Decoding Interest Rates: A Comprehensive Guide and Calculator Overview

Uncover the factors influencing interest rates, and discover how an interest rate calculator becomes your indispensable companion in financial planning.

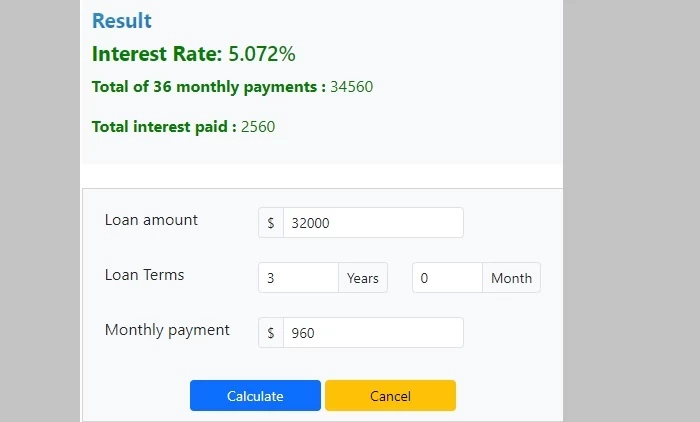

Interest rate calculator:

An interest rate calculator is a tool used to calculate the amount of interest that will be earned or paid on a sum of money based on a specified interest rate over a certain period.

Interest rate:

An interest rate is like a fee that you pay for borrowing money or a reward you earn for saving money. It's usually expressed as a percentage. If you borrow money, you have to pay back the amount you borrowed plus an extra percentage of that amount as interest. If you save money in a bank, the bank pays you a percentage of your savings as interest. So, interest rates are a way to measure the cost of borrowing or the return on savings.

Historical background:

The concept of interest dates back to ancient civilizations, where borrowers paid lenders a fee for the privilege of using their capital. Babylonian and Greek societies engaged in rudimentary lending practices, laying the groundwork for the financial systems we know today. However, interest rates in those times were more about personal agreements than standardized rates we're familiar with now. Fast forward to medieval Europe, and interest rates became a contentious issue, often entangled with religious and moral debates. Charging interest was condemned by some religious doctrines, leading to the emergence of clandestine lending practices. The struggle between the need for capital and societal norms set the stage for a nuanced relationship with interest rates.

The Renaissance era witnessed a flourishing of trade and commerce, paving the way for more sophisticated financial instruments. As banking institutions gained prominence, interest rates became integral to economic growth. Governments began issuing bonds, formalizing interest payments and establishing a foundation for modern financial markets. The Industrial Revolution marked a turning point, propelling economies into a new era of growth. With increased demand for capital, interest rates played a pivotal role in fueling industrialization. Central banks emerged to regulate monetary policy, influencing interest rates and contributing to the stability of financial systems.

The 20th century came with significant fluctuations in interest rates, shaped by global events like the two World Wars and the Great Depression. Post-World War II, a period of economic prosperity ensued, accompanied by relatively low and stable interest rates. However, the latter part of the century experienced volatility, with central banks implementing various strategies to combat inflation and stimulate economic growth. As we step into the digital age, interest rates continue to evolve in response to the dynamics of a globalized economy. Central banks employ a combination of traditional and unconventional monetary policies to navigate challenges and maintain economic stability. The interconnectedness of financial markets in today's world emphasizes the need for a nuanced understanding of interest rates and their far-reaching implications.

Types of Interest Rate:

Simple Interest Rate: A simple interest rate is like a little fee you pay for borrowing money or earning on your savings. It works by charging you or giving you a percentage of the initial amount you borrowed or saved. Unlike some other types, it doesn't change over time. So, if you borrowed $100 with a 5% simple interest rate, you'd pay $5 in interest no matter how much time passes.

Compound Interest Rate: Compound interest is a bit like simple interest but with a twist. Here, you not only pay or earn interest on the initial amount but also on the interest that adds up over time. It's like a snowball effect, where the interest keeps getting more prominent as time goes on. This can make a significant difference in the long run, whether you're borrowing money or saving it.

Fixed Interest Rate: Imagine you borrowed money, and the interest rate stayed the same throughout the whole time you had the loan. That's what a fixed interest rate is like. It gives you a predictable monthly payment, making it easier to budget. Whether it's for a car loan or a mortgage, you know exactly what you'll pay each month.

Variable (or Adjustable) Interest Rate: On the other hand, a variable interest rate can change. It's not set in stone. This means your interest rate might go up or down based on certain factors, like what's happening in the economy. While it can be a bit uncertain, sometimes it might work in your favour if rates go down.

Prime Interest Rate: The prime interest rate is like a reference point for banks. They use it to set interest rates on loans to their customers. It's like a starting point. If the prime rate goes up, other interest rates go up, too. It's an essential number in the financial world.

Nominal Interest Rate: The nominal interest rate is the one you see upfront. It's like the advertised rate on a loan or investment. For example, if you're borrowing money, the lender might say you have a 6% nominal interest rate. It doesn't consider things like inflation; it's the introductory rate.

Real Interest Rate: Now, the real interest rate is more realistic. It's the nominal interest rate minus the impact of inflation. This gives you a clearer picture of how much your money's value will change over time. If inflation is 2%, and your nominal interest rate is 6%, your actual interest rate is 4%.

Effective Interest Rate: Lastly, the effective interest rate takes everything into account. It considers the nominal interest rate and how often the interest is compounded. It's like the actual cost of borrowing or the real earnings on your investment. It's a more accurate way of figuring out what you'll actually pay or earn.

Factor affecting the interest rate:

Inflation: When prices for things go up (inflation), the value of money decreases. So, lenders might charge higher interest rates to make up for the loss in purchasing power.

Economic Conditions: If the economy is doing well, interest rates might be higher because there's more demand for loans. When the economy is not doing so well, rates might be lower to encourage people to borrow and spend.

Central Bank Policies: The central bank can influence interest rates. They might raise rates to cool down a hot economy or lower them to stimulate a sluggish one.

Government Debt: If a government borrows a lot of money, lenders might worry about being repaid. To attract lenders, the government might have to offer higher interest rates.

Credit Risk: If you're borrowing money, your credit history matters. If you have a good credit score, you might get a lower interest rate. If your credit is not so great, lenders charge more to compensate for the risk.

Benefits of interest rate calculator:

- Financial Planning: Facilitates planning by calculating borrowing costs or potential savings earnings.

- Budgeting: Aids in budget creation with precise interest estimates.

- Decision-Making: Informs decisions on loans or investments with a clear interest rate impact.

- Time Efficiency: Saves time with quick and automated calculations.

- Accuracy: Minimizes errors, ensuring precise interest-related results.

- Comparisons: Allows easy comparison of different financial options by adjusting interest rates.

- Education: Acts as an educational tool for understanding the financial impacts of interest rates.

- Loan Planning: Helps plan loan repayments by estimating monthly payments at various interest rates.

- Investment Evaluation: Aids investors in evaluating potential returns with different interest rate assumptions.

If you're interested in exploring additional calculators, check out CoolCalculator for a variety of useful tools.

Interest rate calculator:

An interest rate calculator is a tool used to calculate the amount of interest that will be earned or paid on a sum of money based on a specified interest rate over a certain period.

Interest rate:

An interest rate is like a fee that you pay for borrowing money or a reward you earn for saving money. It's usually expressed as a percentage. If you borrow money, you have to pay back the amount you borrowed plus an extra percentage of that amount as interest. If you save money in a bank, the bank pays you a percentage of your savings as interest. So, interest rates are a way to measure the cost of borrowing or the return on savings.

Historical background:

The concept of interest dates back to ancient civilizations, where borrowers paid lenders a fee for the privilege of using their capital. Babylonian and Greek societies engaged in rudimentary lending practices, laying the groundwork for the financial systems we know today. However, interest rates in those times were more about personal agreements than standardized rates we're familiar with now. Fast forward to medieval Europe, and interest rates became a contentious issue, often entangled with religious and moral debates. Charging interest was condemned by some religious doctrines, leading to the emergence of clandestine lending practices. The struggle between the need for capital and societal norms set the stage for a nuanced relationship with interest rates.

The Renaissance era witnessed a flourishing of trade and commerce, paving the way for more sophisticated financial instruments. As banking institutions gained prominence, interest rates became integral to economic growth. Governments began issuing bonds, formalizing interest payments and establishing a foundation for modern financial markets. The Industrial Revolution marked a turning point, propelling economies into a new era of growth. With increased demand for capital, interest rates played a pivotal role in fueling industrialization. Central banks emerged to regulate monetary policy, influencing interest rates and contributing to the stability of financial systems.

The 20th century came with significant fluctuations in interest rates, shaped by global events like the two World Wars and the Great Depression. Post-World War II, a period of economic prosperity ensued, accompanied by relatively low and stable interest rates. However, the latter part of the century experienced volatility, with central banks implementing various strategies to combat inflation and stimulate economic growth. As we step into the digital age, interest rates continue to evolve in response to the dynamics of a globalized economy. Central banks employ a combination of traditional and unconventional monetary policies to navigate challenges and maintain economic stability. The interconnectedness of financial markets in today's world emphasizes the need for a nuanced understanding of interest rates and their far-reaching implications.

Types of Interest Rate:

Simple Interest Rate: A simple interest rate is like a little fee you pay for borrowing money or earning on your savings. It works by charging you or giving you a percentage of the initial amount you borrowed or saved. Unlike some other types, it doesn't change over time. So, if you borrowed $100 with a 5% simple interest rate, you'd pay $5 in interest no matter how much time passes.

Compound Interest Rate: Compound interest is a bit like simple interest but with a twist. Here, you not only pay or earn interest on the initial amount but also on the interest that adds up over time. It's like a snowball effect, where the interest keeps getting more prominent as time goes on. This can make a significant difference in the long run, whether you're borrowing money or saving it.

Fixed Interest Rate: Imagine you borrowed money, and the interest rate stayed the same throughout the whole time you had the loan. That's what a fixed interest rate is like. It gives you a predictable monthly payment, making it easier to budget. Whether it's for a car loan or a mortgage, you know exactly what you'll pay each month.

Variable (or Adjustable) Interest Rate: On the other hand, a variable interest rate can change. It's not set in stone. This means your interest rate might go up or down based on certain factors, like what's happening in the economy. While it can be a bit uncertain, sometimes it might work in your favour if rates go down.

Prime Interest Rate: The prime interest rate is like a reference point for banks. They use it to set interest rates on loans to their customers. It's like a starting point. If the prime rate goes up, other interest rates go up, too. It's an essential number in the financial world.

Nominal Interest Rate: The nominal interest rate is the one you see upfront. It's like the advertised rate on a loan or investment. For example, if you're borrowing money, the lender might say you have a 6% nominal interest rate. It doesn't consider things like inflation; it's the introductory rate.

Real Interest Rate: Now, the real interest rate is more realistic. It's the nominal interest rate minus the impact of inflation. This gives you a clearer picture of how much your money's value will change over time. If inflation is 2%, and your nominal interest rate is 6%, your actual interest rate is 4%.

Effective Interest Rate: Lastly, the effective interest rate takes everything into account. It considers the nominal interest rate and how often the interest is compounded. It's like the actual cost of borrowing or the real earnings on your investment. It's a more accurate way of figuring out what you'll actually pay or earn.

Factor affecting the interest rate:

Inflation: When prices for things go up (inflation), the value of money decreases. So, lenders might charge higher interest rates to make up for the loss in purchasing power.

Economic Conditions: If the economy is doing well, interest rates might be higher because there's more demand for loans. When the economy is not doing so well, rates might be lower to encourage people to borrow and spend.

Central Bank Policies: The central bank can influence interest rates. They might raise rates to cool down a hot economy or lower them to stimulate a sluggish one.

Government Debt: If a government borrows a lot of money, lenders might worry about being repaid. To attract lenders, the government might have to offer higher interest rates.

Credit Risk: If you're borrowing money, your credit history matters. If you have a good credit score, you might get a lower interest rate. If your credit is not so great, lenders charge more to compensate for the risk.

Benefits of interest rate calculator:

- Financial Planning: Facilitates planning by calculating borrowing costs or potential savings earnings.

- Budgeting: Aids in budget creation with precise interest estimates.

- Decision-Making: Informs decisions on loans or investments with a clear interest rate impact.

- Time Efficiency: Saves time with quick and automated calculations.

- Accuracy: Minimizes errors, ensuring precise interest-related results.

- Comparisons: Allows easy comparison of different financial options by adjusting interest rates.

- Education: Acts as an educational tool for understanding the financial impacts of interest rates.

- Loan Planning: Helps plan loan repayments by estimating monthly payments at various interest rates.

- Investment Evaluation: Aids investors in evaluating potential returns with different interest rate assumptions.

If you're interested in exploring additional calculators, check out CoolCalculator for a variety of useful tools.

Conversation

Latest Blogs

© Blog CoolCalculator, Explore CoolCalculator, your destination for the latest insights, tips, and updates on the world of online calculators. Stay informed and make your calculations smarter with our blog. ,

Designed

by Saad Media Team , Team Lead M.Rizwan Akhtar