Stop Guessing and Start Calculating - Your One-Stop Shop for Financial Clarity

Our comprehensive resources and tools will help you make informed decisions and take control of your finances.

What is Financing?

Financing refers to the provision of funds or capital to support various activities, projects, or investments. It involves the management of money, credit, investments, and other financial instruments to achieve specific goals. Financing can take place in various forms and can be used for personal, business, or governmental purposes.

Several financial calculators make managing your money super easy and efficient. For instance, there's a retirement calculator to help you plan for your future, a commission calculator for figuring out earnings based on sales or work, a discount calculator to determine savings on purchases, and a rent calculator to help budget for housing costs.

Some Key Financial Terminologies

Assets

- Current Assets - Assets that are expected to be converted into cash or used up within one year.

- Fixed Assets - Long-term assets such as property, equipment, and machinery.

Liabilities

- Current Liabilities - Obligations expected to be settled within one year.

- Long-Term Liabilities - Debts and obligations with a maturity of more than one year.

Equity

- Shareholder's Equity - The residual interest in the assets of the company after deducting liabilities.

Income Statement

- Revenue (Sales) - Total income generated from the sale of goods or services.

- Expenses - Costs incurred to generate revenue.

- Net Income - Revenue minus expenses, also known as profit or earnings.

Balance Sheet

- Statement of Financial Position - A snapshot of a company's financial position at a specific point in time, showing assets, liabilities, and equity.

Cash Flow Statement

- Operating Activities - Cash transactions related to the core business operations.

- Investing Activities - Cash transactions for purchasing and selling investments and productive assets.

- Financing Activities - Cash transactions with the company's owners and creditors.

Financial Ratios

- Liquidity Ratios - Measure a company's ability to meet short-term obligations.

- Profitability Ratios - Indicate the company's ability to generate profit.

- Solvency Ratios - Assess a company's ability to meet its long-term obligations.

Return on Investment (ROI)

- Measures the profitability of an investment, expressed as a percentage.

Dividends

- Dividend Yield - The annual dividend income expressed as a percentage of the investment.

- Dividend Payout Ratio - The percentage of earnings paid out as dividends.

Depreciation and Amortization

- Depreciation - Allocation of the cost of a tangible asset over its useful life.

- Amortization - Allocation of the price of an intangible asset over its useful life.

Capital Market

- Primary Market - Where new securities are issued and sold for the first time.

- Secondary Market - Where existing securities are bought and sold among investors.

Risk Management

- Diversification - Spreading investments across different assets to reduce risk.

- Hedging - Using financial instruments to offset the risk of adverse price movements.

Some Common Types of Financing

-

Personal Financing

Personal financing is all about managing your money for your personal needs. It's like handling your expenses and making sure you have enough funds for things like buying a house, getting a car, or paying for education. There are different ways people can get the money they need. One common method is to use their savings. To deal with things regarding savings, use a savings calculator. Savings mean setting aside a portion of your income in a savings account. It's a good habit because it helps you have money ready when you need it.

Another way is through loans. Imagine you want to buy a car but need more money at a time. You can borrow money from a bank or a lending company and pay it back in smaller amounts over time. They might charge you some extra money called interest for letting you borrow theirs. A loan calculator comes in to assist you.

Credit cards are like magic cards that let you buy things even if you don't have the money right away. But be careful with them. If you don't pay the total amount you owe every month, they can charge you extra money, and it can add up quickly.

Now, talk about tools that can help you with these big decisions. If you're thinking of getting a car, there's something called an auto loan calculator. It's like a helpful friend who tells you how much you'll be paying each month if you borrow money for a car. Similarly, a mortgage calculator shapes up your finances for buying a house.

-

Business Financing

When it comes to running a business, whether you're just starting, managing day-to-day operations, or looking to expand, having enough money is crucial. Business financing provides the necessary capital, and there are two primary approaches - equity financing and debt financing.

Equity financing involves selling a share of your business to investors, making them co-owners who share in both the successes and challenges of the business. On the other hand, debt financing entails borrowing money through loans or bonds, with the obligation to repay the borrowed amount along with interest over a specified period. Each method has its advantages and drawbacks, such as sharing control and profits in equity financing or maintaining control but having repayment responsibilities in debt financing.

To navigate these financial decisions effectively, businesses often turn to a helpful tool known as a business calculator. This tool simplifies complex calculations, making it easier to assess aspects like affordable borrowing limits, potential monthly payments, and other critical financial considerations. Think of it as a reliable assistant specifically designed to handle the intricate math involved in managing and planning the financial aspects of your business. An investment calculator also contributes to your business when you invest in a project.

-

Venture Capital

Venture capital is like a helping hand for new and small businesses. Imagine you have an excellent idea for a new company, but you need money to turn that idea into reality. That's where venture capitalists come in. These are people or companies that invest money in your business in exchange for a share of ownership. They take a risk because your business might succeed or fail, but if it does well, they make money, too.

Venture capitalists often look for businesses with high growth potential, like tech startups or innovative ideas. They provide not just money but also advice and guidance to help the business grow. In return, they hope to make a profit when the business becomes successful.

-

Private Equity

Private equity is a bit like venture capital, but it typically gets involved with more established businesses. Imagine a company that's been around for a while and is doing well, but the owner may want to retire or need more money to expand. Private equity firms step in to invest money in exchange for a stake in the company.

These firms often buy a significant portion of the business, or sometimes the whole thing, with the goal of improving its performance and making it more valuable. They might bring in new management, streamline operations, or help the company enter new markets. The idea is to make the business more profitable, and when they eventually sell their stake, they make a profit.

Government Financing

Governments need money to fund various projects and services that benefit the public. One way they get this money is through financing, which involves borrowing funds. They issue bonds, which are IOUs that people can buy. In return, the government promises to pay back the borrowed amount with interest.

Public projects include things like building roads, schools, and hospitals and maintaining public spaces. Services provided by the government cover a wide range, such as healthcare, education, law enforcement, and social programs to help citizens in need.

Apart from borrowing, governments also raise funds through taxation. Taxes are compulsory contributions from individuals and businesses to the government. The government uses tax revenue to finance its activities and services. To calculate taxes, people often use tools like tax calculators or income tax calculators. These tools help individuals estimate how much tax they owe based on their income, deductions, and other factors.

Debt Financing

Debt financing means borrowing money that you have to pay back with some extra money called interest. You can borrow this money from banks by selling bonds or using other types of loans. To figure out how much you'll have to pay back, you can use a tool called a loan calculator. It helps you understand the total cost of the borrowed money over a specific period of time. So, when you're thinking about getting a loan, this calculator can give you an idea of how much you'll need to repay in the end.

Strategies to Pay Off Debt and Achieve Financial Freedom

- Write down all the debts you have, including credit cards, loans, and any other outstanding balances. Include the amount owed and the interest rates.

- Make a monthly budget that outlines your income and expenses. Identify areas where you can cut back to free up more money to put towards paying off your debts.

- Focus on paying off debts with the highest interest rates first. This helps you save money on interest payments over time.

- Build an emergency fund to cover unexpected expenses. This prevents you from relying on credit cards when faced with unforeseen financial challenges. The emergency fund calculator is the hero of the story here.

- Contact your creditors and try to negotiate lower interest rates. A lower rate means more of your payment goes towards reducing the principal amount.

- Consider using the snowball method, where you pay off the smallest debts first. This builds momentum and motivation as you see progress more quickly.

- Look for opportunities to increase your income, such as a part-time job or a side hustle. Use this extra money to accelerate debt repayment.

- Cut unnecessary expenses and live frugally. This allows you to allocate more funds towards debt repayment.

- Set up automatic payments for your debts to ensure you get all the due dates. This helps improve your credit score and avoids late fees.

- Consider seeking advice from a financial counsellor. They can provide personalized strategies and guidance based on your specific situation.

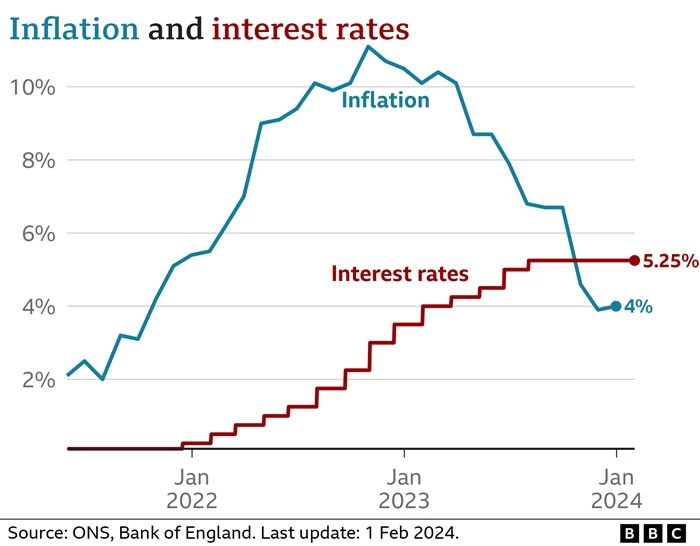

What is Inflation?

Inflation is the rate at which the general level of prices for goods and services rises, leading to a decrease in the purchasing power of a currency. In other words, when inflation occurs, each unit of currency buys fewer goods and services than it did before. Inflation is typically measured as an annual percentage increase in the Consumer Price Index (CPI) or the Producer Price Index (PPI).

The Effects of Inflation on the Finance Industry of a Country

Interest Rates

Central banks often respond to high inflation by raising interest rates. Higher interest rates can influence borrowing costs and lending practices in the finance industry. It may become more expensive for businesses and individuals to borrow money, affecting investment and spending.

Bonds and Fixed-Income Investments

Inflation erodes the purchasing power of future interest and principal payments. This can lead to lower actual returns on bonds and other fixed-income investments. Investors may demand higher interest rates on new bonds to compensate for the expected loss of purchasing power.

Stock Prices

Inflation can impact stock prices. Companies may face higher costs for raw materials and labor, which can reduce profit margins. However, some companies can pass on increased costs to consumers, maintaining or even increasing their profits. The profit calculator is an active participant in the war here.

Real Estate

Inflation can affect real estate prices. While the value of physical assets like property may rise with inflation, borrowing costs and mortgage rates may also increase, potentially impacting the demand for real estate.

Currency Value

Persistent inflation can lead to a decrease in the value of a country's currency on the international market. A weaker currency can affect trade balances and international investments. Suppose you are a person who deals with different coins. In that case, you can join our currency converter to help convert currency quickly.

Risk and Uncertainty

High or unpredictable inflation can introduce uncertainty into the financial markets. Investors may be less willing to make long-term commitments or investments when the future value of money is uncertain.

Income Redistribution

Inflation can result in a redistribution of wealth. Creditors may see a reduction in the real value of the money they are repaid. At the same time, debtors may benefit from paying off loans with less valuable currency.

Consumer Behavior

Inflation can influence consumer behaviour. As the cost of goods and services rises, consumers may alter their spending patterns, focusing on essential items and cutting back discretionary spending.

Financial Literacy

Financial literacy means understanding how money works and how to make intelligent decisions about it. It's about knowing how to manage your money, budget, save, and invest wisely. Being financially literate helps you make informed choices about things like credit, loans, and retirement. It's like having the knowledge and skills to handle your finances well so you can achieve your financial goals and be financially secure.

What is Financing?

Financing refers to the provision of funds or capital to support various activities, projects, or investments. It involves the management of money, credit, investments, and other financial instruments to achieve specific goals. Financing can take place in various forms and can be used for personal, business, or governmental purposes.

Several financial calculators make managing your money super easy and efficient. For instance, there's a retirement calculator to help you plan for your future, a commission calculator for figuring out earnings based on sales or work, a discount calculator to determine savings on purchases, and a rent calculator to help budget for housing costs.

Some Key Financial Terminologies

Assets

- Current Assets - Assets that are expected to be converted into cash or used up within one year.

- Fixed Assets - Long-term assets such as property, equipment, and machinery.

Liabilities

- Current Liabilities - Obligations expected to be settled within one year.

- Long-Term Liabilities - Debts and obligations with a maturity of more than one year.

Equity

- Shareholder's Equity - The residual interest in the assets of the company after deducting liabilities.

Income Statement

- Revenue (Sales) - Total income generated from the sale of goods or services.

- Expenses - Costs incurred to generate revenue.

- Net Income - Revenue minus expenses, also known as profit or earnings.

Balance Sheet

- Statement of Financial Position - A snapshot of a company's financial position at a specific point in time, showing assets, liabilities, and equity.

Cash Flow Statement

- Operating Activities - Cash transactions related to the core business operations.

- Investing Activities - Cash transactions for purchasing and selling investments and productive assets.

- Financing Activities - Cash transactions with the company's owners and creditors.

Financial Ratios

- Liquidity Ratios - Measure a company's ability to meet short-term obligations.

- Profitability Ratios - Indicate the company's ability to generate profit.

- Solvency Ratios - Assess a company's ability to meet its long-term obligations.

Return on Investment (ROI)

- Measures the profitability of an investment, expressed as a percentage.

Dividends

- Dividend Yield - The annual dividend income expressed as a percentage of the investment.

- Dividend Payout Ratio - The percentage of earnings paid out as dividends.

Depreciation and Amortization

- Depreciation - Allocation of the cost of a tangible asset over its useful life.

- Amortization - Allocation of the price of an intangible asset over its useful life.

Capital Market

- Primary Market - Where new securities are issued and sold for the first time.

- Secondary Market - Where existing securities are bought and sold among investors.

Risk Management

- Diversification - Spreading investments across different assets to reduce risk.

- Hedging - Using financial instruments to offset the risk of adverse price movements.

Some Common Types of Financing

-

Personal Financing

Personal financing is all about managing your money for your personal needs. It's like handling your expenses and making sure you have enough funds for things like buying a house, getting a car, or paying for education. There are different ways people can get the money they need. One common method is to use their savings. To deal with things regarding savings, use a savings calculator. Savings mean setting aside a portion of your income in a savings account. It's a good habit because it helps you have money ready when you need it.

Another way is through loans. Imagine you want to buy a car but need more money at a time. You can borrow money from a bank or a lending company and pay it back in smaller amounts over time. They might charge you some extra money called interest for letting you borrow theirs. A loan calculator comes in to assist you.

Credit cards are like magic cards that let you buy things even if you don't have the money right away. But be careful with them. If you don't pay the total amount you owe every month, they can charge you extra money, and it can add up quickly.

Now, talk about tools that can help you with these big decisions. If you're thinking of getting a car, there's something called an auto loan calculator. It's like a helpful friend who tells you how much you'll be paying each month if you borrow money for a car. Similarly, a mortgage calculator shapes up your finances for buying a house.

-

Business Financing

When it comes to running a business, whether you're just starting, managing day-to-day operations, or looking to expand, having enough money is crucial. Business financing provides the necessary capital, and there are two primary approaches - equity financing and debt financing.

Equity financing involves selling a share of your business to investors, making them co-owners who share in both the successes and challenges of the business. On the other hand, debt financing entails borrowing money through loans or bonds, with the obligation to repay the borrowed amount along with interest over a specified period. Each method has its advantages and drawbacks, such as sharing control and profits in equity financing or maintaining control but having repayment responsibilities in debt financing.

To navigate these financial decisions effectively, businesses often turn to a helpful tool known as a business calculator. This tool simplifies complex calculations, making it easier to assess aspects like affordable borrowing limits, potential monthly payments, and other critical financial considerations. Think of it as a reliable assistant specifically designed to handle the intricate math involved in managing and planning the financial aspects of your business. An investment calculator also contributes to your business when you invest in a project.

-

Venture Capital

Venture capital is like a helping hand for new and small businesses. Imagine you have an excellent idea for a new company, but you need money to turn that idea into reality. That's where venture capitalists come in. These are people or companies that invest money in your business in exchange for a share of ownership. They take a risk because your business might succeed or fail, but if it does well, they make money, too.

Venture capitalists often look for businesses with high growth potential, like tech startups or innovative ideas. They provide not just money but also advice and guidance to help the business grow. In return, they hope to make a profit when the business becomes successful.

-

Private Equity

Private equity is a bit like venture capital, but it typically gets involved with more established businesses. Imagine a company that's been around for a while and is doing well, but the owner may want to retire or need more money to expand. Private equity firms step in to invest money in exchange for a stake in the company.

These firms often buy a significant portion of the business, or sometimes the whole thing, with the goal of improving its performance and making it more valuable. They might bring in new management, streamline operations, or help the company enter new markets. The idea is to make the business more profitable, and when they eventually sell their stake, they make a profit.

Government Financing

Governments need money to fund various projects and services that benefit the public. One way they get this money is through financing, which involves borrowing funds. They issue bonds, which are IOUs that people can buy. In return, the government promises to pay back the borrowed amount with interest.

Public projects include things like building roads, schools, and hospitals and maintaining public spaces. Services provided by the government cover a wide range, such as healthcare, education, law enforcement, and social programs to help citizens in need.

Apart from borrowing, governments also raise funds through taxation. Taxes are compulsory contributions from individuals and businesses to the government. The government uses tax revenue to finance its activities and services. To calculate taxes, people often use tools like tax calculators or income tax calculators. These tools help individuals estimate how much tax they owe based on their income, deductions, and other factors.

Debt Financing

Debt financing means borrowing money that you have to pay back with some extra money called interest. You can borrow this money from banks by selling bonds or using other types of loans. To figure out how much you'll have to pay back, you can use a tool called a loan calculator. It helps you understand the total cost of the borrowed money over a specific period of time. So, when you're thinking about getting a loan, this calculator can give you an idea of how much you'll need to repay in the end.

Strategies to Pay Off Debt and Achieve Financial Freedom

- Write down all the debts you have, including credit cards, loans, and any other outstanding balances. Include the amount owed and the interest rates.

- Make a monthly budget that outlines your income and expenses. Identify areas where you can cut back to free up more money to put towards paying off your debts.

- Focus on paying off debts with the highest interest rates first. This helps you save money on interest payments over time.

- Build an emergency fund to cover unexpected expenses. This prevents you from relying on credit cards when faced with unforeseen financial challenges. The emergency fund calculator is the hero of the story here.

- Contact your creditors and try to negotiate lower interest rates. A lower rate means more of your payment goes towards reducing the principal amount.

- Consider using the snowball method, where you pay off the smallest debts first. This builds momentum and motivation as you see progress more quickly.

- Look for opportunities to increase your income, such as a part-time job or a side hustle. Use this extra money to accelerate debt repayment.

- Cut unnecessary expenses and live frugally. This allows you to allocate more funds towards debt repayment.

- Set up automatic payments for your debts to ensure you get all the due dates. This helps improve your credit score and avoids late fees.

- Consider seeking advice from a financial counsellor. They can provide personalized strategies and guidance based on your specific situation.

What is Inflation?

Inflation is the rate at which the general level of prices for goods and services rises, leading to a decrease in the purchasing power of a currency. In other words, when inflation occurs, each unit of currency buys fewer goods and services than it did before. Inflation is typically measured as an annual percentage increase in the Consumer Price Index (CPI) or the Producer Price Index (PPI).

The Effects of Inflation on the Finance Industry of a Country

Interest Rates

Central banks often respond to high inflation by raising interest rates. Higher interest rates can influence borrowing costs and lending practices in the finance industry. It may become more expensive for businesses and individuals to borrow money, affecting investment and spending.

Bonds and Fixed-Income Investments

Inflation erodes the purchasing power of future interest and principal payments. This can lead to lower actual returns on bonds and other fixed-income investments. Investors may demand higher interest rates on new bonds to compensate for the expected loss of purchasing power.

Stock Prices

Inflation can impact stock prices. Companies may face higher costs for raw materials and labor, which can reduce profit margins. However, some companies can pass on increased costs to consumers, maintaining or even increasing their profits. The profit calculator is an active participant in the war here.

Real Estate

Inflation can affect real estate prices. While the value of physical assets like property may rise with inflation, borrowing costs and mortgage rates may also increase, potentially impacting the demand for real estate.

Currency Value

Persistent inflation can lead to a decrease in the value of a country's currency on the international market. A weaker currency can affect trade balances and international investments. Suppose you are a person who deals with different coins. In that case, you can join our currency converter to help convert currency quickly.

Risk and Uncertainty

High or unpredictable inflation can introduce uncertainty into the financial markets. Investors may be less willing to make long-term commitments or investments when the future value of money is uncertain.

Income Redistribution

Inflation can result in a redistribution of wealth. Creditors may see a reduction in the real value of the money they are repaid. At the same time, debtors may benefit from paying off loans with less valuable currency.

Consumer Behavior

Inflation can influence consumer behaviour. As the cost of goods and services rises, consumers may alter their spending patterns, focusing on essential items and cutting back discretionary spending.

Financial Literacy

Financial literacy means understanding how money works and how to make intelligent decisions about it. It's about knowing how to manage your money, budget, save, and invest wisely. Being financially literate helps you make informed choices about things like credit, loans, and retirement. It's like having the knowledge and skills to handle your finances well so you can achieve your financial goals and be financially secure.

Conversation

Latest Blogs

© Blog CoolCalculator, Explore CoolCalculator, your destination for the latest insights, tips, and updates on the world of online calculators. Stay informed and make your calculations smarter with our blog. ,

Designed

by Saad Media Team , Team Lead M.Rizwan Akhtar