Demystifying Salary Calculators

Unlock the secrets of salary calculations with our comprehensive guide! Demystify salary calculators and gain insight into how your income is determined.

Greetings, fellow financial aficionados! Set a board on an enlightening expedition into the enigmatic domain of salary calculations – your handy guide to deciphering the intricate tapestry of your paycheck. Whether you're a seasoned veteran of the corporate battlefield or a fresh-faced recruit beginning on your professional odyssey, grasping the intricacies of salary computation is paramount to achieving financial mastery. Get ready yourselves, dear readers, for we're about to transform this often-misunderstood realm into a treasure trove of financial enlightenment. Together, we'll unravel the mysteries of salary calculations, transforming complex formulas into relatable anecdotes and empowering you to become a savvier financial navigator.

Salary Calculator

A salary calculator is a magical tool that helps you estimate your take-home pay after deductions. It considers various factors like your gross income, taxes, and deductions to give you a clear picture of what you can expect in your bank account each month. Imagine you've just landed a job with a gross salary of $60,000 per year. Using a salary calculator, you can input this figure along with other relevant details like your filing status, deductions, and contributions. The calculator will reveal your net income – the real MVP of your paycheck.

Gross vs. Net Income

Gross income is the significant number you see on your job offer letter, representing your earnings before any deductions. Net income, on the other hand, is the amount you take home after taxes and other deductions have been accounted for. It's like the difference between your dream salary and the reality of your paycheck.

Deductions and Taxes

Ah, the necessary evils of salary calculations – deductions and taxes. Deductions can include contributions to retirement plans, healthcare premiums, and other perks your employer may offer. Taxes, well, we all know about those. Understanding how these factors impact your take-home pay is crucial for financial planning. Let's say you contribute 5% of your salary to a 401(k) retirement plan. This reduces your taxable income, meaning you pay less in taxes. So, if your salary is $50,000 and you contribute $2,500 to your 401(k), you only pay taxes on $47,500. It's like giving your future self a little financial hug.

How do you calculate salaries?

- Enter Basic Information: Input your annual salary or hourly wage in the appropriate field. Ensure that you specify whether your salary is yearly or hourly, as this can affect the calculations.

- Tax Information: Some salary calculators ask for tax-related information. Provide details such as your tax filing status (e.g., single, married, head of household), number of dependents, and any additional deductions or exemptions.

- Location and Currency: Confirm or select the area or currency relevant to your salary calculation. This may affect tax rates and cost of living adjustments.

- Calculate: After entering all the necessary information, click the "Calculate" or "Calculate Salary" button on the calculator's interface.

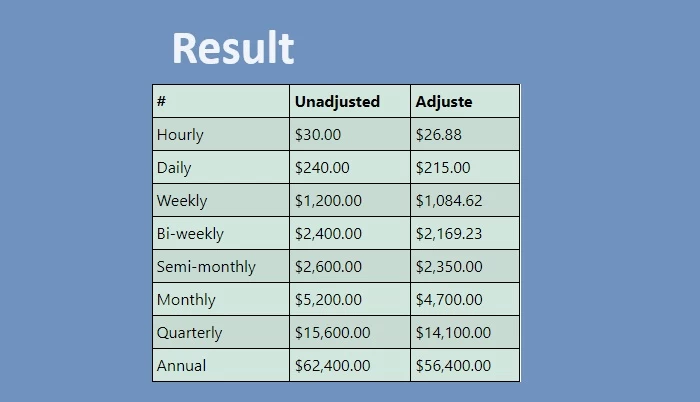

- Review the Results: The calculator will generate a breakdown of your salary, including details like gross income, net income (after taxes and deductions), and potentially other information like retirement contributions and healthcare costs.

Importance of Budgeting

Now that you've mastered the art of salary calculations, it's time to talk about budgeting. Knowing your net income empowers you to create a realistic budget that covers essentials, indulgences, and savings. Budgeting is the key to financial success, helping you live within your means while planning for the future. Consider creating a budget that allocates 50% of your net income to essentials like rent, utilities, and groceries, 30% to indulgences like dining out and entertainment, and 20% to savings and investments. This way, you're not just earning a paycheck – you're building a foundation for financial stability. Discover a multitude of calculators at CoolCalculator, providing solutions for a wide array of calculations.

Benefits of salary calculator:

- Easy Math: A salary calculator helps you do the math quickly and easily. You don't have to spend a lot of time figuring out how much money you'll get.

- No Mistakes: It helps avoid mistakes. Calculating your salary can be tricky, and a small error can make a big difference. The calculator reduces the chance of making mistakes.

- Plan Your Budget: Knowing exactly how much you'll earn helps you plan your budget better. You can decide how much to spend, save, or use for other things.

- Understand Deductions: Salary calculators show you how much money might be taken out for taxes or other deductions. It helps you understand where your money is going.

- Compare Job Offers: If you're considering different job offers, a salary calculator helps you compare them easily. You can see which job gives you more money after deductions.

- Time-Saver: It saves time. Instead of spending a long time with a pen and paper, you can quickly find out your salary using a calculator.

- Negotiate Better: If you're discussing your salary with your boss, knowing the exact numbers from a calculator can help you negotiate for a better deal.

- Plan for the Future: A salary calculator can help you plan for the future. Set financial goals and figure out how long it might take to reach them with your current salary.

Greetings, fellow financial aficionados! Set a board on an enlightening expedition into the enigmatic domain of salary calculations – your handy guide to deciphering the intricate tapestry of your paycheck. Whether you're a seasoned veteran of the corporate battlefield or a fresh-faced recruit beginning on your professional odyssey, grasping the intricacies of salary computation is paramount to achieving financial mastery. Get ready yourselves, dear readers, for we're about to transform this often-misunderstood realm into a treasure trove of financial enlightenment. Together, we'll unravel the mysteries of salary calculations, transforming complex formulas into relatable anecdotes and empowering you to become a savvier financial navigator.

Salary Calculator

A salary calculator is a magical tool that helps you estimate your take-home pay after deductions. It considers various factors like your gross income, taxes, and deductions to give you a clear picture of what you can expect in your bank account each month. Imagine you've just landed a job with a gross salary of $60,000 per year. Using a salary calculator, you can input this figure along with other relevant details like your filing status, deductions, and contributions. The calculator will reveal your net income – the real MVP of your paycheck.

Gross vs. Net Income

Gross income is the significant number you see on your job offer letter, representing your earnings before any deductions. Net income, on the other hand, is the amount you take home after taxes and other deductions have been accounted for. It's like the difference between your dream salary and the reality of your paycheck.

Deductions and Taxes

Ah, the necessary evils of salary calculations – deductions and taxes. Deductions can include contributions to retirement plans, healthcare premiums, and other perks your employer may offer. Taxes, well, we all know about those. Understanding how these factors impact your take-home pay is crucial for financial planning. Let's say you contribute 5% of your salary to a 401(k) retirement plan. This reduces your taxable income, meaning you pay less in taxes. So, if your salary is $50,000 and you contribute $2,500 to your 401(k), you only pay taxes on $47,500. It's like giving your future self a little financial hug.

How do you calculate salaries?

- Enter Basic Information: Input your annual salary or hourly wage in the appropriate field. Ensure that you specify whether your salary is yearly or hourly, as this can affect the calculations.

- Tax Information: Some salary calculators ask for tax-related information. Provide details such as your tax filing status (e.g., single, married, head of household), number of dependents, and any additional deductions or exemptions.

- Location and Currency: Confirm or select the area or currency relevant to your salary calculation. This may affect tax rates and cost of living adjustments.

- Calculate: After entering all the necessary information, click the "Calculate" or "Calculate Salary" button on the calculator's interface.

- Review the Results: The calculator will generate a breakdown of your salary, including details like gross income, net income (after taxes and deductions), and potentially other information like retirement contributions and healthcare costs.

Importance of Budgeting

Now that you've mastered the art of salary calculations, it's time to talk about budgeting. Knowing your net income empowers you to create a realistic budget that covers essentials, indulgences, and savings. Budgeting is the key to financial success, helping you live within your means while planning for the future. Consider creating a budget that allocates 50% of your net income to essentials like rent, utilities, and groceries, 30% to indulgences like dining out and entertainment, and 20% to savings and investments. This way, you're not just earning a paycheck – you're building a foundation for financial stability. Discover a multitude of calculators at CoolCalculator, providing solutions for a wide array of calculations.

Benefits of salary calculator:

- Easy Math: A salary calculator helps you do the math quickly and easily. You don't have to spend a lot of time figuring out how much money you'll get.

- No Mistakes: It helps avoid mistakes. Calculating your salary can be tricky, and a small error can make a big difference. The calculator reduces the chance of making mistakes.

- Plan Your Budget: Knowing exactly how much you'll earn helps you plan your budget better. You can decide how much to spend, save, or use for other things.

- Understand Deductions: Salary calculators show you how much money might be taken out for taxes or other deductions. It helps you understand where your money is going.

- Compare Job Offers: If you're considering different job offers, a salary calculator helps you compare them easily. You can see which job gives you more money after deductions.

- Time-Saver: It saves time. Instead of spending a long time with a pen and paper, you can quickly find out your salary using a calculator.

- Negotiate Better: If you're discussing your salary with your boss, knowing the exact numbers from a calculator can help you negotiate for a better deal.

- Plan for the Future: A salary calculator can help you plan for the future. Set financial goals and figure out how long it might take to reach them with your current salary.

Conversation

Latest Blogs

© Blog CoolCalculator, Explore CoolCalculator, your destination for the latest insights, tips, and updates on the world of online calculators. Stay informed and make your calculations smarter with our blog. ,

Designed

by Saad Media Team , Team Lead M.Rizwan Akhtar