Navigating Global Finances: The Crucial Role of Currency Converters

Learn how currency converters play a vital role in international travel, online shopping, financial planning, and business transactions.

Currency:

Money is something people use to buy things or pay debts. It's like a tool we all agree to use when trading stuff or services. Money helps us measure the value of things, store wealth, and set standards for future transactions. In today's world, where we can easily communicate and do business across borders, currency converters are essential. These converters help us figure out how much money is worth in different countries. Whether you're travelling, doing business internationally, or buying things online from other countries, a currency converter makes it easier to deal with different types of money.

Currency converters are critical in our globalized society. People and businesses often deal with other countries, and being able to convert currencies accurately is crucial. In the age of international travel and digital connections, having a good currency converter helps with smooth transactions and planning finances. It lets people handle the changing exchange rates between different countries more easily.

Currency converter:

Currency exchange is about more than just making things easier. It's also connected to the ups and downs in the worldwide economy. Changes in exchange rates can make things more complicated by affecting the cost of stuff and how much money businesses make. But intelligent people and businesses can use these changes to their advantage, like getting better rates for travel or making more money in international trade.

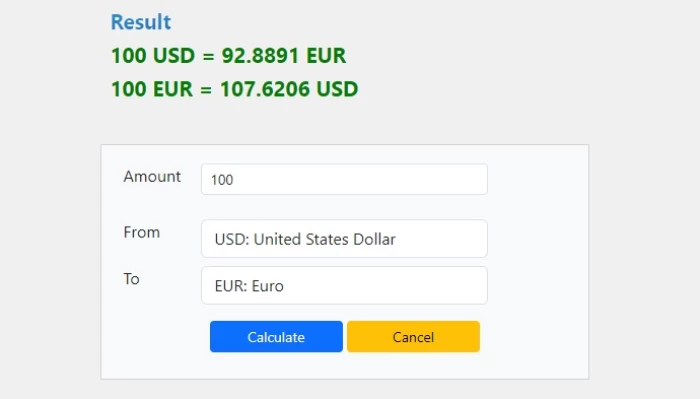

A currency converter is a helpful tool that lets people and businesses make smart choices about their money. When we look closer at currency exchange, we see that knowing about exchange rates is not just for convenience; it's essential for dealing with the opportunities and challenges in our global economy.

Real-Life Applications of currency converter:

International Travel: When travelling to a foreign country, a currency converter helps you understand the equivalent value of your home currency in the local currency. This is essential for budgeting, making purchases, and managing expenses while abroad.

Online Shopping: Many online retailers accept payments in multiple currencies. A currency converter allows consumers to understand the cost of products and services in their currency, helping them make informed purchase decisions.

Financial Planning: Investors and businesses involved in international trade use currency converters to assess the impact of exchange rate fluctuations on their investments and financial transactions. This helps in making informed decisions and managing financial risk.

Business Transactions: Companies engaged in global trade and commerce use currency converters to facilitate international transactions. It helps them negotiate contracts, set prices, and manage financial transactions by accounting for currency exchange rates.

Remittances: People working abroad often send money back to their home countries. A currency converter assists in calculating the equivalent amount in the recipient's local currency, allowing for accurate and transparent financial transactions.

Currency Trading: Forex (foreign exchange) traders use currency converters to track and analyze currency exchange rates. This information is crucial for making trading decisions and predicting market trends.

Cross-Border Investments: Investors with portfolios that include assets denominated in different currencies use currency converters to assess the overall value of their investments. This helps them make strategic decisions based on currency fluctuations.

Tourism Industry: Businesses in the tourism sector, such as hotels, restaurants, and tour operators, use currency converters to set prices for services, manage bookings, and provide accurate information to international visitors.

Global Banking and Finance: Financial institutions use currency converters for various purposes, including international wire transfers, calculating interest rates, and managing currency risks associated with their operations.

Educational Expenses: Students studying abroad or attending international universities may use currency converters to understand the cost of tuition, accommodation, and other expenses in their home currency.

Currency:

Money is something people use to buy things or pay debts. It's like a tool we all agree to use when trading stuff or services. Money helps us measure the value of things, store wealth, and set standards for future transactions. In today's world, where we can easily communicate and do business across borders, currency converters are essential. These converters help us figure out how much money is worth in different countries. Whether you're travelling, doing business internationally, or buying things online from other countries, a currency converter makes it easier to deal with different types of money.

Currency converters are critical in our globalized society. People and businesses often deal with other countries, and being able to convert currencies accurately is crucial. In the age of international travel and digital connections, having a good currency converter helps with smooth transactions and planning finances. It lets people handle the changing exchange rates between different countries more easily.

Currency converter:

Currency exchange is about more than just making things easier. It's also connected to the ups and downs in the worldwide economy. Changes in exchange rates can make things more complicated by affecting the cost of stuff and how much money businesses make. But intelligent people and businesses can use these changes to their advantage, like getting better rates for travel or making more money in international trade.

A currency converter is a helpful tool that lets people and businesses make smart choices about their money. When we look closer at currency exchange, we see that knowing about exchange rates is not just for convenience; it's essential for dealing with the opportunities and challenges in our global economy.

Real-Life Applications of currency converter:

International Travel: When travelling to a foreign country, a currency converter helps you understand the equivalent value of your home currency in the local currency. This is essential for budgeting, making purchases, and managing expenses while abroad.

Online Shopping: Many online retailers accept payments in multiple currencies. A currency converter allows consumers to understand the cost of products and services in their currency, helping them make informed purchase decisions.

Financial Planning: Investors and businesses involved in international trade use currency converters to assess the impact of exchange rate fluctuations on their investments and financial transactions. This helps in making informed decisions and managing financial risk.

Business Transactions: Companies engaged in global trade and commerce use currency converters to facilitate international transactions. It helps them negotiate contracts, set prices, and manage financial transactions by accounting for currency exchange rates.

Remittances: People working abroad often send money back to their home countries. A currency converter assists in calculating the equivalent amount in the recipient's local currency, allowing for accurate and transparent financial transactions.

Currency Trading: Forex (foreign exchange) traders use currency converters to track and analyze currency exchange rates. This information is crucial for making trading decisions and predicting market trends.

Cross-Border Investments: Investors with portfolios that include assets denominated in different currencies use currency converters to assess the overall value of their investments. This helps them make strategic decisions based on currency fluctuations.

Tourism Industry: Businesses in the tourism sector, such as hotels, restaurants, and tour operators, use currency converters to set prices for services, manage bookings, and provide accurate information to international visitors.

Global Banking and Finance: Financial institutions use currency converters for various purposes, including international wire transfers, calculating interest rates, and managing currency risks associated with their operations.

Educational Expenses: Students studying abroad or attending international universities may use currency converters to understand the cost of tuition, accommodation, and other expenses in their home currency.

Conversation

Latest Blogs

© Blog CoolCalculator, Explore CoolCalculator, your destination for the latest insights, tips, and updates on the world of online calculators. Stay informed and make your calculations smarter with our blog. ,

Designed

by Saad Media Team , Team Lead M.Rizwan Akhtar