Mortgage Calculator: Your Guide to Homeownership Affordability

Navigate the path to homeownership effortlessly with our Mortgage Calculator. Crunch numbers, gauge affordability, and make informed decisions for your dream home. Your guide to stress-free homeownership awaits!

Solving mysteries is fun, like in movies or books. But when it comes to figuring out money stuff, like buying a house, it could be more enjoyable. Deciding how much you can spend on a home can feel like solving a tricky puzzle. Many people use mortgage calculators to help with this. These calculators change the price of a home or the loan amount into an estimated monthly payment. They're good for getting a rough idea of what you might pay each month, but they only show some of the costs. Suppose you only rely on a mortgage calculator without making your adjustments. In that case, you might be in for a surprise later on.

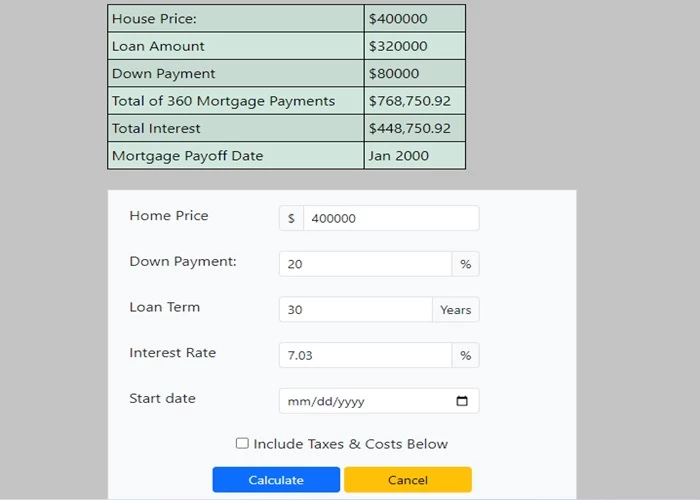

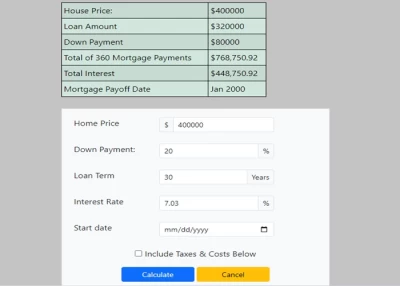

Fundamental Components of a Mortgage Calculator: At the heart of every mortgage calculator lie four essential components: the loan amount, down payment, interest rate, and loan term. These elements play a pivotal role in determining the financial commitments associated with your mortgage.

Impact of Different Factors on Mortgage Payments: It's essential to recognize the influence of various factors on your mortgage payments. Interest rate fluctuations and the size of your down payment can significantly impact the overall cost of your mortgage. A higher down payment may lower your monthly payments, while changes in interest rates can affect the total interest paid.

Customization of mortgage calculations:

Customizing mortgage calculations is a pivotal aspect of the home-buying journey, allowing individuals to tailor financial parameters to their unique circumstances. Begin by understanding fundamental mortgage elements such as the loan amount, interest rate, and loan term. Customize the loan duration based on preferences; shorter terms lead to higher monthly payments but less overall interest paid, while longer terms offer lower monthly payments with increased interest over time. Explore interest rate options, differentiating between fixed and adjustable rates—factor in additional costs like property taxes, insurance, and potential private mortgage insurance.

Leverage online calculators to input specific loan details and assess how varying parameters impact monthly payments and overall costs. Consider scenarios involving extra payments for accelerated loan repayment. Account for potential life changes, such as fluctuations in income or interest rates—review amortization schedules to understand how payments contribute to principal and interest over time. Seeking professional advice from mortgage advisors can provide personalized insights, helping you navigate complex financial scenarios. Regularly review and adjust calculations as financial situations evolve, ensuring ongoing alignment with goals and circumstances. Customizing mortgage calculations empowers informed decision-making, facilitating a mortgage plan that enhances overall economic well-being.

How it is beneficial to use Mortgage Calculator:

- Financial Planning: Mortgage calculators help users plan their finances by estimating monthly mortgage payments. This allows individuals to assess whether they can afford a particular loan and helps in creating a budget.

- Budgeting: Users can experiment with different loan amounts, interest rates, and loan terms to see how they affect monthly payments. This helps borrowers set realistic budgets and make informed decisions about the type and amount of mortgage they can comfortably manage.

- Comparison of Loan Options: Mortgage calculators enable borrowers to compare different loan options by inputting various interest rates and terms. This allows users to identify the most cost-effective and suitable mortgage for their financial situation.

- Interest Savings: Users can use mortgage calculators to explore the impact of making extra payments or paying more frequently. This can lead to significant interest savings over the life of the loan.

- Down Payment Planning: Calculators can assist individuals in determining the down payment amount required for a specific loan. This helps in planning and saving for the initial home purchase costs.

- Accessibility and Convenience: Mortgage calculators are readily available online and are easy to use. This accessibility makes it convenient for anyone to assess and understand their potential mortgage scenarios quickly.

Mortgage Mistakes to Avoid:

Securing a mortgage demands a careful approach to avoid potential financial pitfalls. Rushing into agreements without exploring offers from multiple lenders can lead to costly oversights, making it imperative to research and gather quotes for the best terms diligently. Ignoring the significant impact of credit scores on mortgage rates is a common mistake; regular checks and improvements are crucial. Hidden costs like closing fees and insurance should be factored into budgets, ensuring a comprehensive financial plan.

Prudent debt management is essential to prevent overextension while choosing the right mortgage type aligned with individual financial goals is paramount. Skipping pre-approval is a risk, as it provides clarity on borrowing capacity and enhances buyer appeal. Reading and understanding the fine print of mortgage agreements is non-negotiable, as is considering long-term plans to accommodate potential life changes. Timely payments are imperative to prevent credit damage and foreclosure risks. Vigilant monitoring of interest rates and seizing refinancing opportunities can optimize financial positions over time. In essence, avoiding mortgage mistakes requires a blend of research, financial mindfulness, and strategic planning. Looking for more calculators? CoolCalculator has you covered with a variety of tools to simplify your financial and mathematical tasks.

Solving mysteries is fun, like in movies or books. But when it comes to figuring out money stuff, like buying a house, it could be more enjoyable. Deciding how much you can spend on a home can feel like solving a tricky puzzle. Many people use mortgage calculators to help with this. These calculators change the price of a home or the loan amount into an estimated monthly payment. They're good for getting a rough idea of what you might pay each month, but they only show some of the costs. Suppose you only rely on a mortgage calculator without making your adjustments. In that case, you might be in for a surprise later on.

Fundamental Components of a Mortgage Calculator: At the heart of every mortgage calculator lie four essential components: the loan amount, down payment, interest rate, and loan term. These elements play a pivotal role in determining the financial commitments associated with your mortgage.

Impact of Different Factors on Mortgage Payments: It's essential to recognize the influence of various factors on your mortgage payments. Interest rate fluctuations and the size of your down payment can significantly impact the overall cost of your mortgage. A higher down payment may lower your monthly payments, while changes in interest rates can affect the total interest paid.

Customization of mortgage calculations:

Customizing mortgage calculations is a pivotal aspect of the home-buying journey, allowing individuals to tailor financial parameters to their unique circumstances. Begin by understanding fundamental mortgage elements such as the loan amount, interest rate, and loan term. Customize the loan duration based on preferences; shorter terms lead to higher monthly payments but less overall interest paid, while longer terms offer lower monthly payments with increased interest over time. Explore interest rate options, differentiating between fixed and adjustable rates—factor in additional costs like property taxes, insurance, and potential private mortgage insurance.

Leverage online calculators to input specific loan details and assess how varying parameters impact monthly payments and overall costs. Consider scenarios involving extra payments for accelerated loan repayment. Account for potential life changes, such as fluctuations in income or interest rates—review amortization schedules to understand how payments contribute to principal and interest over time. Seeking professional advice from mortgage advisors can provide personalized insights, helping you navigate complex financial scenarios. Regularly review and adjust calculations as financial situations evolve, ensuring ongoing alignment with goals and circumstances. Customizing mortgage calculations empowers informed decision-making, facilitating a mortgage plan that enhances overall economic well-being.

How it is beneficial to use Mortgage Calculator:

- Financial Planning: Mortgage calculators help users plan their finances by estimating monthly mortgage payments. This allows individuals to assess whether they can afford a particular loan and helps in creating a budget.

- Budgeting: Users can experiment with different loan amounts, interest rates, and loan terms to see how they affect monthly payments. This helps borrowers set realistic budgets and make informed decisions about the type and amount of mortgage they can comfortably manage.

- Comparison of Loan Options: Mortgage calculators enable borrowers to compare different loan options by inputting various interest rates and terms. This allows users to identify the most cost-effective and suitable mortgage for their financial situation.

- Interest Savings: Users can use mortgage calculators to explore the impact of making extra payments or paying more frequently. This can lead to significant interest savings over the life of the loan.

- Down Payment Planning: Calculators can assist individuals in determining the down payment amount required for a specific loan. This helps in planning and saving for the initial home purchase costs.

- Accessibility and Convenience: Mortgage calculators are readily available online and are easy to use. This accessibility makes it convenient for anyone to assess and understand their potential mortgage scenarios quickly.

Mortgage Mistakes to Avoid:

Securing a mortgage demands a careful approach to avoid potential financial pitfalls. Rushing into agreements without exploring offers from multiple lenders can lead to costly oversights, making it imperative to research and gather quotes for the best terms diligently. Ignoring the significant impact of credit scores on mortgage rates is a common mistake; regular checks and improvements are crucial. Hidden costs like closing fees and insurance should be factored into budgets, ensuring a comprehensive financial plan.

Prudent debt management is essential to prevent overextension while choosing the right mortgage type aligned with individual financial goals is paramount. Skipping pre-approval is a risk, as it provides clarity on borrowing capacity and enhances buyer appeal. Reading and understanding the fine print of mortgage agreements is non-negotiable, as is considering long-term plans to accommodate potential life changes. Timely payments are imperative to prevent credit damage and foreclosure risks. Vigilant monitoring of interest rates and seizing refinancing opportunities can optimize financial positions over time. In essence, avoiding mortgage mistakes requires a blend of research, financial mindfulness, and strategic planning. Looking for more calculators? CoolCalculator has you covered with a variety of tools to simplify your financial and mathematical tasks.

Conversation

Latest Blogs

© Blog CoolCalculator, Explore CoolCalculator, your destination for the latest insights, tips, and updates on the world of online calculators. Stay informed and make your calculations smarter with our blog. ,

Designed

by Saad Media Team , Team Lead M.Rizwan Akhtar