Why is Fixed Mortgage the Best Choice?

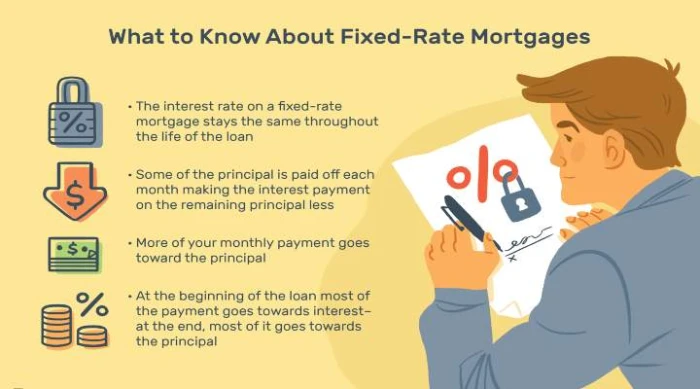

A fixed-rate mortgage (FRM) is often the best option for buying a home because it is predictable, stable, and easy to understand.

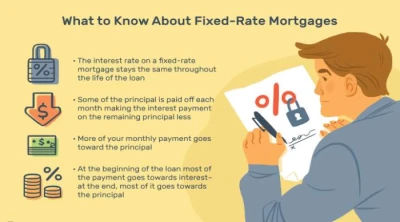

A fixed-rate mortgage (FRM) is often the best option for buying a home because it is predictable, stable, and easy to understand. Unlike adjustable-rate mortgages (ARMs), where the interest rate can change over time, a fixed-rate mortgage keeps the same interest rate for the entire loan period. This steady rate can be helpful for borrowers, especially those who prefer to plan their finances for the long term and want to avoid the risk of interest rates going up.

Reasons that Why Fixed Rate Mortgage is the Best Choice

Predictability and Stability

A fixed-rate mortgage is popular because it offers predictability. With this type of loan, you know exactly how much you'll pay each month for the whole term of the mortgage. This stability is excellent for people who like to keep their finances steady and manageable. Since the interest rate doesn't change, your payments for the loan's principal and interest stay the same, no matter what happens in the economy. This helps you budget better and protects you from sudden financial stress if interest rates increase.

Protection against Interest Rate Increases

A fixed-rate mortgage (FRM) is a safe choice if interest rates go up in the future. With an FRM, you lock in the current low interest rate for the entire loan period. Your monthly payments won't change, even if interest rates go up. On the other hand, if you have an adjustable-rate mortgage, your payments could go up a lot if interest rates increase, which might cause financial problems. But with a fixed-rate mortgage, your housing costs stay the same, protecting you from these risks.

Long-Term Savings and Peace of Mind

A fixed-rate mortgage might start with a slightly higher interest rate than an adjustable-rate mortgage, but it can save you a lot of money in the long run. Over 15 or 30 years, the total interest you pay with a fixed-rate mortgage could be less, especially if interest rates increase significantly. This makes it a good option for people who plan to stay in their homes for a long time.

Additionally, having the peace of mind that your mortgage payments won't suddenly end up is incredibly valuable. This security makes a fixed-rate mortgages slightly higher initial interest rate worth it for many homeowners. Knowing that your home won't change dramatically because of outside economic factors help reducing the stress.

Simplicity and Transparency

Fixed-rate mortgages are easy to understand. Unlike adjustable-rate mortgages, which have complicated rules about how and when the interest rates can change, fixed-rate mortgages are precise. Borrowers know precisely what they agree to, making the mortgage process less stressful, especially for first-time homebuyers. This simplicity also makes comparing offers from different lenders easier, helping borrowers make intelligent choices.

Understanding why this type of mortgage is preferred involves examining the key aspects of fixed-rate home loans, fixed refinance rates, and the contrast between fixed and variable interest rates.

-

More about the Fixed Rate Home Loans

Fixed-rate home loans are mortgage agreements in which the interest rate stays the same for the entire loan period. This means your monthly payments won't change, even if interest rates increase. This steady payment amount is why fixed-rate mortgages are popular, especially for first-time homebuyers. They help you know exactly what to expect for your payments, making managing your budget and planning for the future easier.

-

Fixed Refinance Rates

Refinancing with a fixed-rate mortgage is another aspect where this loan proves advantageous. When homeowners refinance, they often do so to secure a lower interest rate, reduce monthly payments, or adjust the loan term. Opting for fixed refinance rates allows homeowners to lock in a lower rate for the remaining mortgage duration, providing consistent payments and protecting them from potential interest rate increases. In a volatile market, where interest rates might rise, having a fixed refinance rate can save homeowners money over time.

-

Best Fixed-Rate Mortgage

To pick the best fixed-rate mortgage, you must compare different lenders and their offers. Look at the interest rate, how long the loan lasts, and any extra fees. The best mortgages usually have reasonable interest rates and low fees, which helps you save money in the long run. Some lenders also have special deals for first-time homebuyers or veterans, making the mortgage even more attractive.

You can have a better idea about home mortgage and you can assess a mortgage refinance plan thoroughly if you use a mortgage calculator.

Fixed VS Variable Interest Rates

Choosing between a fixed and changing interest rate is important when borrowing money.

A changing interest rate goes up and down based on what's happening in the economy. This means your monthly payment can also change. It might be lower initially but could go up later, costing you more money in the long run.

A fixed interest rate stays the same no matter what happens. This means your monthly payment will remain the same. It's better when you're still trying to figure out what will happen to the economy or if you think interest rates will increase.

-

Fixed Remortgage Interest Rates

Fixed interest rates offer the same benefits for homeowners looking to remortgage as they do for first-time homebuyers. By switching to a fixed remortgage interest rate, homeowners can secure their mortgage payments for a new term, ensuring their payments remain consistent even if interest rates in the broader market rise. This can be particularly advantageous for those nearing retirement or with fixed incomes, as it provides financial predictability.

A fixed-rate mortgage is an excellent option for people buying a home who want stable and predictable payments. It helps you manage the high cost of owning a home without worrying about rising interest rates. Although some other types of mortgages start with lower fees, a mortgage's stability and peace of mind often make it the better choice. Whether buying your first home or planning to stay there long, a fixed-rate mortgage gives you steady payments and security that many homeowners value.

A fixed-rate mortgage (FRM) is often the best option for buying a home because it is predictable, stable, and easy to understand. Unlike adjustable-rate mortgages (ARMs), where the interest rate can change over time, a fixed-rate mortgage keeps the same interest rate for the entire loan period. This steady rate can be helpful for borrowers, especially those who prefer to plan their finances for the long term and want to avoid the risk of interest rates going up.

Reasons that Why Fixed Rate Mortgage is the Best Choice

Predictability and Stability

A fixed-rate mortgage is popular because it offers predictability. With this type of loan, you know exactly how much you'll pay each month for the whole term of the mortgage. This stability is excellent for people who like to keep their finances steady and manageable. Since the interest rate doesn't change, your payments for the loan's principal and interest stay the same, no matter what happens in the economy. This helps you budget better and protects you from sudden financial stress if interest rates increase.

Protection against Interest Rate Increases

A fixed-rate mortgage (FRM) is a safe choice if interest rates go up in the future. With an FRM, you lock in the current low interest rate for the entire loan period. Your monthly payments won't change, even if interest rates go up. On the other hand, if you have an adjustable-rate mortgage, your payments could go up a lot if interest rates increase, which might cause financial problems. But with a fixed-rate mortgage, your housing costs stay the same, protecting you from these risks.

Long-Term Savings and Peace of Mind

A fixed-rate mortgage might start with a slightly higher interest rate than an adjustable-rate mortgage, but it can save you a lot of money in the long run. Over 15 or 30 years, the total interest you pay with a fixed-rate mortgage could be less, especially if interest rates increase significantly. This makes it a good option for people who plan to stay in their homes for a long time.

Additionally, having the peace of mind that your mortgage payments won't suddenly end up is incredibly valuable. This security makes a fixed-rate mortgages slightly higher initial interest rate worth it for many homeowners. Knowing that your home won't change dramatically because of outside economic factors help reducing the stress.

Simplicity and Transparency

Fixed-rate mortgages are easy to understand. Unlike adjustable-rate mortgages, which have complicated rules about how and when the interest rates can change, fixed-rate mortgages are precise. Borrowers know precisely what they agree to, making the mortgage process less stressful, especially for first-time homebuyers. This simplicity also makes comparing offers from different lenders easier, helping borrowers make intelligent choices.

Understanding why this type of mortgage is preferred involves examining the key aspects of fixed-rate home loans, fixed refinance rates, and the contrast between fixed and variable interest rates.

-

More about the Fixed Rate Home Loans

Fixed-rate home loans are mortgage agreements in which the interest rate stays the same for the entire loan period. This means your monthly payments won't change, even if interest rates increase. This steady payment amount is why fixed-rate mortgages are popular, especially for first-time homebuyers. They help you know exactly what to expect for your payments, making managing your budget and planning for the future easier.

-

Fixed Refinance Rates

Refinancing with a fixed-rate mortgage is another aspect where this loan proves advantageous. When homeowners refinance, they often do so to secure a lower interest rate, reduce monthly payments, or adjust the loan term. Opting for fixed refinance rates allows homeowners to lock in a lower rate for the remaining mortgage duration, providing consistent payments and protecting them from potential interest rate increases. In a volatile market, where interest rates might rise, having a fixed refinance rate can save homeowners money over time.

-

Best Fixed-Rate Mortgage

To pick the best fixed-rate mortgage, you must compare different lenders and their offers. Look at the interest rate, how long the loan lasts, and any extra fees. The best mortgages usually have reasonable interest rates and low fees, which helps you save money in the long run. Some lenders also have special deals for first-time homebuyers or veterans, making the mortgage even more attractive.

You can have a better idea about home mortgage and you can assess a mortgage refinance plan thoroughly if you use a mortgage calculator.

Fixed VS Variable Interest Rates

Choosing between a fixed and changing interest rate is important when borrowing money.

A changing interest rate goes up and down based on what's happening in the economy. This means your monthly payment can also change. It might be lower initially but could go up later, costing you more money in the long run.

A fixed interest rate stays the same no matter what happens. This means your monthly payment will remain the same. It's better when you're still trying to figure out what will happen to the economy or if you think interest rates will increase.

-

Fixed Remortgage Interest Rates

Fixed interest rates offer the same benefits for homeowners looking to remortgage as they do for first-time homebuyers. By switching to a fixed remortgage interest rate, homeowners can secure their mortgage payments for a new term, ensuring their payments remain consistent even if interest rates in the broader market rise. This can be particularly advantageous for those nearing retirement or with fixed incomes, as it provides financial predictability.

A fixed-rate mortgage is an excellent option for people buying a home who want stable and predictable payments. It helps you manage the high cost of owning a home without worrying about rising interest rates. Although some other types of mortgages start with lower fees, a mortgage's stability and peace of mind often make it the better choice. Whether buying your first home or planning to stay there long, a fixed-rate mortgage gives you steady payments and security that many homeowners value.

Conversation

Latest Blogs

© Blog CoolCalculator, Explore CoolCalculator, your destination for the latest insights, tips, and updates on the world of online calculators. Stay informed and make your calculations smarter with our blog. ,

Designed

by Saad Media Team , Team Lead M.Rizwan Akhtar