How Do You Do a Mortgage Calculation?

Discover the power of our Online Mortgage Calculator! From estimating monthly payments to exploring refinancing options, our intuitive tool simplifies the complex world of mortgages.

The online mortgage calculator is a tool that helps you estimate your monthly mortgage payments, interest rates, amortization schedules, and other costs associated with buying or refinancing a home. It can help you compare different loan options, plan your budget, and save money on interest and fees. Here is how to use an online mortgage calculator and what its benefits are.

Types of Mortgage Calculator

There are several types of mortgage calculators available to help individuals with different aspects of the home financing process. Here are some common types of mortgage calculators.

1. Basic Mortgage Payment Calculator

This is the most common type of mortgage calculator and is used to estimate monthly mortgage payments based on the loan amount, interest rate, loan term, and down payment. It provides a simple breakdown of principal and interest.

2. Amortization Calculator

An amortization calculator helps you create an amortization schedule, which shows how your monthly payments are distributed between principal and interest over the life of the loan. It can be useful for understanding how your equity in the property grows over time.

3. Refinance Calculator

A refinance calculator allows you to estimate how much you can save or how your monthly payments may change if you decide to refinance your existing mortgage. It considers factors like the new interest rate, loan term, and closing costs.

4. Mortgage Qualification Calculator

This calculator helps you determine how much home you can afford by considering your income, expenses, debt, and credit score. It provides an estimate of the maximum mortgage you may qualify for.

5. Bi-Weekly Payment Calculator

Bi-weekly payment calculators show the potential savings and shorter loan term associated with making bi-weekly mortgage payments instead of monthly payments. By making 26 half-payments per year (equivalent to 13 full payments), you can pay off your mortgage faster.

6. Fixed VS Adjustable-Rate Mortgage (ARM) Calculator

This calculator allows you to compare the cost and payments of a fixed-rate mortgage and an adjustable-rate mortgage over time. It helps you make an informed decision about which type of mortgage suits your financial goals.

7. Mortgage Insurance (PMI) Calculator

If your down payment is less than 20% of the home's value, you may need to pay private mortgage insurance (PMI). A PMI calculator estimates the monthly PMI cost and helps you understand when you might be able to remove it.

8. Extra Payment Calculator

This calculator shows the impact of making extra payments toward your mortgage. It illustrates how additional payments can reduce the total interest paid and shorten the loan term.

9. Interest-Only Mortgage Calculator

Interest-only mortgages allow borrowers to pay only the interest for a specific period. This calculator helps you understand the costs and payments associated with interest-only loans.

10. FHA, VA, or USDA Loan Calculator

These calculators are designed for government-backed loan programs and help borrowers estimate their monthly payments and upfront costs specific to these loan types.

11. Investment Property Mortgage Calculator

If you're considering buying an investment property, this calculator can help you assess the potential cash flow and return on investment for the property.

These are just a few of the many mortgage calculators available to help individuals in various aspects of the home buying and mortgage financing process. On Calculator.Cool you can choose the most relevant calculator depending on your specific needs to assist you in your financial planning.

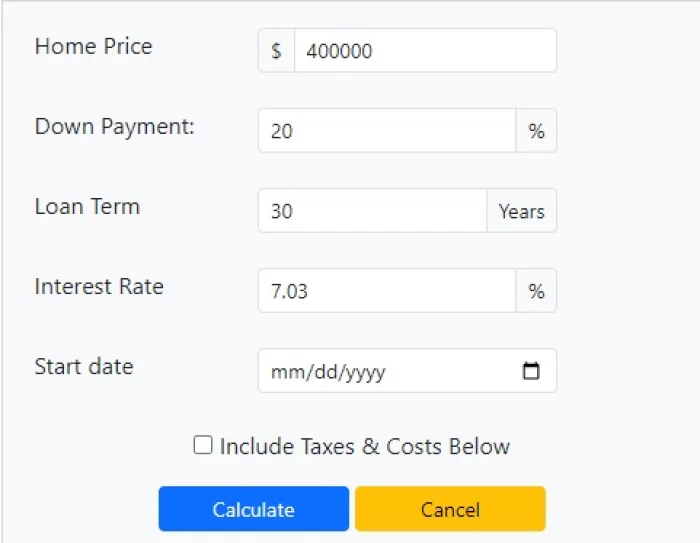

Mortgage Calculator Manual

Welcome to the mortgage calculator! This tool is designed to help you estimate your monthly mortgage payments and other financial aspects related to your home purchase. Here's a step-by-step guide on how to use this calculator effectively.

Step 1 - Home Price

Input the total price of the home you are considering. For example, if the home costs $400,000, enter "400000" in the "Home Price" field.

Step 2 - Down Payment

Specify the percentage of the home's price that you plan to pay as a down payment. In this case, you mentioned 20%. Enter "20" in the "Down Payment" field.

Step 3 - Loan Term

Select the desired loan term, typically in years. You mentioned 30 years. Enter "30" in the "Loan Term" field.

Step 4 - Interest Rate

Enter the annual interest rate for your mortgage. For instance, if the interest rate is 7.03%, enter "7.03" in the "Interest Rate" field.

Step 5 - Start Date

Input the start date for your mortgage. This is optional and can be entered in the "mm/dd/yyyy" format. It is used for calculating your mortgage schedule.

Step 6 - Include Taxes & Costs Below

If your mortgage includes taxes, insurance, or homeowner association fees, check the corresponding boxes to include them in your calculations. If not, leave these boxes unchecked.

Step 7 - Calculate

After entering all the necessary information, click the "Calculate" button. The mortgage calculator will provide you with the estimated monthly mortgage payment, including principal and interest. It will also show you the breakdown of other expenses like property taxes, homeowner's insurance, and the total monthly payment.

Step 8 - Analyze Results

Review the results provided by the calculator. These results will give you a clear picture of your potential monthly financial commitment for your mortgage. You'll be able to see the principal and interest payments, taxes, insurance, and the total monthly payment.

Step 9 - Refining Your Calculation

You can experiment with different scenarios by adjusting the input values. For example, you can change the down payment, loan term, and interest rate to see how they affect your monthly payment.

Step 10 - Save or Print

If desired, you can save or print the results for future reference or when discussing mortgage options with lenders or real estate professionals.

Remember that this mortgage calculator is a valuable tool for initial planning and estimation. To get a precise mortgage offer, it's advisable to consult with a mortgage lender, as various factors can impact your final mortgage terms. This calculator is a great starting point for your financial planning and decision-making in the home buying process.

Benefits of Online Mortgage Calculator

There are many benefits of using an online mortgage calculator, while some of them are listed below.

- Find out how much home you can afford based on your income and expenses.

- Compare different loan scenarios and see how changing the loan term, interest rate, down payment, or prepayments can affect your monthly payment and total cost.

- Save money on interest by choosing a shorter loan term or making extra payments toward your principal.

- Avoid paying unnecessary fees by avoiding loans that require mortgage insurance or have high closing costs.

- Plan ahead for future expenses by knowing how much you will pay in property taxes, homeowners insurance, and HOA fees each month and year.

The use of an online mortgage calculator in our lives is that it can help us make informed decisions about one of the most important financial transactions we will ever make such as buying or refinancing a home.

By using an online mortgage calculator, we can avoid getting into a loan that we cannot afford or that has unfavorable terms. We can also find ways to reduce our interest payments and pay off our loan faster. An online mortgage calculator can help us achieve our home ownership goals and save money in the long run.

The online mortgage calculator is a tool that helps you estimate your monthly mortgage payments, interest rates, amortization schedules, and other costs associated with buying or refinancing a home. It can help you compare different loan options, plan your budget, and save money on interest and fees. Here is how to use an online mortgage calculator and what its benefits are.

Types of Mortgage Calculator

There are several types of mortgage calculators available to help individuals with different aspects of the home financing process. Here are some common types of mortgage calculators.

1. Basic Mortgage Payment Calculator

This is the most common type of mortgage calculator and is used to estimate monthly mortgage payments based on the loan amount, interest rate, loan term, and down payment. It provides a simple breakdown of principal and interest.

2. Amortization Calculator

An amortization calculator helps you create an amortization schedule, which shows how your monthly payments are distributed between principal and interest over the life of the loan. It can be useful for understanding how your equity in the property grows over time.

3. Refinance Calculator

A refinance calculator allows you to estimate how much you can save or how your monthly payments may change if you decide to refinance your existing mortgage. It considers factors like the new interest rate, loan term, and closing costs.

4. Mortgage Qualification Calculator

This calculator helps you determine how much home you can afford by considering your income, expenses, debt, and credit score. It provides an estimate of the maximum mortgage you may qualify for.

5. Bi-Weekly Payment Calculator

Bi-weekly payment calculators show the potential savings and shorter loan term associated with making bi-weekly mortgage payments instead of monthly payments. By making 26 half-payments per year (equivalent to 13 full payments), you can pay off your mortgage faster.

6. Fixed VS Adjustable-Rate Mortgage (ARM) Calculator

This calculator allows you to compare the cost and payments of a fixed-rate mortgage and an adjustable-rate mortgage over time. It helps you make an informed decision about which type of mortgage suits your financial goals.

7. Mortgage Insurance (PMI) Calculator

If your down payment is less than 20% of the home's value, you may need to pay private mortgage insurance (PMI). A PMI calculator estimates the monthly PMI cost and helps you understand when you might be able to remove it.

8. Extra Payment Calculator

This calculator shows the impact of making extra payments toward your mortgage. It illustrates how additional payments can reduce the total interest paid and shorten the loan term.

9. Interest-Only Mortgage Calculator

Interest-only mortgages allow borrowers to pay only the interest for a specific period. This calculator helps you understand the costs and payments associated with interest-only loans.

10. FHA, VA, or USDA Loan Calculator

These calculators are designed for government-backed loan programs and help borrowers estimate their monthly payments and upfront costs specific to these loan types.

11. Investment Property Mortgage Calculator

If you're considering buying an investment property, this calculator can help you assess the potential cash flow and return on investment for the property.

These are just a few of the many mortgage calculators available to help individuals in various aspects of the home buying and mortgage financing process. On Calculator.Cool you can choose the most relevant calculator depending on your specific needs to assist you in your financial planning.

Mortgage Calculator Manual

Welcome to the mortgage calculator! This tool is designed to help you estimate your monthly mortgage payments and other financial aspects related to your home purchase. Here's a step-by-step guide on how to use this calculator effectively.

Step 1 - Home Price

Input the total price of the home you are considering. For example, if the home costs $400,000, enter "400000" in the "Home Price" field.

Step 2 - Down Payment

Specify the percentage of the home's price that you plan to pay as a down payment. In this case, you mentioned 20%. Enter "20" in the "Down Payment" field.

Step 3 - Loan Term

Select the desired loan term, typically in years. You mentioned 30 years. Enter "30" in the "Loan Term" field.

Step 4 - Interest Rate

Enter the annual interest rate for your mortgage. For instance, if the interest rate is 7.03%, enter "7.03" in the "Interest Rate" field.

Step 5 - Start Date

Input the start date for your mortgage. This is optional and can be entered in the "mm/dd/yyyy" format. It is used for calculating your mortgage schedule.

Step 6 - Include Taxes & Costs Below

If your mortgage includes taxes, insurance, or homeowner association fees, check the corresponding boxes to include them in your calculations. If not, leave these boxes unchecked.

Step 7 - Calculate

After entering all the necessary information, click the "Calculate" button. The mortgage calculator will provide you with the estimated monthly mortgage payment, including principal and interest. It will also show you the breakdown of other expenses like property taxes, homeowner's insurance, and the total monthly payment.

Step 8 - Analyze Results

Review the results provided by the calculator. These results will give you a clear picture of your potential monthly financial commitment for your mortgage. You'll be able to see the principal and interest payments, taxes, insurance, and the total monthly payment.

Step 9 - Refining Your Calculation

You can experiment with different scenarios by adjusting the input values. For example, you can change the down payment, loan term, and interest rate to see how they affect your monthly payment.

Step 10 - Save or Print

If desired, you can save or print the results for future reference or when discussing mortgage options with lenders or real estate professionals.

Remember that this mortgage calculator is a valuable tool for initial planning and estimation. To get a precise mortgage offer, it's advisable to consult with a mortgage lender, as various factors can impact your final mortgage terms. This calculator is a great starting point for your financial planning and decision-making in the home buying process.

Benefits of Online Mortgage Calculator

There are many benefits of using an online mortgage calculator, while some of them are listed below.

- Find out how much home you can afford based on your income and expenses.

- Compare different loan scenarios and see how changing the loan term, interest rate, down payment, or prepayments can affect your monthly payment and total cost.

- Save money on interest by choosing a shorter loan term or making extra payments toward your principal.

- Avoid paying unnecessary fees by avoiding loans that require mortgage insurance or have high closing costs.

- Plan ahead for future expenses by knowing how much you will pay in property taxes, homeowners insurance, and HOA fees each month and year.

The use of an online mortgage calculator in our lives is that it can help us make informed decisions about one of the most important financial transactions we will ever make such as buying or refinancing a home.

By using an online mortgage calculator, we can avoid getting into a loan that we cannot afford or that has unfavorable terms. We can also find ways to reduce our interest payments and pay off our loan faster. An online mortgage calculator can help us achieve our home ownership goals and save money in the long run.

Conversation

Latest Blogs

© Blog CoolCalculator, Explore CoolCalculator, your destination for the latest insights, tips, and updates on the world of online calculators. Stay informed and make your calculations smarter with our blog. ,

Designed

by Saad Media Team , Team Lead M.Rizwan Akhtar