Mastering Your Finances – A Guide to Loan Types and Calculators

Discover the world of loans and empower your financial decisions. Uncover the various types of loan calculators, from mortgages to student loans, providing clarity on monthly payments and total repayment amounts.

A loan is a sum of money that you borrow from a bank, credit union, or other financial institution with the agreement to pay it back over time. When you take out a loan, you’re typically charged interest, which is an additional amount that you pay for the privilege of borrowing the money. Loans can be used for various purposes, such as buying a home or a car, paying for education, or covering unexpected expenses.

Loan Calculator

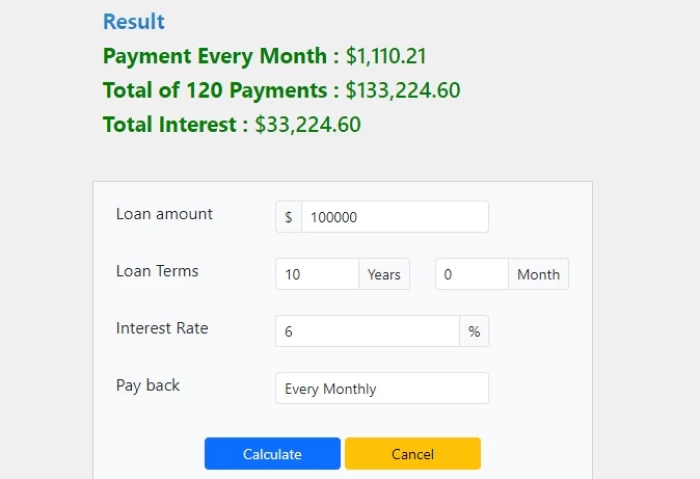

A loan calculator calculates how much you’ll need to repay on a loan over time. It takes into account the loan amount, interest rate, and the loan term (the duration over which you’ll be repaying the loan). By inputting these details into the calculator, you can get an idea of your monthly payments and the total amount you’ll repay by the end of the loan term. This tool is helpful for planning and budgeting, allowing you to understand the financial implications of taking out a loan before actually borrowing the money.

Types of Loan Calculators

-

Simple Loan Calculator

A simple loan calculator is like a helpful friend when you need to know how much money you have to pay back every month for a loan. It’s easy to use, just type in the amount of money you want to borrow, the interest rate, and how long you think you’ll need to pay it at all back. Once you hit the button, it tells you exactly how much you need to pay each month.

-

Mortgage Calculator

Imagine you’re buying a house, and you’re curious about how much your monthly payments will be. Well, the mortgage calculator is there for you. You type in the cost of the house, how much money you can pay right away (the down payment), the interest rate, and how many years you want to take to pay it off. Then, like magic, it shows you the monthly amount you’ll need to pay for your new home.

-

Auto Loan Calculator

Getting a new car often means dealing with loans, and that’s where the auto loan calculator comes in handy. You put in the price of the vehicle, how much money you can pay at the start, the interest rate, and the number of months you’ll be paying. It then reveals the amount you’ll need to pay each month for your shiny new wheels.

-

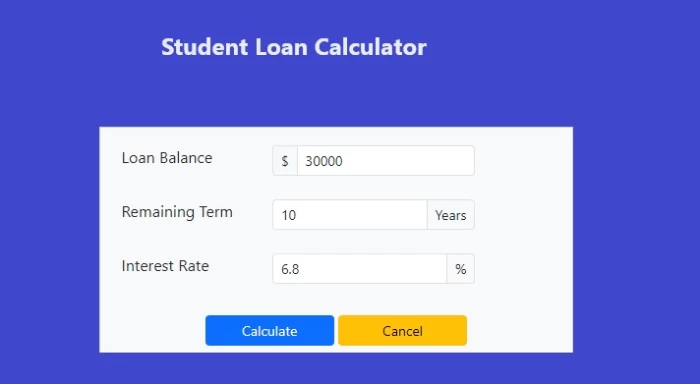

Student Loan Calculator

Imagine you’re a student and you’ve got a loan for your education. The student loan calculator is your friend in this situation. You tell it how much you borrowed, the interest rate, and how long you have to pay it all back. It then shows you how much you need to pay each month and the total amount you’ll have to repay.

-

Personal Loan Calculator

When you need money for personal reasons, the personal loan calculator is your go-to tool. You enter the amount you want to borrow, the interest rate, and how many months you’ll take to pay it off. It gives you the lowdown on your monthly payment and the total interest you’ll have to shell out.

-

Credit Card Payoff Calculator

If you’re trying to say goodbye to credit card debt, the credit card payoff calculator is like a guide. You type in your current balance, the interest rate, and how much you can pay each month. It reveals the time it will take to bid farewell to the debt and the total interest you’ll end up paying.

-

Debt Consolidation Calculator

Thinking about putting all your debts in one basket? The debt consolidation calculator helps you out. You enter details about your different debts, their interest rates, and the terms of a consolidation loan. It then shows you potential savings and your new monthly payment, making the whole process a lot clearer.

How to Calculate a Loan?

Imagine you have a loan calculator. With this, you can type in the amount of money you want to borrow, the interest rate, and how long you want to take to pay it back. The calculator then works its magic and tells you how much money you need to pay each month and the total amount you’ll give back by the end.

- Loan Amount

This is the amount of money you want to borrow.

- Interest Rate

This is the percentage of the loan amount that the lender charges you as interest. It’s like a fee for borrowing the money.

- Loan Term

This is the amount of time you have to pay back the loan. It’s often measured in months or years.

- Loan Payment

This is the amount of money you need to pay regularly to the lender. It includes both the repayment of the loan amount and the interest.

- Payback Amount

This is the total amount of money you’ll end up paying back to the lender. It includes the original loan amount plus the interest.

Real-Life Applications of Loan Calculator

Loan calculators act as valuable financial companions, assisting individuals and businesses in diverse money matters. These handy tools come into play during significant life events, such as home or car purchases. If you’re curious about your monthly payment for a loan, these calculators provide the answers. Small enterprises also turn to them when contemplating loans for items like equipment. For education expenses, students and families make use of loan calculators to unravel the costs of student loans. Essentially, they function as intelligent assistants, revealing whether borrowing is affordable and offering insights into repayment timelines. In essence, loan calculators serve as friendly advisors, simplifying financial planning and helping users make well-informed decisions about their money.

A loan is a sum of money that you borrow from a bank, credit union, or other financial institution with the agreement to pay it back over time. When you take out a loan, you’re typically charged interest, which is an additional amount that you pay for the privilege of borrowing the money. Loans can be used for various purposes, such as buying a home or a car, paying for education, or covering unexpected expenses.

Loan Calculator

A loan calculator calculates how much you’ll need to repay on a loan over time. It takes into account the loan amount, interest rate, and the loan term (the duration over which you’ll be repaying the loan). By inputting these details into the calculator, you can get an idea of your monthly payments and the total amount you’ll repay by the end of the loan term. This tool is helpful for planning and budgeting, allowing you to understand the financial implications of taking out a loan before actually borrowing the money.

Types of Loan Calculators

-

Simple Loan Calculator

A simple loan calculator is like a helpful friend when you need to know how much money you have to pay back every month for a loan. It’s easy to use, just type in the amount of money you want to borrow, the interest rate, and how long you think you’ll need to pay it at all back. Once you hit the button, it tells you exactly how much you need to pay each month.

-

Mortgage Calculator

Imagine you’re buying a house, and you’re curious about how much your monthly payments will be. Well, the mortgage calculator is there for you. You type in the cost of the house, how much money you can pay right away (the down payment), the interest rate, and how many years you want to take to pay it off. Then, like magic, it shows you the monthly amount you’ll need to pay for your new home.

-

Auto Loan Calculator

Getting a new car often means dealing with loans, and that’s where the auto loan calculator comes in handy. You put in the price of the vehicle, how much money you can pay at the start, the interest rate, and the number of months you’ll be paying. It then reveals the amount you’ll need to pay each month for your shiny new wheels.

-

Student Loan Calculator

Imagine you’re a student and you’ve got a loan for your education. The student loan calculator is your friend in this situation. You tell it how much you borrowed, the interest rate, and how long you have to pay it all back. It then shows you how much you need to pay each month and the total amount you’ll have to repay.

-

Personal Loan Calculator

When you need money for personal reasons, the personal loan calculator is your go-to tool. You enter the amount you want to borrow, the interest rate, and how many months you’ll take to pay it off. It gives you the lowdown on your monthly payment and the total interest you’ll have to shell out.

-

Credit Card Payoff Calculator

If you’re trying to say goodbye to credit card debt, the credit card payoff calculator is like a guide. You type in your current balance, the interest rate, and how much you can pay each month. It reveals the time it will take to bid farewell to the debt and the total interest you’ll end up paying.

-

Debt Consolidation Calculator

Thinking about putting all your debts in one basket? The debt consolidation calculator helps you out. You enter details about your different debts, their interest rates, and the terms of a consolidation loan. It then shows you potential savings and your new monthly payment, making the whole process a lot clearer.

How to Calculate a Loan?

Imagine you have a loan calculator. With this, you can type in the amount of money you want to borrow, the interest rate, and how long you want to take to pay it back. The calculator then works its magic and tells you how much money you need to pay each month and the total amount you’ll give back by the end.

- Loan Amount

This is the amount of money you want to borrow.

- Interest Rate

This is the percentage of the loan amount that the lender charges you as interest. It’s like a fee for borrowing the money.

- Loan Term

This is the amount of time you have to pay back the loan. It’s often measured in months or years.

- Loan Payment

This is the amount of money you need to pay regularly to the lender. It includes both the repayment of the loan amount and the interest.

- Payback Amount

This is the total amount of money you’ll end up paying back to the lender. It includes the original loan amount plus the interest.

Real-Life Applications of Loan Calculator

Loan calculators act as valuable financial companions, assisting individuals and businesses in diverse money matters. These handy tools come into play during significant life events, such as home or car purchases. If you’re curious about your monthly payment for a loan, these calculators provide the answers. Small enterprises also turn to them when contemplating loans for items like equipment. For education expenses, students and families make use of loan calculators to unravel the costs of student loans. Essentially, they function as intelligent assistants, revealing whether borrowing is affordable and offering insights into repayment timelines. In essence, loan calculators serve as friendly advisors, simplifying financial planning and helping users make well-informed decisions about their money.

Conversation

Latest Blogs

© Blog CoolCalculator, Explore CoolCalculator, your destination for the latest insights, tips, and updates on the world of online calculators. Stay informed and make your calculations smarter with our blog. ,

Designed

by Saad Media Team , Team Lead M.Rizwan Akhtar