The Power of Sales Tax Calculators

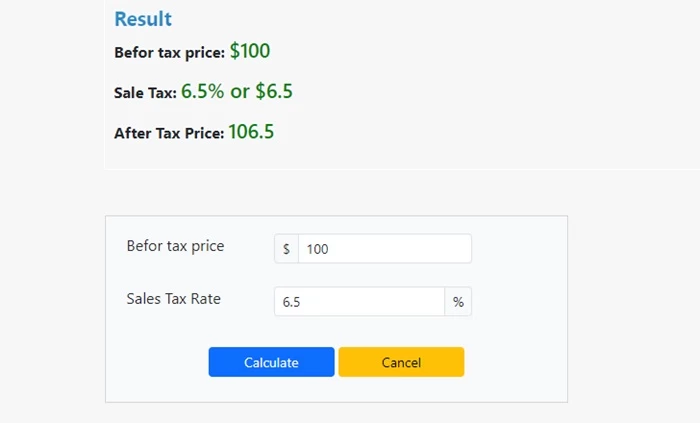

Simplify financial processes, enhance compliance, and save valuable time with these indispensable tools for businesses and individuals. Discover the convenience and precision that sales tax calculators bring to your financial calculations.

In the intricate landscape of commerce, the nuances of sales tax calculations stand as a formidable force shaping the financial trajectory of businesses. Imagine as the engine of economic transactions, sales tax exerts a profound influence, with its repercussions echoing throughout the business-consumer relationship. Consider the staggering statistic that underscores its significance – an estimated 45% of businesses struggle with sales tax compliance, revealing a complex web that demands meticulous attention.

Sales tax, a pivotal element in the financial framework, constitutes a consummate portion of revenue for governments. However, its impact extends far beyond the bureaucratic realm, permeating the very fabric of commercial transactions. As consumers, we encounter its effects daily, subtly embedded in the final price of goods and services. The labyrinth of sales tax calculations, though fundamental, is fraught with challenges that businesses grapple with on a regular basis.

Navigating this intricate web manually introduces an array of obstacles, with human error and time consumption standing out prominently. The manual calculation of sales tax demands precision and vigilance. Yet, it remains susceptible to the fallibility inherent in human nature. In an era that values efficiency and accuracy, the traditional methods of calculating sales tax pose a considerable threat to the seamless functioning of businesses. Furthermore, the time-intensive nature of manual calculations is an opportunity cost that businesses need help to afford in the relentless pursuit of competitiveness.

In this landscape, where precision and efficiency are non-negotiable, the challenges associated with manual sales tax calculations take centre stage. As we delve deeper into the intricate world of sales tax dynamics, it becomes imperative to explore innovative solutions that not only mitigate these challenges but also pave the way for a future where businesses can thrive unhindered by the complexities of tax calculations.

Problems regarding sales tax management:

Sales tax management can be challenging for many people due to several common issues. One prevalent problem is the need for more clarity surrounding different tax rates for various products or services. People often need help to grasp these rates, making it essential to simplify and clearly communicate them. Additionally, the ever-changing nature of tax rules poses a challenge, leading to uncertainty about what is taxable and what is not. Staying updated on tax law changes and effectively communicating them can help alleviate this issue.

Manual errors in tax calculations present another significant concern. Mistakes in calculating taxes can result in overcharging or undercharging customers, potentially leading to financial discrepancies. Employing automated systems or calculators can significantly reduce the risk of human errors in tax calculations. Exemptions and exceptional cases, where certain products or services may be tax-exempt, add complexity to the process. Clearly defining exempt items and providing staff with proper training to handle exceptional cases can help navigate these situations more effectively.

The rise of online sales introduces its own set of challenges, particularly concerning customers from different locations with varying tax rates. Implementing geolocation tools in online systems can automate the application of the correct tax rate based on the customer's location. Record-keeping poses a time-consuming challenge, and errors in tracking sales and tax collected can lead to complications during reporting and auditing. Utilizing digital tools for accurate record-keeping can streamline this aspect of sales tax management.

Understanding the concept of nexus, or the presence of a business in a specific tax jurisdiction, can be perplexing. Seeking professional advice to comprehend nexus and ensure compliance with tax laws in different locations is crucial. Customer communication is often overlooked, with customers needing to be made aware of the taxes they are being charged and why. Clear communication of taxes on receipts or invoices, along with providing information about the cost breakdown, can enhance transparency.

Applications of Sales tax calculator:

- Consumer Budgeting: Personal Finance Planning: Individuals can use a sales tax calculator to estimate the total cost of goods and services, helping them budget more effectively.

- Comparison Shopping: Consumers can compare prices across different regions or online platforms, taking into account variations in sales tax rates.

- Pricing Strategy: Businesses can use a sales tax calculator to determine the final selling price of their products, considering applicable sales tax rates in different locations.

- Checkout Processes: Online retailers often use sales tax calculators to dynamically calculate and display the total cost at checkout based on the customer's location.

- Budgeting for Travelers: Travelers can estimate expenses, including sales tax when planning trips to different locations.

- Home Purchases: Buyers and sellers in real estate transactions can use a sales tax calculator to estimate closing costs, which may include taxes on the purchase.

- Investment Planning: Investors can use sales tax information to evaluate the financial implications of buying and selling assets.

- Teaching Tool: Sales tax calculators can be used as educational tools in schools and colleges to teach students about financial literacy and the practical application of taxes.

- Policy Evaluation: Researchers and policymakers can use sales tax data to analyze the economic impact of tax policies on consumer behaviour and business operations.

- Accounting: Small businesses can use sales tax calculators to ensure accurate accounting and compliance with local tax regulations.

Visit CoolCalculator to find a collection of calculators catering to different needs and make your calculations hassle-free.

In the intricate landscape of commerce, the nuances of sales tax calculations stand as a formidable force shaping the financial trajectory of businesses. Imagine as the engine of economic transactions, sales tax exerts a profound influence, with its repercussions echoing throughout the business-consumer relationship. Consider the staggering statistic that underscores its significance – an estimated 45% of businesses struggle with sales tax compliance, revealing a complex web that demands meticulous attention.

Sales tax, a pivotal element in the financial framework, constitutes a consummate portion of revenue for governments. However, its impact extends far beyond the bureaucratic realm, permeating the very fabric of commercial transactions. As consumers, we encounter its effects daily, subtly embedded in the final price of goods and services. The labyrinth of sales tax calculations, though fundamental, is fraught with challenges that businesses grapple with on a regular basis.

Navigating this intricate web manually introduces an array of obstacles, with human error and time consumption standing out prominently. The manual calculation of sales tax demands precision and vigilance. Yet, it remains susceptible to the fallibility inherent in human nature. In an era that values efficiency and accuracy, the traditional methods of calculating sales tax pose a considerable threat to the seamless functioning of businesses. Furthermore, the time-intensive nature of manual calculations is an opportunity cost that businesses need help to afford in the relentless pursuit of competitiveness.

In this landscape, where precision and efficiency are non-negotiable, the challenges associated with manual sales tax calculations take centre stage. As we delve deeper into the intricate world of sales tax dynamics, it becomes imperative to explore innovative solutions that not only mitigate these challenges but also pave the way for a future where businesses can thrive unhindered by the complexities of tax calculations.

Problems regarding sales tax management:

Sales tax management can be challenging for many people due to several common issues. One prevalent problem is the need for more clarity surrounding different tax rates for various products or services. People often need help to grasp these rates, making it essential to simplify and clearly communicate them. Additionally, the ever-changing nature of tax rules poses a challenge, leading to uncertainty about what is taxable and what is not. Staying updated on tax law changes and effectively communicating them can help alleviate this issue.

Manual errors in tax calculations present another significant concern. Mistakes in calculating taxes can result in overcharging or undercharging customers, potentially leading to financial discrepancies. Employing automated systems or calculators can significantly reduce the risk of human errors in tax calculations. Exemptions and exceptional cases, where certain products or services may be tax-exempt, add complexity to the process. Clearly defining exempt items and providing staff with proper training to handle exceptional cases can help navigate these situations more effectively.

The rise of online sales introduces its own set of challenges, particularly concerning customers from different locations with varying tax rates. Implementing geolocation tools in online systems can automate the application of the correct tax rate based on the customer's location. Record-keeping poses a time-consuming challenge, and errors in tracking sales and tax collected can lead to complications during reporting and auditing. Utilizing digital tools for accurate record-keeping can streamline this aspect of sales tax management.

Understanding the concept of nexus, or the presence of a business in a specific tax jurisdiction, can be perplexing. Seeking professional advice to comprehend nexus and ensure compliance with tax laws in different locations is crucial. Customer communication is often overlooked, with customers needing to be made aware of the taxes they are being charged and why. Clear communication of taxes on receipts or invoices, along with providing information about the cost breakdown, can enhance transparency.

Applications of Sales tax calculator:

- Consumer Budgeting: Personal Finance Planning: Individuals can use a sales tax calculator to estimate the total cost of goods and services, helping them budget more effectively.

- Comparison Shopping: Consumers can compare prices across different regions or online platforms, taking into account variations in sales tax rates.

- Pricing Strategy: Businesses can use a sales tax calculator to determine the final selling price of their products, considering applicable sales tax rates in different locations.

- Checkout Processes: Online retailers often use sales tax calculators to dynamically calculate and display the total cost at checkout based on the customer's location.

- Budgeting for Travelers: Travelers can estimate expenses, including sales tax when planning trips to different locations.

- Home Purchases: Buyers and sellers in real estate transactions can use a sales tax calculator to estimate closing costs, which may include taxes on the purchase.

- Investment Planning: Investors can use sales tax information to evaluate the financial implications of buying and selling assets.

- Teaching Tool: Sales tax calculators can be used as educational tools in schools and colleges to teach students about financial literacy and the practical application of taxes.

- Policy Evaluation: Researchers and policymakers can use sales tax data to analyze the economic impact of tax policies on consumer behaviour and business operations.

- Accounting: Small businesses can use sales tax calculators to ensure accurate accounting and compliance with local tax regulations.

Visit CoolCalculator to find a collection of calculators catering to different needs and make your calculations hassle-free.

Conversation

Latest Blogs

© Blog CoolCalculator, Explore CoolCalculator, your destination for the latest insights, tips, and updates on the world of online calculators. Stay informed and make your calculations smarter with our blog. ,

Designed

by Saad Media Team , Team Lead M.Rizwan Akhtar