Roles of Passive Income in Building Wealth

Passive income plays a multifaceted role in building wealth. It provides financial stability through diversification, and enables compound growth via reinvestment.

In today’s dynamic financial landscape, passive income has gained significant attention as a critical factor in building wealth. Passive income refers to earnings derived from activities in which a person is not actively involved, such as rental properties, dividends from investments, or royalties from intellectual property. Unlike active income, where time and effort are directly exchanged for money, passive income continues to flow with minimal day-to-day involvement. Understanding the roles of passive income in wealth accumulation is crucial for anyone seeking financial independence.

Passive Income Diversifies Income Streams

One of the primary roles of passive income in building wealth is diversification. Job loss, economic downturns, or unforeseen personal circumstances can disrupt this income stream, potentially leading to financial hardship. Passive income offers an additional safety net by creating multiple income sources. Whether through rental properties, stock dividends, or business investments, passive income reduces dependence on one revenue stream and distributes financial risk across various assets. This diversification helps create financial resilience, essential for long-term wealth building.

Compound Growth through Investments

Passive income, mainly from financial investments, plays a crucial role in wealth accumulation due to the power of compounding. For example, dividends from stocks can be reinvested to purchase more shares, leading to increased dividend payouts in the future. Similarly, rental income from properties can be used to purchase additional real estate, amplifying returns. This cycle of reinvesting passive income creates a snowball effect, where wealth grows at an accelerating rate without requiring continuous active labor.

Financial Independence and Freedom

Achieving financial independence is one of passive income’s most significant roles in wealth building. Economic freedom means that an individual’s passive income covers their living expenses, freeing them from the necessity of working to earn money. This autonomy gives individuals more choices, pursuing personal passions, or spending more time with family. The stability and reliability of passive income allow people to make decisions based on their desires rather than financial constraints, offering a lifestyle that is less dependent on the demands of an employer or the constraints of a fixed schedule.

Scaling Time and Effort

Active income is money you earn for the time you work. Passive income is money you make without having to work as much. So, with passive income, you can make money even when you’re not working. This is especially beneficial for wealth building because it breaks the time-for-money exchange cycle. For example, while a person can only work a certain number of hours daily, passive income streams, such as investment portfolios or real estate properties, generate income around the clock. Passive income allows people to leverage their resources in a way that active income can’t.

Tax Efficiency

Passive income can also offer tax advantages, which play a significant role in wealth building. Many passive income streams such as dividends, capital gains, or real estate investments, are taxed lower than earned income. Additionally, various deductions such as depreciation on rental properties can further reduce the taxable amount. Lower tax rates mean individuals retain more income, accelerating their wealth accumulation. Strategic tax planning can thus turn passive income into a more powerful tool for growing wealth, as the money saved on taxes can be reinvested into additional income-generating assets.

Wealth Preservation

Beyond accumulating wealth, passive income also helps in preserving it. Wealth preservation is crucial for ensuring that the gains made over years of investment and saving are recovered due to poor financial decisions, economic downturns, or lifestyle inflation. Passive income streams provide a steady cash flow supporting one’s life without depleting savings or investment portfolios. This is especially important during retirement or periods of economic uncertainty, where active income might no longer be viable. Individuals can preserve their wealth over the long term by maintaining passive income, ensuring financial security across generations.

Importance of Passive in Wealth Building

Understanding the importance and relevance of passive income, especially for beginners and young adults, can provide a solid foundation for long-term wealth accumulation.

Importance of Passive Income

The primary importance of passive income lies in its ability to create financial freedom. Unlike traditional active income, which requires ongoing labor or time investment such as a salaried job, passive income allows individuals to earn continuously with little to no direct involvement after the initial work. This type of income can create stability, allowing individuals to save more, invest further, and spend time on things they are passionate about without being tied to a 9 to 5 job. Moreover, passive income streams can act as safety nets during financial hardships, offering peace of mind and security amid economic uncertainty.

Relevance of Passive Income with Economy

In today’s fast-paced world, passive income has become increasingly relevant. The rise of the gig economy, digital platforms, and technological advances make it easier for people to create passive income streams. Whether investing in stocks, creating content or leasing properties, there are more accessible ways to earn passive income. It’s particularly relevant for individuals looking to retire early or build wealth without relying on a single job. Furthermore, passive income supports lifestyle flexibility, allowing individuals to travel, pursue hobbies, or start businesses without financial stress.

Passive Income for Beginners

Starting with passive income can feel daunting for beginners, but it becomes easier with the right approach. Simple avenues like high-yield savings accounts, dividend-paying stocks, or creating digital products such as E-books, are ideal starting points. Beginners should focus on low-risk options and educate themselves on the potential income streams that align with their skills and resources. Once established, they can gradually scale these opportunities and diversify their sources of income.

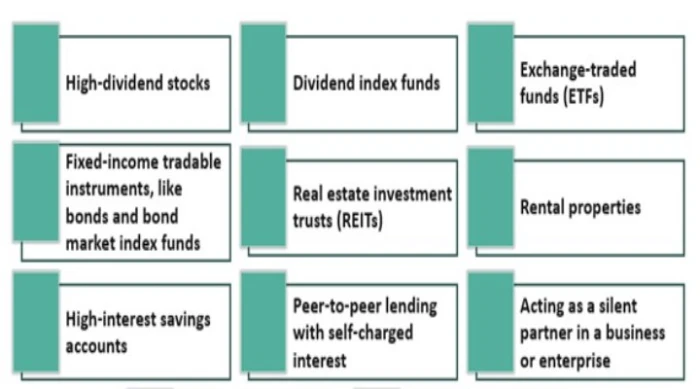

Best Passive Income Ideas

There are many ways to make money without working. Here are some of the best passive income ideas.

- Real Estate Investments

Renting out properties can provide consistent income.

- Dividend Stocks

Stocks that pay regular dividends offer a reliable income stream.

- Peer-to-Peer Lending

People can make money by lending to others or small companies.

- Creating Digital Products

E-books, online courses, or digital templates can generate recurring income.

Passive Income Ideas for Young Adults

For young adults, passive income ideas should balance time, effort, and financial commitment. Starting a YouTube channel, investing in fractional shares or REITs (Real Estate Investment Trusts), or affiliate marketing can be excellent. These methods require smaller financial investments upfront but can grow over time, making them suitable for individuals in the early stages of their careers.

Stocks for Building Passive Income Wealth

Investing in stocks is one of the most common ways to build passive income wealth. Dividend-paying stocks from stable companies can offer a steady income stream. Index funds, exchange-traded funds (ETFs), and blue-chip stocks are excellent options for beginners looking for relatively lower-risk investments that can generate consistent returns over time. Reinvesting dividends can also accelerate wealth-building by compounding earnings.

Passive income plays a multifaceted role in building wealth. It provides financial stability through diversification, enables compound growth via reinvestment, and offers financial independence by decoupling income from active labor. Additionally, it enhances tax efficiency and helps preserve wealth, making it a critical component of any long-term wealth-building strategy. Individuals can build and protect their wealth by creating multiple passive income streams, achieve financial freedom, and secure a more stable and prosperous future.

Also, read the following related posts.

In today’s dynamic financial landscape, passive income has gained significant attention as a critical factor in building wealth. Passive income refers to earnings derived from activities in which a person is not actively involved, such as rental properties, dividends from investments, or royalties from intellectual property. Unlike active income, where time and effort are directly exchanged for money, passive income continues to flow with minimal day-to-day involvement. Understanding the roles of passive income in wealth accumulation is crucial for anyone seeking financial independence.

Passive Income Diversifies Income Streams

One of the primary roles of passive income in building wealth is diversification. Job loss, economic downturns, or unforeseen personal circumstances can disrupt this income stream, potentially leading to financial hardship. Passive income offers an additional safety net by creating multiple income sources. Whether through rental properties, stock dividends, or business investments, passive income reduces dependence on one revenue stream and distributes financial risk across various assets. This diversification helps create financial resilience, essential for long-term wealth building.

Compound Growth through Investments

Passive income, mainly from financial investments, plays a crucial role in wealth accumulation due to the power of compounding. For example, dividends from stocks can be reinvested to purchase more shares, leading to increased dividend payouts in the future. Similarly, rental income from properties can be used to purchase additional real estate, amplifying returns. This cycle of reinvesting passive income creates a snowball effect, where wealth grows at an accelerating rate without requiring continuous active labor.

Financial Independence and Freedom

Achieving financial independence is one of passive income’s most significant roles in wealth building. Economic freedom means that an individual’s passive income covers their living expenses, freeing them from the necessity of working to earn money. This autonomy gives individuals more choices, pursuing personal passions, or spending more time with family. The stability and reliability of passive income allow people to make decisions based on their desires rather than financial constraints, offering a lifestyle that is less dependent on the demands of an employer or the constraints of a fixed schedule.

Scaling Time and Effort

Active income is money you earn for the time you work. Passive income is money you make without having to work as much. So, with passive income, you can make money even when you’re not working. This is especially beneficial for wealth building because it breaks the time-for-money exchange cycle. For example, while a person can only work a certain number of hours daily, passive income streams, such as investment portfolios or real estate properties, generate income around the clock. Passive income allows people to leverage their resources in a way that active income can’t.

Tax Efficiency

Passive income can also offer tax advantages, which play a significant role in wealth building. Many passive income streams such as dividends, capital gains, or real estate investments, are taxed lower than earned income. Additionally, various deductions such as depreciation on rental properties can further reduce the taxable amount. Lower tax rates mean individuals retain more income, accelerating their wealth accumulation. Strategic tax planning can thus turn passive income into a more powerful tool for growing wealth, as the money saved on taxes can be reinvested into additional income-generating assets.

Wealth Preservation

Beyond accumulating wealth, passive income also helps in preserving it. Wealth preservation is crucial for ensuring that the gains made over years of investment and saving are recovered due to poor financial decisions, economic downturns, or lifestyle inflation. Passive income streams provide a steady cash flow supporting one’s life without depleting savings or investment portfolios. This is especially important during retirement or periods of economic uncertainty, where active income might no longer be viable. Individuals can preserve their wealth over the long term by maintaining passive income, ensuring financial security across generations.

Importance of Passive in Wealth Building

Understanding the importance and relevance of passive income, especially for beginners and young adults, can provide a solid foundation for long-term wealth accumulation.

Importance of Passive Income

The primary importance of passive income lies in its ability to create financial freedom. Unlike traditional active income, which requires ongoing labor or time investment such as a salaried job, passive income allows individuals to earn continuously with little to no direct involvement after the initial work. This type of income can create stability, allowing individuals to save more, invest further, and spend time on things they are passionate about without being tied to a 9 to 5 job. Moreover, passive income streams can act as safety nets during financial hardships, offering peace of mind and security amid economic uncertainty.

Relevance of Passive Income with Economy

In today’s fast-paced world, passive income has become increasingly relevant. The rise of the gig economy, digital platforms, and technological advances make it easier for people to create passive income streams. Whether investing in stocks, creating content or leasing properties, there are more accessible ways to earn passive income. It’s particularly relevant for individuals looking to retire early or build wealth without relying on a single job. Furthermore, passive income supports lifestyle flexibility, allowing individuals to travel, pursue hobbies, or start businesses without financial stress.

Passive Income for Beginners

Starting with passive income can feel daunting for beginners, but it becomes easier with the right approach. Simple avenues like high-yield savings accounts, dividend-paying stocks, or creating digital products such as E-books, are ideal starting points. Beginners should focus on low-risk options and educate themselves on the potential income streams that align with their skills and resources. Once established, they can gradually scale these opportunities and diversify their sources of income.

Best Passive Income Ideas

There are many ways to make money without working. Here are some of the best passive income ideas.

- Real Estate Investments

Renting out properties can provide consistent income.

- Dividend Stocks

Stocks that pay regular dividends offer a reliable income stream.

- Peer-to-Peer Lending

People can make money by lending to others or small companies.

- Creating Digital Products

E-books, online courses, or digital templates can generate recurring income.

Passive Income Ideas for Young Adults

For young adults, passive income ideas should balance time, effort, and financial commitment. Starting a YouTube channel, investing in fractional shares or REITs (Real Estate Investment Trusts), or affiliate marketing can be excellent. These methods require smaller financial investments upfront but can grow over time, making them suitable for individuals in the early stages of their careers.

Stocks for Building Passive Income Wealth

Investing in stocks is one of the most common ways to build passive income wealth. Dividend-paying stocks from stable companies can offer a steady income stream. Index funds, exchange-traded funds (ETFs), and blue-chip stocks are excellent options for beginners looking for relatively lower-risk investments that can generate consistent returns over time. Reinvesting dividends can also accelerate wealth-building by compounding earnings.

Passive income plays a multifaceted role in building wealth. It provides financial stability through diversification, enables compound growth via reinvestment, and offers financial independence by decoupling income from active labor. Additionally, it enhances tax efficiency and helps preserve wealth, making it a critical component of any long-term wealth-building strategy. Individuals can build and protect their wealth by creating multiple passive income streams, achieve financial freedom, and secure a more stable and prosperous future.

Also, read the following related posts.

Conversation

Latest Blogs

© Blog CoolCalculator, Explore CoolCalculator, your destination for the latest insights, tips, and updates on the world of online calculators. Stay informed and make your calculations smarter with our blog. ,

Designed

by Saad Media Team , Team Lead M.Rizwan Akhtar