The Power of VAT Calculator: Elevate Your Tax Accuracy

Discover the ultimate tool for precision in tax calculations with 'The Power of VAT Calculator.' Elevate your tax accuracy and streamline financial calculations effortlessly.

Imagine a world where tax calculations are as easy as a stroll in the park, where errors vanish like morning dew, and precious time is no longer held captive by complex math. Step into the VAT Calculator Wonderland, where businesses liberate themselves from the burdens of intricate tax calculations! Gone are the days of furrowed brows and late-night tax troubles. The VAT Calculator is here to unravel the mystery of Value Added Tax, making number crunching as simple as ordering your morning coffee. It's not just a calculator; it's your shortcut to financial clarity!

Bid farewell to hours lost in the labyrinth of tax calculations. With the VAT Calculator, time becomes your ally. It transforms daunting tasks into swift, efficient manoeuvres, letting you focus on what truly matters – growing your business! No more sleepless nights worrying about mathematical mishaps. The VAT Calculator is your guardian against errors, ensuring that every digit falls into its designated place. Precision has a new address, and it's your financial statements!

Historical background:

A long time ago, people used to pay taxes in a way that could be confusing. They would pay taxes at different stages of making a product. For example, if someone made a chair, they might pay tax on the wood they bought, then again when they sold the chair. This got messy, so some smart folks came up with an idea. Instead of taxing the whole chair at each step, they thought, "What if we tax only the 'value' that is added at each stage?" This is where the term "Value Added" comes from.

So, in the 1950s and 1960s, countries started trying out this new way of taxing things. It was simpler because you only paid tax on the part of the product that was added by each business, not the entire value. This made it easier to track and calculate. France was the first country to use this system in the early 1950s officially. Other countries liked the idea and began adopting it, too. Eventually, Value Added Tax, or VAT for short, became a popular way for governments to collect taxes on goods and services.

Today, many countries around the world use VAT. It helps governments raise money reasonably and efficiently. People pay a little bit of tax at each step of making and selling things, and that money goes to the government to pay for essential services like schools, roads, and hospitals. And that's the story of how VAT became a common way of collecting taxes.

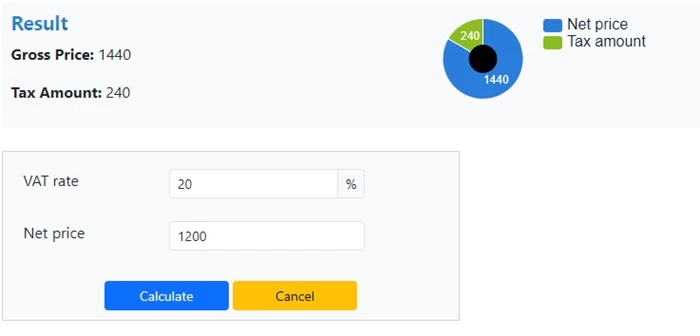

How to calculate VAT?

Suppose you have a product that costs $100, and the VAT rate is 10%. To calculate the VAT, you would use the formula:

VAT = VAT rate × Value of Goods or Services

VAT = 0.10 × $100

= $10

=0.10×$100=$10

So, in this example, the VAT on the product is $10. The total cost, including VAT would be the sum of the original cost and the VAT:

Total Cost=Cost of Goods+VAT

=$100+$10

=$110

In many countries, businesses are required to collect VAT on behalf of the government. When a business sells a product or service, it charges VAT to the customer, manages the VAT amount, and then remits the collected VAT to the government.

Benefits of VAT calculator:

A VAT (Value Added Tax) calculator offers several advantages, especially in simplifying financial transactions and aiding businesses in managing their finances more efficiently. One primary benefit is its role in helping individuals and businesses determine the exact amount of VAT they need to pay or can reclaim. This accuracy is crucial for maintaining compliance with tax regulations.

Moreover, a VAT calculator streamlines the complex process of calculating taxes on goods and services. By automating these calculations, it reduces the likelihood of errors, ensuring that businesses remain in good standing with tax authorities. This not only saves time but also helps prevent potential financial penalties that may result from miscalculations. Additionally, a VAT calculator promotes transparency and clarity in financial transactions. Businesses can provide accurate and easily understandable invoices to their customers, fostering trust and preventing disputes over incorrect tax amounts. The calculator thus serves as a valuable tool for both businesses and consumers, contributing to a more seamless and reliable economic environment. If you're interested in exploring additional calculators, check out CoolCalculator for a variety of useful tools.

Imagine a world where tax calculations are as easy as a stroll in the park, where errors vanish like morning dew, and precious time is no longer held captive by complex math. Step into the VAT Calculator Wonderland, where businesses liberate themselves from the burdens of intricate tax calculations! Gone are the days of furrowed brows and late-night tax troubles. The VAT Calculator is here to unravel the mystery of Value Added Tax, making number crunching as simple as ordering your morning coffee. It's not just a calculator; it's your shortcut to financial clarity!

Bid farewell to hours lost in the labyrinth of tax calculations. With the VAT Calculator, time becomes your ally. It transforms daunting tasks into swift, efficient manoeuvres, letting you focus on what truly matters – growing your business! No more sleepless nights worrying about mathematical mishaps. The VAT Calculator is your guardian against errors, ensuring that every digit falls into its designated place. Precision has a new address, and it's your financial statements!

Historical background:

A long time ago, people used to pay taxes in a way that could be confusing. They would pay taxes at different stages of making a product. For example, if someone made a chair, they might pay tax on the wood they bought, then again when they sold the chair. This got messy, so some smart folks came up with an idea. Instead of taxing the whole chair at each step, they thought, "What if we tax only the 'value' that is added at each stage?" This is where the term "Value Added" comes from.

So, in the 1950s and 1960s, countries started trying out this new way of taxing things. It was simpler because you only paid tax on the part of the product that was added by each business, not the entire value. This made it easier to track and calculate. France was the first country to use this system in the early 1950s officially. Other countries liked the idea and began adopting it, too. Eventually, Value Added Tax, or VAT for short, became a popular way for governments to collect taxes on goods and services.

Today, many countries around the world use VAT. It helps governments raise money reasonably and efficiently. People pay a little bit of tax at each step of making and selling things, and that money goes to the government to pay for essential services like schools, roads, and hospitals. And that's the story of how VAT became a common way of collecting taxes.

How to calculate VAT?

Suppose you have a product that costs $100, and the VAT rate is 10%. To calculate the VAT, you would use the formula:

VAT = VAT rate × Value of Goods or Services

VAT = 0.10 × $100

= $10

=0.10×$100=$10

So, in this example, the VAT on the product is $10. The total cost, including VAT would be the sum of the original cost and the VAT:

Total Cost=Cost of Goods+VAT

=$100+$10

=$110

In many countries, businesses are required to collect VAT on behalf of the government. When a business sells a product or service, it charges VAT to the customer, manages the VAT amount, and then remits the collected VAT to the government.

Benefits of VAT calculator:

A VAT (Value Added Tax) calculator offers several advantages, especially in simplifying financial transactions and aiding businesses in managing their finances more efficiently. One primary benefit is its role in helping individuals and businesses determine the exact amount of VAT they need to pay or can reclaim. This accuracy is crucial for maintaining compliance with tax regulations.

Moreover, a VAT calculator streamlines the complex process of calculating taxes on goods and services. By automating these calculations, it reduces the likelihood of errors, ensuring that businesses remain in good standing with tax authorities. This not only saves time but also helps prevent potential financial penalties that may result from miscalculations. Additionally, a VAT calculator promotes transparency and clarity in financial transactions. Businesses can provide accurate and easily understandable invoices to their customers, fostering trust and preventing disputes over incorrect tax amounts. The calculator thus serves as a valuable tool for both businesses and consumers, contributing to a more seamless and reliable economic environment. If you're interested in exploring additional calculators, check out CoolCalculator for a variety of useful tools.

Conversation

Latest Blogs

© Blog CoolCalculator, Explore CoolCalculator, your destination for the latest insights, tips, and updates on the world of online calculators. Stay informed and make your calculations smarter with our blog. ,

Designed

by Saad Media Team , Team Lead M.Rizwan Akhtar