cash safer over time. But having different investments doesn't mean you'll always make money or won't lose any money, especially when the whole market is going down.

Diversification is essential, but it's just one part of a reasonable investment plan. You should consider how much risk you can handle, how long you plan to invest, and what you want to achieve with your money. You should also regularly check your investments and change them as needed to balance risk and reward.

Also, read the following related posts.

- Best Passive Income Ideas

- Ways to Save Money on Everyday Expenses

Conversation

Latest Blogs

© Blog CoolCalculator, Explore CoolCalculator, your destination for the latest insights, tips, and updates on the world of online calculators. Stay informed and make your calculations smarter with our blog. ,

Designed

by Saad Media Team , Team Lead M.Rizwan Akhtar